You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

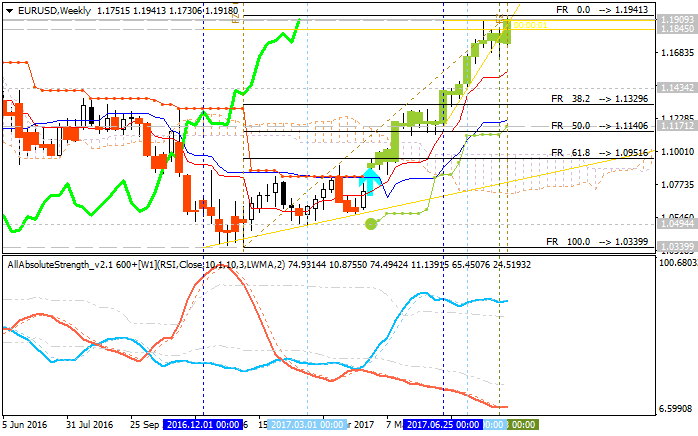

Weekly EUR/USD Outlook: 2017, August 27 - September 03 (based on the article)

EUR/USD was looking good during the last full week of August and remained range-bound. What’s next? The inflation figures stand out as we turn the page into September.

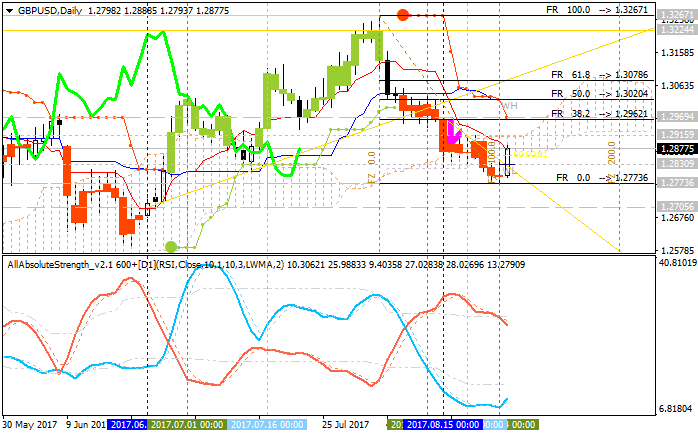

Weekly GBP/USD Outlook: 2017, August 27 - September 03 (based on the article)

GBP/USD was making attempts to recover but did not go anywhere fast and found itself grinding lower. The upcoming week feature the manufacturing PMI as well as other figures.

Weekly USD/JPY Outlook: 2017, August 27 - September 03 (based on the article)

Dollar/yen was leaning lower in a week that saw further political issues for President Trump. Nevertheless, the pair maintains a distance from the 108.10 level which remains critical.

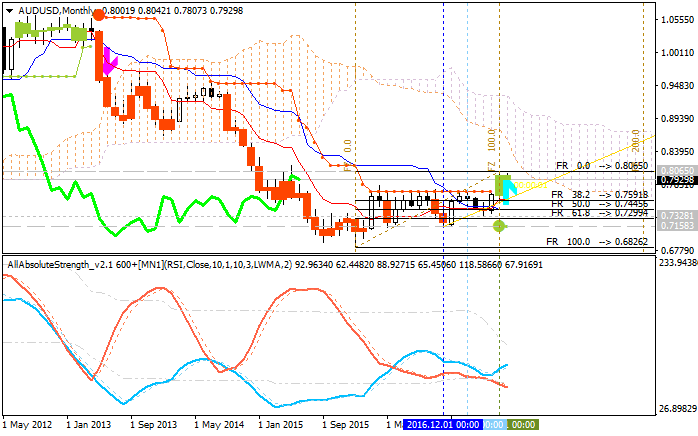

Weekly AUD/USD Outlook: 2017, August 27 - September 03 (based on the article)

The Australian dollar stabilized on high ground, consolidating previous gains. What’s next? Australian capital expenditure and Chinese data stand out in a busier week.

EUR/USD - daily bullish; 1.1941 is the key (based on the article)

Daily price is above Ichimoku cloud in the bullish area of the chart for the ranging within the following support/resistance levels:

Ascending triangle pattern was formed by the price to be crossed to above together with 1.1941 resistance evel for the bullish trend to be continuing.

GBP/USD - ranging within/around Ichimoku cloud for the direction of the strong trend to be started (based on the article)

Daily price is ranging within and around Ichimoku cloud waiting for the direction of the strong trend to be started.

If the daily price breaks 1.2942 resistance level on close bar so the bullish reversal will be started.

If the price breaks 1.2773 support level on close D1 bar so the bearish trend will be resumed.

If not so the price will be on ranging market condition within the levels.

Consumer Confidence Index

Intra-Day Fundamentals - EUR/USD, USD/CAD and USD/CNH: Consumer Confidence Index

2017-08-29 15:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report :

==========

EUR/USD M5: range price movement by Consumer Confidence Index news events

==========

USD/CAD M5: range price movement by Consumer Confidence Index news events

==========

USD/CNH M5: range price movement by Consumer Confidence Index news events

GOLD (XAU/USD) - daily bullish breakout; 1,300/1,375 are the keys (based on the article)

Daily price is located far above from Ichimoku cloud in the bullish area of the chart: the price is on bullish breakout for 1,300 resistance level to be crossing for the bullish trend to be continuing.

AUD/USD Intra-Day Fundamentals: Australian Building Approvals and range price movement

2017-08-30 02:30 GMT | [AUD - Building Approvals]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Building Approvals] = Change in the number of new building approvals issued.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Building Approvals news event