You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

GOLD (XAU/USD): Bad news for gold when interest rates go up (based on the article)

Daily price is on secondary correction within the primary bullish trend on the chart: price was bounce from 1,263.79 resistance to below for the support level at 1,222.84 to be testing for the correctional trend to be continuing with 1,188/1,171 bearish daily reversal target.

EUR/USD Intra-Day Fundamentals: U.S. Factory Orders and range price movement

2017-03-06 15:00 GMT | [USD - Factory Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Factory Orders] = Change in the total value of new purchase orders placed with manufacturers.

==========

From rttnews article:

==========

EUR/USD M5: range price movement by U.S. Factory Orders news event

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and 41 pips range price movement

2017-03-07 03:30 GMT | [AUD - Cash Rate]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

From news.com.au article:

==========

AUD/USD M5: 41 pips range price movement by RBA Cash Rate news event

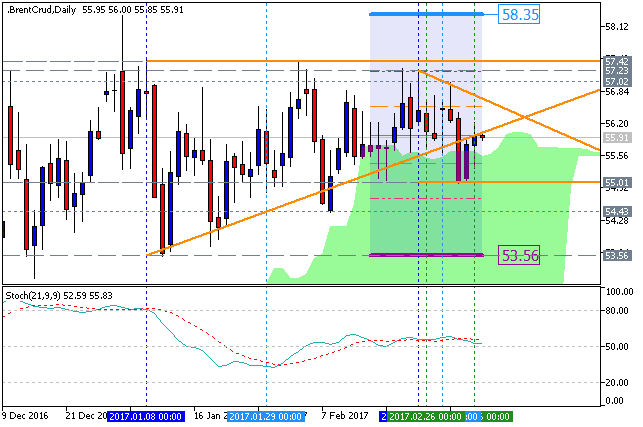

Brent Crude Oil - ready to go (adapted from the article)

Daily price is located near and above Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart. The price is moving along the upper border of Ichimoku cloud to be ready for bearish reversal or to the bullish trend to be resumed.

s

EUR/USD Intra-Day Fundamentals: German Factory Orders and range price movement

2017-03-07 07:00 GMT | [EUR - German Factory Orders]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Factory Orders] = Change in the total value of new purchase orders placed with manufacturers.

==========

From official report:

==========

EUR/USD M5: range price movement by German Factory Orders news event

USD/CNH Intra-Day Fundamentals: China CGAC Trade Balance and 99 pips range price movement

2017-03-08 03:35 GMT | [CNY - Trade Balance]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Trade Balance] = Difference in value between imported and exported goods during the previous month.

==========

From theaustralian article:

==========

USD/CNH M5: 99 pips range price movement by China Trade Balance news event

Dollar Index: daily bullish reversal (based on the article)

Daily price broke Ichimoku cloud for the bullish reversal: the price is on testing 102.26 resistance level for the bullish trend to be continuing, otherwise - ranging.

NZD/USD Technical Outlook: breakdown with the bearish reversal (based on the article)

Daily price is on breakdown to be started in 1st of March this year: price broke Ichimoku cloud to below to be reversed from the bullish to the primary bearish market condition with 0.6947/0.6933 resistance levelss to be testing for the bearish trend to be continuing.

USD/CNH Intra-Day Fundamentals: China Consumer Price Index and 113 pips range price movement

2017-03-09 01:30 GMT | [CNY - CPI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers.

==========

From btvi article:

==========

USD/CNH M5: 113 pips range price movement by China Consumer Price Index news event

GOLD (XAU/USD) - ranging correction with descending triangle pattern to be formed with 1,206 support level (based on the article)

Daily price is located above Ichimoku cloud and below 200-day SMA in the bullish area of the chart with the secondary ranging condition.

If the price breaks 200-day SMA value at 1,263.79 to above so the primary bullish trend will be resumed.

If daily price breaks 1,206.59 support level to below so the bearish reversal may be started.

If not so the price will be on ranging waiting for the direction of the trend.