You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

5 Things To Know About Euro-Zone GDP

There were a handful of clear messages in the raft of European first quarter GDP data released on Thursday. By and large they were disappointing, showing a struggle for growth across the euro zone, with Germany providing the sole ray of light. Here’s what’s to know.

1. Much of the euro zone is strugglingOf the 13 member states that have reported quarterly numbers, Italy, the Netherlands, Cyprus, Portugal, Estonia and Finland all registered contraction on the previous three months. Of the remaining five, the Greek economy continued to shrink on a year on year basis during the quarter. And the French economy was static, showing no growth on the final three months of 2013.

Apart from Germany’s, most of these numbers fell short of expectations. Overall the euro zone managed just a 0.2% expansion on the quarter and 0.9% on the year against consensus forecasts of a 1.1% increase on the year.

What’s more, prospects for the second quarter aren’t much better. The first quarter numbers were boosted by weather-related factors, argued Peter Vanden Houte, an economist at ING Bank. Second quarter data are likely to give back some of those gains. Meanwhile, recent survey evidence and industrial production figures across the region have been disappointing–even from Germany.

2. Low inflation, even outright deflation, are not antithetical to growth

For instance, Hungary’s inflation rate turned negative in April, contracting 0.1% on the year, yet the economy had a storming first quarter, expanding 1.1% on the previous three months and 3.2% on the year.

Ditto for Poland. Polish consumer price inflation rate has been declining steadily and was only just positive on the year in April–at 0.3%–but it too had a storming performance during the first quarter, expanding 3.5% on the year.

3. Look outside the euro zone

As well as Hungary and Poland, the U.K. economy performed well, expanding 0.8% on the quarter and 3.1% on the year. Lithuania and Romania expanded 2.9% and 3.8% on the year respectively, although their quarterly rates of growth slowed during the first three months of the year.

Of course there are exceptions. Bulgaria, the Czech Republic and Denmark, which are all outside of the single currency region, have been finding growth hard to come by.

And this particular strength across the European Union’s eastern fringes could yet prove to be short lived. It doesn’t seem the Ukrainian crisis had much of an effect on growth during the first quarter, but the impact could yet show up in second quarter data.

Both investors and ECB President Mario Draghi have recently cited the confrontation between Russia and Ukraine as a source of downside risk for European economies.

4. The ECB has plenty of justification to pull on its monetary levers

Euro-zone consumer prices rose just 0.7% on the year in April, far below the ECB’s target of slightly under 2%.

ECB Vice President Vitor Constancio reiterated the central bank’s determination “to act swiftly if required” in a speech on Thursday. Mr Draghi made the point that the central bank’s governing council was holding off acting until more data was available in June. The first-quarter GDP numbers will undoubtedly help to tilt the balance towards action.

And investors are expecting it. The euro fell to 11-week lows in the wake of Thursday’s data releases. Euro-zone sovereign bonds have continued to rally and Germany’s equity market has tested all-time highs on the view that the ECB will provide more liquidity.

5. Japan's example suggests ECB action alone might not be enough

With much of the single currency region struggling to generate escape velocity and even the German economy looking vulnerable, some economists doubt the central bank will be willing or able to provide the scale of policy action needed to get member economies back to sustainable long term growth.

Even though Germany’s policymakers have increasingly come round to the idea that the ECB needs to do more to help growth and forestall a slide into deflation, there are doubts about whether the ECB might be able to pursue wholesale asset purchases like those undertaken by the Bank of Japan, the Federal Reserve and the Bank of England did with their quantitative easing programs.

Other policy tools open to the ECB, such as another long term refinancing operation to shore up bank lending, are likely to be less effective. Especially in light of the fact that euro-zone fiscal policy by and large remains contractionary as governments aim to bring their deficits to back under treaty thresholds.

What’s more, if aging populations are a primary driver of deflation, as some economists think, the euro zone’s poor demographics will prove to be another huge hurdle for the central bank.

2014-05-15 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

if actual > forecast = good for currency (for USD in our case)

USD Philly Fed Manufacturing Index = Level of a diffusion index based on surveyed manufacturers in Philadelphia==========

Philly Fed Index Drops Less Than Expected In May

Activity in the Philadelphia-area manufacturing sector expanded for the third consecutive month in May, according to a report released by the Federal Reserve Bank of Philadelphia on Thursday, although the index of activity in the sector fell compared to the previous month.

While the Philly Fed said its diffusion index of current general activity dipped to 15.4 in May from 16.6 in April, a positive reading still indicates growth in the regional manufacturing sector. Economists had expected the index to drop to a reading of 14.3.

How Bear Markets Start (adapted from Forbes article)

----------

During the March-April market plunge, many of the formerly best performing stocks declined a big 20%-60%. Investors who were lulled into complacency by Wall Street bullishness were shocked. That’s why it’s important to listen to impartial analysts who don’t have a conflict of interest. A money manager can never tell you to go to cash.

Early this year, my column on Forbes.com was headed: The Most Reliable Indicator Of An Approaching Market Top. Now you can see that the ETF (iShares Russell 2000, IWM) for the Russell 2000 index (small cap stocks) and the Nasdaq composite are well below their January levels and their highs for this year. They have big, bearish “head & shoulder (H&S)” tops. The IWM has broken its 200 day MA, which is considered the dividing line between a bull and bear market if the trend persist.

Over the past two months, the Nasdaq lost 10.7% (top to bottom) while the other major indices declined less than half that much. The DJI is now back at its all-time high. But are these 30 stocks, subject to easy manipulation, really a true measure of the stock market?

In March I got warning signals from all my technical indicators that meaningful declines in the favorite high-flyers were ahead. I cautioned investors (see CNBC, CNBC Asia, YouTube, etc.) to ignore the DJI and S&P 500 and focus on the small-cap stocks and the Nasdaq to get a true reading of the markets. When Wall Street is looking at the DJI and the S&P 500, it’s more important to look at the Nasdaq and the small cap indices to tell you about the only thing that can change the price of a stock or an index: a change in money flow.

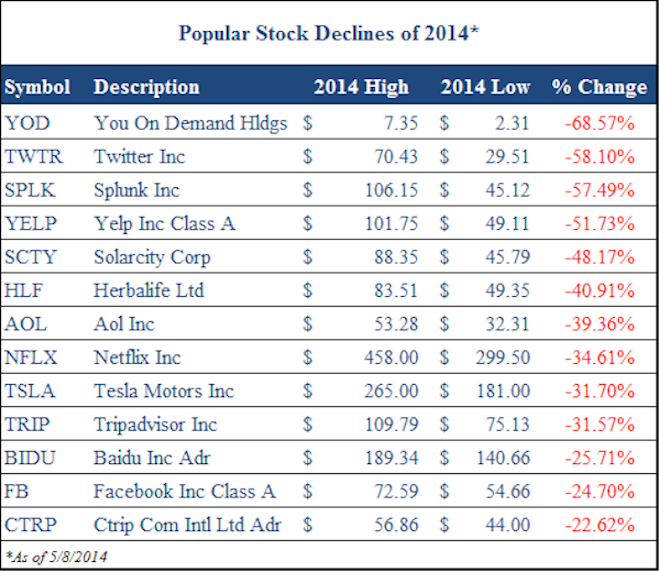

The popular stocks got slammed. Look at this list and their losses since late March when I got my “sell” signal. These are losses for just two months, which many traders following the traditional advice incurred. As you can see, the action of the DJI was irrelevant.

Our weight of the evidence now shows very clear signals. Being prepared is the way to benefit from declining prices. With the “bear” ETFs even the less-experienced investors can profit if they have the proper guidance. Just don’t use the “Ostrich Strategist” in a bear market, which is burying your head in the sand until the stock market plunge is over. There are some great opportunities ahead.

Why gold could struggle if CPI heats up

There's nothing like a little inflation talk to bring out the gold bugs.

But analysts say even the prospect of slightly higher-than-expected U.S. inflation readings after Wednesday's higher-than-expected April PPI won't be much of a catalyst for prices, and could actually hold back gains.

Helped by a falling dollar and weaker global equities prices, gold rose Wednesday above the key psychological level of $1,300, a zone that often attracts buying. The August gold futures contract was at about $1,305 per troy ounce, while the front-month June futures contract on Comex was at $1,304.

But some analysts said gold could continue to struggle near-term, but if it holds a higher range it may begin to edge higher. Gold hit a six-month low at the end of last year, trading at $1,181 on Dec. 31. Since then it has gained 10.5 percent.

"I think in the near-term, it's probably going to...break back below $1,300," said Howard Wen, precious metals analyst at HSBC. "We have CPI tomorrow...Normally if CPI data is high that would be a positive for gold but that could be a negative because of the Fed's linking of inflation and unemployment to monetary policy. The Fed is concerned about a lack of inflation. Ironically, if it's below expectations, that would be a positive for gold.""We pushed above the 200-day moving average...We pushed above it Monday," he said. He noted the market extended gains after crossing $1,301.10 and could move sideways to possibly higher. "We are right now in a choppy trading range, and we have been for the past three weeks. If we can push prices above last week's high of $1,315.80, in the June futures contract, that would be a bullish upside breakout and would suggest the trend is sideways to higher."

Kevin Grady, president of Phoenix Futures and Options, said if gold can settle above $1,325, it will attract more longs.

Forum on trading, automated trading systems and testing trading strategies

How to Start with MT5, a summary !

angevoyageur, 2013.03.15 16:12

How to start with MT5 platform : summary.

As our topic about "How to start with Metatrader 5" is going to be huge, here you find a summary, with main links.

For developpers.

Work in progress, stay tuned :-)

NASDAQ OMX Releases its SMARTS FX Surveillance Solution for Compliance Team

Leading foreign exchange solutions provider NASDAQ OMX Group has launched its SMARTS FX Trade Surveillance used in international FX trading.

The SMARTS module can help regulators and surveillance professionals to track FX products trading for any potential insider trades or front-running, illegal pricing, manipulation of benchmark forex rates, and other suspicious behaviors. The system enables users to track and moderate risks common to the FX market and also enables them to have a whole picture of trades of each individual currency pairs such as Non-Deliverable Forwards, Spot, and Forward.

This helps compliance teams obtain a deeper visualization of the various FX trades based on financial market trends and rate fixes. SMARTS provides users with all information feeds from several market data providers.

"As the regulatory requirements in the FX market continue to evolve, it has been a challenge for brokers and their compliance teams to identify where to initiate monitoring activity and to focus their resources," Rob Lang, the Vice President and Global Head of SMARTS, NASDAQ OMX, said in a press release.

"Through a co-development initiative with six major FX trading firms, SMARTS has worked to define the behaviors that support the FX surveillance priorities of these industry players, as well as develop a set of now-deployed alerts within the unique data constraints of the FX markets."

NASDAQ OMX SMARTS solution gathers data on options, equities, energy, commodities, futures and fixed income, which helps compliance professionals to have all the trading data to help them investigate the possibility of market manipulation and abuse

Becoming an Emotionally Intelligent Trader (based on dailyfx article)

We’re only in it for the money. That key trading concept is obvious but shouldn’t be forgotten. The reason why this mantra is key is because we’re not into trading for the following reasons:

Why Emotions Get Shunned By Traders

Some traders opt for an Automated Trading or Black Box strategy. The purpose of a black-box system is to have your preferred trading rules or edge programmed so as to put you into a trade and exit you from a trade when the edge is gone or the profit target is achieved. The argument of this approach is that your emotions can’t get in the way of you entering or exiting a trade. However, a trading career is made up of more than just on trade and if you do not have the emotional strength to stick with your edge, programmer or discretionary, then your emotions are still getting the best of you.

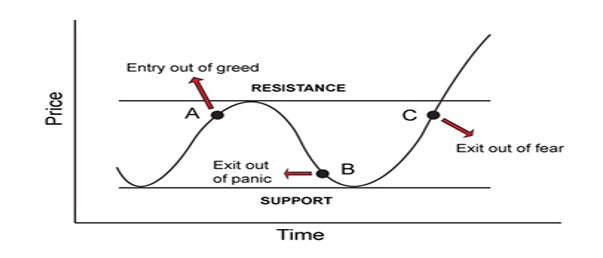

Either way, your emotions are at play. If you’re deciding when to enter the trade yourself, known as discretionary trading, your emotions are obviously at play. The way emotions effect newer traders is that new traders hope their losses will come back so they let them run in order to avoid booking a loss. They fear that their profits will turn into losses so they cut them short. However, this fear and hope tug-of-war doesn’t work out in the traders favor in the long term.

A Better Way to Look at Emotions

Emotions aren’t bad if you know how to steer them towards your benefit. By default, you likely don’t like being wrong or losing money, who would? However, taking a big picture view, being wrong sometimes and losing a little money when deciding if the market is going to move in the direction you believe it will, these two things aren’t that bad and are in fact, inevitable.

So a better way to look at emotions is to flip how you’re using hope and fear and most specifically fear. If you can switch your fear from a place of fearing a losing to trade to fearing a losing trade getting out of control, you’ll discover a key emotional truth to trading well, regardless of your balance.

As the opening quote mentions, instead of hoping that your loss will turn into a profit so you don’t look like a failure, you should hope that your profits grow larger while always fearing a large relative loss. By flipping these from there default function, you’re no longer holding onto a losing trading waiting for it to come back while closing out your good trades at a minimal profit afraid that the profit will slip through your fingers. As Michael Martin put it, that’s like pulling your flowers and letting your weeds flourish in hoping they change.

Applying Your Emotions to FX Trading Appropriately

So now that you know that your emotions are not your enemy when appropriately adjusted, what’s the best way to apply this information? This may come as a shock, but you need to start from the premise that you don’t know FOR SURE if your next trade will hit its protective stop or profit target. Of course, you’d prefer that every trade hit its profit target but by now, you know that’s not always the case.

However, like the picture from above, you’re not sure if the next trade will take you off the road you were

planning on driving down (read: the trend bends or ends to get you out of your trade). Therefore, when you’re in a trade based on your edge or indicators, it’s best to keep an eye for trades that go against you from the start and see that it’s best to fear these trades and get out there or just accept that your profit target most likely will not get hit but whatever you do, don’t remove your stop and hope for a trade that goes sour right away. These are the trades you should rightly fear draining your equity.

On the flip side, if you’re entering at the right time and price (unbeknownst to you or not), and the trade goes in your favor right away, then it’s best to keep the hope in play that this could be a big move that makes your day, week, month, or year and move your stop up to break even when your system sees it appropriate.

I’ll leave you with a quote from Michael Martin that’s been helpful for me and I hope it does the same for you. “Winners never quit, but quitters have more equity in their accounts when they admit defeat and return tomorrow with a fresh start and a clear head.” This world of trading is a paradox, the trading paradox involves embracing losing trades early and often while allowing those few golden trades make your year.

Trading the News: U. of Michigan Confidence (based on dailyfx article)

U. of Michigan Confidence to Improve for Second Consecutive Month.

- Print of 84.5 Would Mark the Highest Reading Since July.

Trading the News: U. of Michigan Confidence

A second straight rise in the U. of Michigan Confidence survey may spur a further decline in the EUR/USD as the ongoing improvement in the world’s largest economy puts increased pressure on the Federal Reserve to normalize monetary policy sooner rather than later.

What’s Expected:

Why Is This Event Important:

Despite expectations for a rate hike in 2015, a further pickup in household sentiment may undermine the Fed’s scope to retain the zero-interest rate policy (ZIRP) well into the following year, and a positive development may help to paint a more bullish outlook for the dollar as it raises the outlook for growth and inflation.

The ongoing improvement in the labor market along with the expansion in private sector lending may encourage a further pickup in consumer sentiment, and a better-than-expected print may generate a more bearish outlook for the EUR/USD as it raises the prospects for a stronger recovery.

However, sticky inflation paired with subdued wage growth may drag household confidence, and a dismal U. of Michigan release may spur a more meaningful rebound in the EUR/USD as drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: U. of Michigan Survey Advances to 84.5 or Higher

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Household Confidence Falters- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Fails to Retain Bullish RSI Momentum- Close Below Support to Favor Bearish Outlook

- Interim Resistance: 1.3960-70 (61.8% expansion)

- Interim Support: 1.3650 (78.6 expansion) to 1.3660 (23.6 retracement)

Impact that the U. of Michigan Confidence has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

The University of Michigan Confidence survey beat estimates last month coming in at 82.6 vs. 81.0 expected. The figure has failed to break 86 since 2007. Although not a large market mover, any major deviation from expectations could add to pressure on the greenback.

Trading Video: Risk and Yield Trends Unlikely to Turn EURUSD, EURJPY

A sharp drop from risk trends had FX traders looking for volatility amongst the majors. Yet, the masses refused to bite having become quite acclimated to provocative counter-moves that routinely fall short of momentum. At the same time, trends arising from divergent monetary policy bearings surrendered their drive to a compression in yields. While short-term ambitions have been put on hold, the medium-term trade potential remains. A risk aversion move would be far more violent and self-sustaining than a 'risk on' outcome; and the recent shift in central bank bearings has considerable premium yet to play out. We look at how the trade picture changes for pairs like EURUSD, GBPUSD, EURJPY and others as volatility changes around major themes in today's Trading Video.