You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

The EUR/USD pair fell during most of the week, but did manage to close right at the 1.37 handle, which is significant as it would has been both supportive and resistive recently. On top of that, there is an uptrend of sorts still being held by a line there, and as a result we feel that this market could continue to go higher. We may have just found the summer range – the area between the 1.37 level on the bottom, and the 1.40 level on the top.

House prices: countries with the cheapest and most expensive property markets

Authoritative research by the OECD highlights property markets in Australia and France as overpriced - but Portugal's a bargainGold Is Not Stable After All

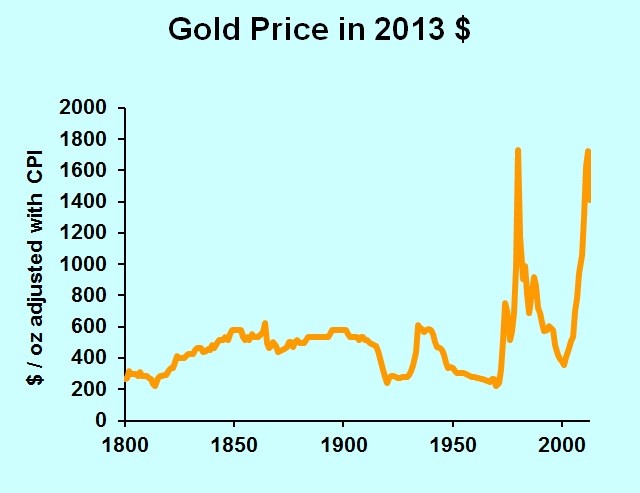

I like gold. My wedding ring is simple but classy. My crowns in my mouth are so good that I forget they are there. The electronic contacts in my computer work just fine. Gold is great. But not as a steady measure of purchasing power, nor as a guaranteed investment.

“Gold has the same purchasing power today that it had in 1913,” I continue to read. So let’s look at the data and see what we can conclude about gold, its stability and purchasing power, and then we’ll turn to gold as an investment.

To get an idea of the purchasing power of an ounce of gold, we’ll adjust the gold price by the Consumer Price Index. (I’ve noted elsewhere that Long-term Inflation estimates are misleading, but they are what we’ve got. Just keep in mind that your purchasing power has risen more than the CPI indicates.)

The chart shows a fairly steady price of gold for most of our history, followed by two giant spikes. We’ll get to the spikes later, but let’s narrow in on the seemingly steady period. It turns out that the era from 1800 through 1972 looks steady because those spikes require the chart’s vertical axis to be up at $2000.

If you had bought gold in 1800, you would have increased your purchasing power by 13 percent in five years. That’s not quite a stable measure of purchasing power, but given the accuracy of our price statistics, it’s in the ballpark. As an investment however, note that 13 percent over five years is lousy when interest rates are six to seven percent per year, as they were back then.

Pity, though, the person who bought gold in 1805. In nine years, his gold had lost 26 percent of its purchasing power. Gold was neither a stable measure of value nor a good investment.

The next few decades were good for gold owners. The gold price was steady while consumer prices fell. From the 1814 low until the start of the Civil War, the purchasing power of an ounce of gold more than doubled.

The inflationary years of the Civil War showed gold’s value in a time of crisis. Consumer prices rose 74 percent from 1861 through 1864, but the price of gold doubled.

Now let’s fast forward to the two spikes in the gold price series. In 1980, gold averaged $613 an ounce, though on the best day it traded at $850. By 1982 gold was trading the low $300s. It turns out that the Federal Reserve got serious about fighting inflation just as investors got serious about using gold to hedge against inflation. Ouch.

Then we had another run-up in 2011-12, with gold hitting a daily high of $1,781. As I am writing, May 15, 2014, gold is trading at just under $1,300, off 27 percent from its peak of a few years ago.

Instead of belaboring the data, let’s just say that gold’s value goes up and down. It is not a steady measure of value or purchasing power. Like all other assets, its value is not intrinsic; it has value only as people are willing and able to pay for it. That willingness and ability come and go, and thus gold’s value will rise and fall in the future.

The dollar ended Friday’s session slightly lower against the yen as a weaker-than-expected reading on U.S. consumer sentiment offset a report showing that U.S. home construction rose strongly in April.

USD/JPY settled at 101.52, down 0.05% for the day, not far from the two-month trough of 101.30 reached in the previous session. For the week, the pair was down 0.66%.

The Commerce Department reported Friday that U.S. housing starts rose 13.2% last month, after a 2.0% increase in March. It was the largest increase in five months, indicating that the economy is shaking off the effect of a weather related slowdown over the winter.

The upbeat housing data was overshadowed by a report showing that consumer confidence in the U.S. deteriorated this month. The University of Michigan's consumer sentiment index dropped to 81.8, from 84.1 the month before. Analysts had expected a slight uptick to 84.5.

The euro was lower against the dollar, with EUR/USD settling at 1.3693, holding just above the two-and-a-half month low of 1.3647 reached on Thursday. For the week, the pair was down 0.45%.

The single currency remained under pressure after weaker-than-expected data on euro zone first quarter growth on Thursday added to pressure on the European Central Bank to ease monetary policy at its next meeting in June, in order to safeguard the recovery in the region.

The euro zone’s gross domestic product grew just 0.2% in the first quarter, compared to expectations for growth of 0.4% and expanded by a smaller than expected 0.9% from a year earlier.

EUR/JPY ended Friday’s session at 139.03, down 0.17% for the day, after falling to lows of 138.78 earlier in the session, the weakest since February 12.

Elsewhere, sterling pushed higher against the dollar on Friday, with GBP/USD up 0.14% to 1.6812 at the close. For the week, the pair lost 0.35%.

Sterling weakened across the board on Wednesday after the Bank of England indicated that it is in no rush to hike interest rates, saying the economic recovery was still at an early stage.

In the week ahead, investors will be looking to the minutes from the Federal Reserve's latest monetary policy meeting, due for release on Wednesday, for insight on the central bank's view of the economy.

The euro zone is to publish what will be closely watched data on private sector activity, while the U.K. is to release data on consumer prices.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, May 19

- New Zealand is to publish data on producer price inflation. Japan is to release a report on core machinery orders.

- Germany’s

Bundesbank President Jens Weidmann is to speak at an event in

Frankfurt; his comment will be closely watched. Later in the day the

German central bank is to publish its monthly report.

- Markets in Canada are to remain closed for a national holiday.

Tuesday, May 20- The Reserve Bank of Australia is to publish the minutes

of its latest policy meeting, which contain valuable insights into

economic conditions from the bank’s perspective.

- In the euro zone, Germany is to release data on producer price inflation.

- The U.K. is to release data on consumer price inflation, which accounts for the majority of overall inflation.

- Canada is to publish data on wholesale sales.

- In

the U.S., Federal Reserve Bank of Philadelphia Charles Plosser and

Federal Reserve Bank of New York President William Dudley are to speak.

Wednesday, May 21- The Bank of Japan is to announce its benchmark interest

rate and publish its monetary policy statement, which outlines economic

conditions and the factors affecting the bank’s decision. The

announcement is to be followed by a press conference.

- Japan is also to publish data on the trade balance, the difference in value between imports and exports.

- Australia is to publish data on the wage price index and a private sector report on consumer sentiment.

- The euro zone is to release data on the current account.

- The

U.K. is to release data on retail sales, the government measure of

consumer spending, which accounts for the majority of overall economic

activity. Meanwhile, the Bank of England is to publish the minutes of

its May meeting.

- Fed Chair Janet Yellen is to speak at an event in New York.

- Later Wednesday, the Fed is to publish the minutes of its May meeting.

Thursday, May 22- China is to publish the preliminary reading of the HSCB manufacturing index.

- New Zealand and Australia are to produce data on inflation expectations.

- The

euro zone is to release data on manufacturing and service sector

activity, while Germany and France are to release individual reports.

- The

U.K. is to publish revised data on first quarter economic growth, as

well as reports on business investment and public sector borrowing. The

U.K. is also to produce private sector data on industrial order

expectations.

- Canada is to release data on retail sales.

- The U.S. is to release its weekly report on initial jobless claims and private sector data on existing home sales.

Friday, May 23The dollar edged lower against the yen late Friday after U.S. data on housing starts and consumer sentiment painted an uneven picture of the economic recovery.

USD/JPY settled at 101.52, down 0.05% for the day, not far from the two-month trough of 101.30 reached in the previous session. For the week, the pair was down 0.66%.

The dollar briefly edged up to session highs against the yen after the Commerce Department reported that U.S. housing starts rose 13.2% last month, after a 2.0% increase in March.

It was the largest increase in five months, indicating that the economy is shaking off the effect of a weather related slowdown over the winter.

The upbeat housing data was offset by a report showing that U.S. consumer confidence deteriorated this month. The University of Michigan's consumer sentiment index dropped to 81.8, from 84.1 the month before. Analysts had expected a slight uptick to 84.5.

Elsewhere Friday, EUR/JPY settled at 139.03, down 0.17% for the day, after falling to lows of 138.78 earlier in the session, the weakest since February 12.

The single currency remained under pressure after weaker-than-expected data on euro zone first quarter growth on Thursday added to pressure on the European Central Bank to ease monetary policy at its next meeting in June, in order to safeguard the recovery in the region.

The euro zone’s gross domestic product grew just 0.2% in the first quarter, compared to expectations for growth of 0.4% and expanded by a smaller than expected 0.9% from a year earlier.

In the week ahead, investors will be looking to the minutes from the Federal Reserve's latest monetary policy meeting, due for release on Wednesday, for insight on the central bank's view of the economy.

The Bank of Japan’s monetary policy decision on Wednesday will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, May 19

- Japan is to release a report on core machinery orders.

Tuesday, May 20- In the U.S., Federal Reserve Bank of Philadelphia

Charles Plosser and Federal Reserve Bank of New York President William

Dudley are to speak.

Wednesday, May 21- The BoJ is to announce its benchmark interest rate and

publish its monetary policy statement, which outlines economic

conditions and the factors affecting the bank’s decision. The

announcement is to be followed by a press conference.

- Japan is also to publish data on the trade balance, the difference in value between imports and exports.

- Fed Chair Janet Yellen is to speak at an event in New York.

- Later Wednesday, the Fed is to publish the minutes of its May meeting.

Thursday, May 22- The U.S. is to release its weekly report on initial jobless claims and private sector data on existing home sales.

Friday, May 23The dollar moved higher against the Swiss franc on Friday, but remained below the three-month peaks hit in the previous session as investors digested a mixed bag of U.S. economic data.

USD/CHF ended Friday’s session at 0.8926, up 0.19% for the day, holding just below the highs of 0.8959 struck on Thursday, the most since February 13.

The dollar was boosted after the Commerce Department reported that U.S. housing starts jumped 13.2% in April, after a 2.0% increase in March.

It was the largest increase in five months, indicating that the economy is shaking off the effect of a weather related slowdown over the winter.

The upbeat housing data was offset by a report showing that U.S. consumer confidence deteriorated in May. The University of Michigan's consumer sentiment index dropped to 81.8, from 84.1 the month before. Analysts had expected a slight uptick to 84.5.

The dollar advanced to three month highs against Swissy in the previous session as sharp losses in the euro bolstered the greenback.

The single currency came under renewed selling pressure after weaker-than-expected data on euro zone first quarter growth added to pressure on the European Central Bank to ease monetary policy at its next meeting in June, in order to safeguard the recovery in the region.

The euro zone’s gross domestic product grew just 0.2% in the first quarter, compared to expectations for growth of 0.4% and expanded by a smaller than expected 0.9% from a year earlier.

EUR/CHF ended Friday’s session at 1.2221, edging up 0.08%.

In the week ahead, investors will be looking to the minutes from the Federal Reserve's latest monetary policy meeting, due for release on Wednesday, for insight on the central bank's view of the economy.

Ahead of the coming week, Investing.com has compiled a list of this and other significant events likely to affect the markets. The guide skips Monday, as there are no relevant events on this day.

Tuesday, May 20

- In the U.S., Federal Reserve Bank of Philadelphia

Charles Plosser and Federal Reserve Bank of New York President William

Dudley are to speak.

Wednesday, May 21- Fed Chair Janet Yellen is to speak at an event in New York.

- Later Wednesday, the Fed is to publish the minutes of its May meeting.

Thursday, May 22- The U.S. is to release its weekly report on initial jobless claims and private sector data on existing home sales.

Friday, May 23The U.S. dollar was lower against the Canadian dollar late Friday following the release of upbeat U.S. housing sector data, which offset a report pointing to a deterioration in U.S. consumer sentiment.

USD/CAD ended Friday’s session at 1.0863, down 0.17% for the day. For the week, the pair lost 0.32%.

Investor sentiment was boosted after the Commerce Department reported that U.S. housing starts jumped 13.2% in April, after a 2.0% increase in March.

It was the largest increase in five months, indicating that the economy is shaking off the effect of a weather related slowdown over the winter.

The upbeat housing data was offset by a report showing that U.S. consumer confidence deteriorated in May. The University of Michigan's consumer sentiment index dropped to 81.8, from 84.1 the month before. Analysts had expected a slight uptick to 84.5.

Earlier in the week risk appetite was hit by concerns over the outlook for global growth after data showed that the euro zone economy grew less strongly than forecast in the first three months of the year.

The euro zone’s gross domestic product grew just 0.2% in the first quarter, compared to expectations for growth of 0.4% and expanded by a smaller than expected 0.9% from a year earlier.

In Canada, data on Friday showed that foreigners reduced their holdings in Canadian securities in March, while Canadian investors purchased foreign securities at the fastest pace in 16 months.

Statistics Canada said foreign investors sold a net C$1.23 billion in Canadian securities, while Canadian investors acquired C$7.88 billion in foreign securities, the largest investment abroad since November 2012.

In the week ahead, investors will be looking to the minutes from the Federal Reserve's latest monetary policy meeting, due for release on Wednesday, for insight on the central bank's view of the economy.

Canadian data on retail sales and consumer prices will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, May 19

- Markets in Canada are to remain closed for a national holiday.

Tuesday 20- Canada is to publish data on wholesale sales.

- In

the U.S., Federal Reserve Bank of Philadelphia Charles Plosser and

Federal Reserve Bank of New York President William Dudley are to speak.

Wednesday, May 21- Fed Chair Janet Yellen is to speak at an event in New York.

- Later Wednesday, the Fed is to publish the minutes of its May meeting.

Thursday, May 22- Canada is to release data on retail sales, the

government measure of consumer spending, which accounts for the majority

of overall economic activity.

- The U.S. is to release its weekly report on initial jobless claims and private sector data on existing home sales.

Friday, May 23The Australian dollar eased up modestly against its U.S. counterpart on Friday, as market players weighed a mixed bag of U.S. data on housing starts and consumer sentiment.

AUD/USD hit 0.9408 on Wednesday, the pair’s highest since April 15, before subsequently consolidating at 0.9365 by close of trade on Friday, up 0.1% for the day and 0.02% higher for the week.

The pair is likely to find support at 0.9326, the low from May 15 and resistance at 0.9408, the high from May 14.

The Commerce Department reported Friday that U.S. housing starts rose 13.2% in April, after a 2.0% increase in March. It was the largest increase in five months, indicating that the economy is shaking off the effect of a weather-related slowdown over the winter.

But the upbeat housing data was overshadowed by a report showing that consumer confidence in the U.S. deteriorated this month. The University of Michigan's consumer sentiment index dropped to 81.8 in May, from 84.1 in April. Analysts had expected a slight uptick to 84.5.

Meanwhile, in Australia, the nation’s Treasury said, in its annual budget report released Tuesday, that the government aims to nearly halve its budget deficit over the next year through a combination of spending cuts and tax increases.

According to the report, the deficit is forecast to fall from A$50 billion to A$30 billion, while the spending cuts however are expected to lead to thousands of job losses.

The budget report also mentioned the government's plans to spend as much as A$11 billion on key infrastructure projects such as roads, railways and a new airport in Sydney.

Data from the Commodities Futures Trading Commission released Friday showed that speculators increased their bullish bets on the Australian dollar in the week ending May 13.

Net longs totaled 17,127 contracts, compared to net longs of 8,637 in the preceding week.

In the week ahead, investors will be looking ahead to the release of the minutes from both the Reserve Bank of Australia’s and the Federal Reserve's most recent monetary policy meeting.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets. The guide skips Monday, as there are no relevant events on this day.

Tuesday, May 20

- The Reserve Bank of Australia is to publish the minutes

of its latest policy meeting, which contain valuable insights into

economic conditions from the bank’s perspective.

- In the

U.S., Federal Reserve Bank of Philadelphia Charles Plosser and Federal

Reserve Bank of New York President William Dudley are to speak.

Wednesday, May 21- Australia is to publish data on the wage price index and a private sector report on consumer sentiment.

- Fed

Chair Janet Yellen is to speak at an event in New York. Later

Wednesday, the Fed is to publish the minutes of its May meeting.

Thursday, May 22- China is to publish the preliminary reading of the HSCB

manufacturing index. The Asian nation is Australia’s largest trade

partner.

- Australia is to produce data on inflation expectations.

- The U.S. is to release its weekly report on initial jobless claims and private sector data on existing home sales.

Friday, May 23Just to make it shorter :

==============

Economic Calendar events to watch this week

The economic calendar for upcoming week is less busy after last week saw several key economic data releases. The main events this week are the publication of the minutes of the Federal Reserve’s April meeting and data on U.S. home sales. Economy watchers will also be focusing on manufacturing data from China and the euro zone. Here are some key events to watch:

Federal Reserve minutes

The Fed is to publish the minutes from its April 29-30 meeting on Wednesday. There was no press conference after the most recent monetary policy meeting, and the rate statement was by and large unchanged from the previous release. The minutes are expected to indicate that the unwinding of the bank’s stimulus program will proceed on its current timetable.

Fed speakers

Fed Chair Janet Yellen is to deliver the commencement address at New York University on Wednesday. Other Fed speakers this week include Richard Fischer (Dallas) on Monday, Charles Plosser (Philadelphia) and William Dudley (New York) on Tuesday, Narayana Kocherlakota (Minneapolis) and Dudley again on Wednesday; and Williams again on Thursday.

Global manufacturing data

China is to publish the preliminary reading of the HSBC manufacturing PMI on Thursday while the euro zone is also to publish its manufacturing PMI. The HSBC Chinese manufacturing PMI has remained in contraction territory since December 2013, fuelling fears over a slowdown in the world’s second largest economy. Economy watchers are expecting an uptick to 48.4 this month from 48.1 in April. The euro zone manufacturing index is expected to pull back slightly from last month’s three-year highs.

US home sales

The U.S. is to release data on existing home sales on Thursday and a report on new home sales on Friday. Market expectations are for a pick-up in sales of both new and existing homes, while weak numbers would point to underlying weakness in the sector.

Bank of Japan monetary policy announcement

The BoJ is to announce its benchmark interest rate and publish its monetary policy statement on Wednesday. The BoJ will now have data on the impact of last month’s sales tax increase on the economy, which could prompt further monetary policy action by the bank.

The New Zealand dollar fell from the previous session’s one-week high against its U.S. counterpart on Friday, amid indications that the U.S. economy is shaking off the effect of a weather-related slowdown over the winter.

NZD/USD hit 0.8694 on Thursday, the pair’s highest since May 7, before subsequently consolidating at 0.8634 by close of trade, down 0.12% for the day but still 0.25% higher for the week.

The pair is likely to find support at 0.8607, the low from May 13 and resistance at 0.8694, the high from May 15.

The Commerce Department reported Friday that U.S. housing starts rose 13.2% last month, the largest increase in five months and following a 2.0% increase in March.

The upbeat housing data came one day after a report from the U.S. Department of Labor showed that the number of people who filed for unemployment assistance in the U.S. last week fell to a six-year low of 297,000.

The robust data underlined the view that the U.S. economy was regaining traction after being slowed by unusually cold temperatures during the winter months.

Meanwhile, in its annual budget release published Thursday, New Zealand's Treasury said the operating surplus will be NZ$372 million in the year through June 2015, up from a previously forecast NZ$86 million.

The Treasury also forecast the nation's jobless rate will decline to 4.4% in 2018 from a projected 5.4% next fiscal year.

The report came after Reserve Bank of New Zealand Chairman Graeme Wheeler said last week that the speed and extent of further interest rate increases will depend on economic performance and how much the nation’s strong currency weighs on inflation.

The central bank has already raised its benchmark interest rate twice this year to 3%, after keeping at a record low 2.5% to support the economy.

Data from the Commodities Futures Trading Commission released Friday showed that speculators decreased their bullish bets on the New Zealand dollar in the week ending May 13.

Net longs totaled 19,340 contracts as of last week, compared to net longs of 20,693 contracts in the previous week.

In the week ahead, investors will be looking to the minutes from the Federal Reserve's latest monetary policy meeting, due for release on Wednesday, for insight on the central bank's view of the economy.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, May 19

- New Zealand is to publish data on producer price inflation.

Tuesday, May 20- Federal Reserve Bank of Philadelphia Charles Plosser

and Federal Reserve Bank of New York President William Dudley are to

speak.

Wednesday, May 21- Fed Chair Janet Yellen is to speak at an event in New

York. Later Wednesday, the Fed is to publish the minutes of its May

meeting.

Thursday, May 22- New Zealand is to produce data on inflation expectations.

- China

is to publish the preliminary reading of the HSCB manufacturing index.

The Asian nation is the New Zealand’s second-largest trade partner.

- The U.S. is to release its weekly report on initial jobless claims and private sector data on existing home sales.

Friday, May 23