AUDUSD Technical Analysis 2015, 08.02 - 15.02: Bearish Monthly Breakdown With .7719 Support Level

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.09 05:46

AUD/USD – Continues to Rest Above Support at 0.77 (based on marketpulse article)

For more than the last week now the Australian dollar has steadied well and traded in a narrow range between support at 0.77 and 0.78. Earlier last week the Australian dollar was on a roller-coaster ride dropping sharply to a new multi-year low below 0.7630 before rallying strongly and moving back up above the 0.77 level and more recently 0.78 before easing back again into its present range. It is presently relying on support from the current key level at 0.77. Prior to all the recent activity, in the last couple of weeks the Australian dollar fall very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200. The 0.77 range is currently offering some support to the Australian dollar which has allowed it to consolidate a little and temporarily stop the recent decline over the last week. Several weeks ago it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in.

Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650. Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory.

It seems a long way away now but the Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

Australia’s central bank lowered its 2015 growth and inflation forecasts and predicted unemployment will rise, underscoring this week’s decision to cut interest rates. “Growth overall is now forecast to remain at a below-trend pace somewhat longer than had earlier been expected,” the Reserve Bank of Australia said Friday in its quarterly monetary policy statement in Sydney. “The economy is expected to be operating with a degree of spare capacity for some time yet, and domestic cost pressures are likely to remain subdued.” The RBA reduced its forecast average expansion for this year to between 1.75 percent and 2.75 percent from between 2 percent and 3 percent estimated in November. It lowered projected headline consumer-price growth to 1.25 percent in the year through June from between 1.5 percent and 2.5 percent seen three months earlier.

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

|---|---|---|---|---|---|

| 0.7700 | — | — | 0.8200 | 0.8650 | 0.8800 |

During the early hours of the Asian trading session on Monday, the AUD/USD is heading lower back under the 0.78 level with eyes on the support around the 0.77 level. Current range: trading back below 0.7800 around 0.7760.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.07 09:28

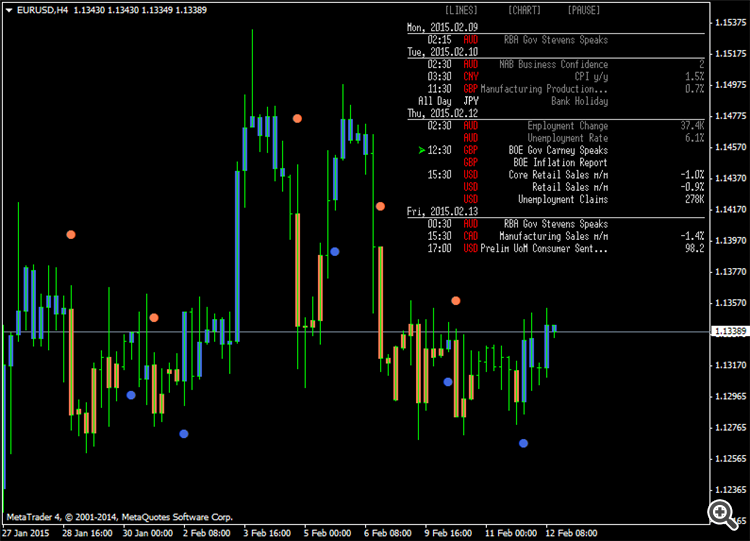

Forex Weekly Outlook February 9-13 (based on forexcrunch article)

Glenn Stevens’ speech, Australian employment data, Mark Carney’s

speech, BOE Inflation Report, US retail sales, Unemployment Claims and

Prelim UoM Consumer Sentiment are the major market movers for this week.

Here is an outlook on the highlights coming our way.

Last week Non-Farm Payrolls release exceeded forecasts with a 257,000

jobs gain in January, following 329,000 addition in the previous month.

Economists expected a gain of 236,000 positions. However, the

unemployment rate edged higher to 5.7% from 5.6% in December. Full-time

positions edged up 777,000, reaching more than 120 million for the first

time since July 2008. The strong job gain together with a smaller than

expected rise in the number of jobless claims indicate solid economic

recovery. Will this trend continue?

- Glenn Stevens speaks: Monday, 0:15. RBA Governor Glenn Stevens is scheduled to speak in Sydney. Australia’s central bank cut its cash rate to a minimum low of 2.25% after 18 months of static rates. Stevens may elaborate on the reasons behind the unexpected rate cut and talk about deflationary pressures and the impact of foreign markets on RBA’s recent policy decision.

- Australian employment data: Thursday, 0:30. Australia’s job market expanded in December, adding 37,400 jobs, well above the 5,300 increase forecasted by analysts. The big job gain lowered the unemployment rate from 6.2% to 6.1%. The increase in positions showed a solid rise in full-time jobs compared to a slight fall in part-time jobs. Furthermore, the participation rate increased to 64.8% in December from 64.7% in the prior month, indicating the economy is expanding. Australia’s labor market is expected to contract by 4,700 jobs, while the unemployment rate is predicted to climb to 6.2%.

- Mark Carney speaks: Thursday, 10:30. The Bank of England governor, Mark Carney is expected to speak in London about the Inflation report. Carney has launched a strong attack on austerity measures in the Eurozone, claiming such measures are too harsh to enable recovery and may lead the 18-nation single currency area deeper into a debt. He noted that low inflation in the euro-area is potentially dangerous to growth and calls for a real course of action to escape the debt trap.

- UK inflation data: Thursday, 10:30. The Bank of England noted in its November inflation report that the economy is expanding more slowly and price pressures declined from the previous three months. The slower growth was caused by sluggish expansion in global economies and weaker growth forecast. The Central bank noted the slowdown in the housing market and the low commodity prices weighing on CPI inflation.

- US retail sales: Thursday, 13:30. U.S. retail sales plunged 0.9% in December, posting their largest decline in 11 months after positive growth in the fourth quarter. The sharp fall may be attributed to seasonal adjustments after the holiday spending spree. Economists forecasted a 0.2% gain. However lower gasoline prices are expected to boost consumer spending in the coming months. Meanwhile, Core sales excluding automobiles dropped 1.0% following a 0.5% gain in the previous month and lower than the 0.1% increase predicted by analysts. Retail sales are expected to decline 0.3%, while core sales are predicted to drop 0.4%.

- US Unemployment Claims: Thursday, 13:30. The number of jobless claims rose less than expected last week, reaching 278,000 following 267,000 in the previous week. Analysts expected a larger gain of 287,000. Claims were volatile in recent months due to seasonal changes, but remained positive. The four-week moving average fell 6,500 to 292,750 last week. jobless claims is expected to reach 279,000 this week.

- US Prelim UoM Consumer Sentiment: Friday, 15:00. Consumer sentiment spiked in January to 98.2, exceeding economists’ forecast of 94.2, rising 4.4 points higher than in December. Lower gasoline prices as well as the ongoing improvement in the labor market boosted spending and raising consumer sentiment to an 11-year high. The economy is in solid growth at the beginning of 2015 and is expected to continue this positive trend. Consumer sentiment is expected to remain at 98.2 this time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.09 11:21

2015-02-09 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - ANZ Job Advertisements]- past data is 1.8%

- forecast data is n/a

- actual data is 1.3% according to the latest press release

if actual > forecast (or previous data) = good for currency (for AUD in our case)

[AUD - ANZ Job Advertisements] = Change in the number of jobs advertised in the major daily newspapers and websites covering the capital cities. This data tends to have more impact when it's released ahead of the government employment data rather than after.

==========

- Job advertisements rose a further 1.3% m/m in January to record their eighth consecutive monthly rise (in seasonally adjusted terms). Job ads have now trended higher for 15 consecutive months and are up 10.0% over the year to January.

- The continued strength in January was driven by internet job ads, which rose 1.5% m/m. In annual terms, internet job ads are running at 14.8% y/y, the fastest rate since April 2011. This contrasts with newspaper job ads which declined by 6.7% m/m, to be down 23.8% y/y. The pace of deterioration in newspaper job ads appears to have stepped up in recent months, although this series is particularly volatile and makes up only 3% of overall ANZ job ads.

- Newspaper job ads trending down in all states and territories with the exception of NSW, with recent weakness in WA and the NT particularly pronounced.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 20 pips price movement by AUD - ANZ Job Advertisements news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.09 08:47

AUD/USD weekly outlook: February 9 - 13 (based on investing.com article)

The Australian dollar was little changed against its U.S. counterpart on Friday, after a robust U.S. jobs report for January reinforced expectations for a mid-year rate hike by the Federal Reserve.

The Labor Department reported Friday that the U.S. economy added 257,000 jobs in January, far more than the 234,000 forecast by economists. December’s figure was revised to 329,000 from a previously reported 252,000.

While the unemployment rate ticked up to 5.7% last month from December’s 5.6%, hourly earnings and the participation rate both saw increases in January.

The upbeat data added to the view that the strengthening economic recovery may prompt the Federal Reserve to start raising rates from near zero levels as early as June.

AUD/USD hit a session low of 0.7779 following the robust jobs data from a high of 0.7875 earlier, before subsequently consolidating at 0.7799 by close of trade, up 0.01% for the day and 0.36% higher for the week.

The Aussie plunged to 0.7651 against the greenback on Tuesday, the pair's lowest since May 2009, after the Reserve Bank of Australia unexpectedly cut interest rates to a new record-low 2.25% from 2.50%, citing an overvalued local currency.

At the conclusion of its monthly policy meeting, RBA Governor Glenn Stevens said that growth will be weaker for a longer period of time and that the unemployment rate should rise higher than expected.

On Friday, the central bank eased the outlook for inflation in its quarterly Statement of Monetary Policy, while leaving clues to its next policy moves deliberately vague.

Elsewhere, concerns over Greek debt negotiations continued to weigh on market sentiment.

Standard and Poor’s downgraded Greece to B- from B late Friday, one notch above default, and kept the outlook at "negative", indicating that further ratings cuts are possible.

In the week ahead investors will be awaiting Thursday's U.S. data on retail sales and jobless claims and Friday’s report on consumer sentiment for further indications on the strength of the economic recovery.

Speeches by RBA Governor Glenn Stevens will also be in focus as well as key Australian employment data.

Over the weekend, China reported a trade surplus of $60.0 billion in January, compared to expectations for $48.9 billion and up from a surplus of $49.6 in December.

Exports slumped 3.3% from a year earlier last month, missing expectations for a 6.3% increase, while imports tumbled 19.9%, much worse than forecasts for a decline of 3.0%.

The Asian nation is Australia's largest trade partner.

Monday, February 9

- RBA Governor Stevens is due to speak at an event in Sydney. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy.

Tuesday, February 10

- Australia is to publish private sector data on business confidence as well as official data on house price inflation.

- China is to report on consumer and producer price inflation.

Wednesday, February 11

- Australia is to release private sector data on consumer sentiment and official data on home loans.

Thursday, February 12

- Australia is to release data on the change in the number of people employed and the unemployment rate, in addition to private sector data on inflation expectations.

- The U.S. is to release reports on retail sales and initial jobless claims.

Friday, February 13

- RBA Governor Stevens is due to testify before the House of Representatives' Standing Committee on Economics, in Canberra.

- The U.S. is to round up the week with preliminary data on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.10 05:34

2015-02-10 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]- past data is 1.5%

- forecast data is 1.1%

- actual data is 0.8% according to the latest press release

if actual > forecast (or previous data) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to respond by raising interest rates.

==========

China CPI Slows To 0.8% In January

Consumer prices in China were up just 0.8 percent on year in January, the National Bureau of Statistics said on Tuesday.

That was well shy of forecasts for a gain of 1.0 percent and down sharply from 1.5 percent in December.

On a monthly basis, consumer prices were up 0.3 percent - the same as in December.

Producer prices also disappointed, tumbling 4.3 percent on year versus expectations for a decline of 3.8 percent following the 3.3 percent fall in the previous month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 48 pips price movement by CNY - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.10 14:59

AUD/USD Fundamental Analysis February 11, 2015 – Forecast (based on fxempire article)

The AUD/USD rallied to 0.7836 gaining 33 points after the house price index gained and printed above expectations and the US dollar tumbled a bit in the morning session. China’s slowing inflation and a 35th straight contraction in factory gate prices give policy makers room undertake extra stimulus after cutting interest rates in November and reducing banks’ reserve requirements last week.

The Abbott government must remain focused on economic reform despite the uncertainty surrounding its leadership. That’s the view of the Organization for Economic Cooperation and Development, warning its members that policy action since the global financial crisis appears to be losing steam. The OECD makes a number of recommendations in a report prepared for the G20 finance ministers meeting in Istanbul on Monday that supports the Australian government’s agenda. The OECD again pushed for a higher and broader GST, but Prime Minister Tony Abbott said only last week the government had no plans to touch the GST “this term or next”, insisting the rate could not change unless all the states and territories agreed.

Despite the Reserve Bank of Australia cutting interest rates for the first time since August 2013 this week, abruptly ending a period of stability that saw rates remain on hold for a record period, the Aussie has held out.

With the domestic cash rate now sitting at 2.25 per cent, its lowest ever mark, the announcement initially succeeded in spurring another bout of selling for the Australian dollar. It quickly plummeted to 0.7630 on the news, a level not seen in over six years. But since then the majority of losses have now been re-captured, in a rally that’s left many investors scratching their heads.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.11 05:38

Video: Looking for More Stable, Technical-Centric Pairs Like AUDUSD (based on dailyfx article)

- Tumultuous fundamental themes and volatility-inducing event risk makes for lower probability trades

- With 'risk' churning, the Greece standoff intensifying and a BoE report ahead; Yen, EUR and GBP are risky

- In avoiding areas of the market with the greatest threats, more stable options can be found

The EURUSD, EURJPY and EURGBP face considerable risk for extreme volatility while enjoying limited capacity for projecting a consistent direction through the turmoil. Many traders seek out the high-volatility scenarios to provide trade setups. However, volatility with little clarity on the 'trigger', the potential for consistent direction and the extent of follow through can represent more risk than reward. Sometimes, the better path is to reduce our exposure to open-ended fundamental threats to focus on more straightforward catalysts or technicals. In today's Strategy Video, we discuss why EUR, GBP and JPY pairs may be better to avoid now while AUD, NZD, CAD and even USD could offer more acceptable opportunities.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.11 14:27

AUDIO - As the Currency Markets Turn with Justin Krebs

Justin Krebs joins Merlin for a thorough look at many different listener questions. The duo takes a look at the Aussie Dollar, Canadian Dollar, Japanese Yen, Suisse Franc, Dollar index, Fibonacci and much more!

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.12 05:39

2015-02-12 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Employment Change]- past data is 42.3K

- forecast data is 5.0K

- actual data is -12.2K according to the latest press release

if actual > forecast (or previous data) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

JANUARY KEY POINTS

TREND ESTIMATES (MONTHLY CHANGE)

- Employment increased to 11,666,000.

- Unemployment increased to 782,300.

- Unemployment rate remained steady at 6.3% from a revised December 2014 estimate.

- Participation rate remained steady at 64.7%.

- Aggregate monthly hours worked increased 0.7 million hours to 1,604.4 million hours.

SEASONALLY ADJUSTED ESTIMATES (MONTHLY CHANGE)

- Employment decreased 12,200 to 11,668,700. Full-time employment decreased 28,100 to 8,078,000 and part-time employment increased 15,900 to 3,590,700.

- Unemployment increased 34,500 to 795,200. The number of unemployed persons looking for full-time work increased 200 to 551,800 and the number of unemployed persons only looking for part-time work increased 34,300 to 243,400.

- Unemployment rate increased 0.3 pts to 6.4%.

- Participation rate remained steady at 64.8%.

- Aggregate monthly hours worked increased 8.2 million hours (0.5%) to 1 ,607.6 million hours.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 72 pips price movement by AUD - Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.12 11:37

Trading News Events: U.S. Retail Sales (based on dailyfx article)

Another contraction in U.S. Retail Sales may drag on the greenback and

generate a near-term rebound in EUR/USD as it dampens the Fed’s scope to

raise the benchmark interest rate in mid-2015.

What’s Expected:

Why Is This Event Important:

The Fed may have little choice but to further delay its normalization

cycle as lower energy costs show little evidence of boosting

private-sector consumption, and we may see the central bank implement a

more dovish twist to the forward-guidance for monetary policy as it

struggles to achieve the 2% target for inflation.

Nevertheless, the pickup in job/wage growth may pave the way for a

better-than-expected print, and a positive development may spark a

bearish reaction in EUR/USD as market participants ramp up bets for

higher borrowing-costs.

How To Trade This Event Risk

Bearish USD Trade: U.S. Retail Sales Falls Another 0.4% or Greater

- Need green, five-minute candle following the release to consider a long trade on EUR/USD.

- If market reaction favors a bearish dollar trade, buy EUR/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need red, five-minute candle to favor a short EUR/USD trade.

- Implement same setup as the bearish dollar trade, just in reverse.

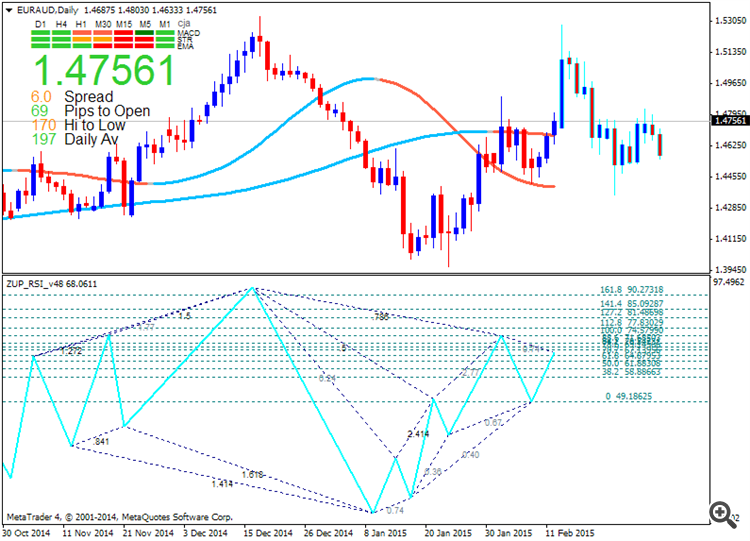

EUR/USD Daily

- Long-term outlook for EUR/USD remains bearish as the RSI retains the downward trend carried over from back in October 2013.

- Interim Resistance: 1.1600 pivot to 1.6110 (61.8% expansion)

- Interim Support: 1.1096 (2015 low) to 1.1100 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| DEC 2014 |

01/14/2014 13:30 GMT | -0.1% | -0.9% | +30 | -1 |

U.S. Retail Sales contracted 0.9% in December, largely driven by lower gas receipts, after climbing a revised 0.4% the month prior. Despite the worse-than-expected print, it seems as though the Fed remains confident in raising the benchmark interest rate in mid-2015 as the central bank anticipates falling oil prices to have a positive impact on the economy as it boosts disposable incomes. Nevertheless, the dollar struggled to hold its ground following the print, with EUR/USD climbing above the 1.1825 region, but the market reaction was short-lived as the pair consolidated throughout the North America trade to end the day at 1.1773.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 36 pips price movement by USD - Retail Sales news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish with secondary flat which was started in the beginning of the previous week:

W1 price is on bearish market condition with trying to break 0.7719 support level for the bearish to be continuing

MN price is on bearish breakdown with 0.7719 support level.

If D1 price will break 0.7625 support level on close bar so the bearish trend will be continuing for whole the week

If D1 price will break 0.7849 resistance level so the market rally inside the primary bearish will be started

If D1 price will break 0.8024 resistance - we may see good breakout of the price movement

If not so it will be bearish ranging between 0.7625 and 0.7849 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2015-02-09 00:15 GMT (or 02:15 MQ MT5 time) | [AUD - RBA Gov Stevens Speech]

2015-02-09 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - ANZ Job Advertisements]

2015-02-10 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - NAB Business Confidence]

2015-02-10 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2015-02-11 22:00 GMT (or 00:00 MQ MT5 time) | [AUD - RBA Assist Gov Debelle Speech]

2015-02-12 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Employment Change]

2015-02-12 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Retail Sales]

2015-02-12 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

2015-02-12 22:30 GMT (or 00:30 MQ MT5 time) | [AUD- RBA Gov Stevens Speech]

2015-02-13 15:00 GMT (or 17:00 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movementSUMMARY : bearish

TREND : flat