You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Dollar Index - "The US unit may build on Friday’s gains if the Fed ends up dominating the spotlight, stoking March rate hike possibilities. Dangling the prospect of a two-pronged tightening effort – raising front-end borrowing costs and reducing the weight of the balance sheet on the long end of the yield curve – may go a long way indeed. Unsettling news-flow from team Trump may shatter this rosy vision however."

USD/JPY - "The 2017 FOMC voting members (Minneapolis Fed President Neel Kashkari, Philadelphia Fed President Patrick Harker and Fed Governor Jerome Powell) schedule to speak in the week ahead may strike a similar tone to Chair Yellen, and the fresh rhetoric may do little to alter the interest rate outlook as Fed Fund Futures continue to highlight limited expectations for a March rate-hike, with market participants still pricing a greater than 60% probability for a move in June. The FOMC Minutes may share a similar and fail to prop up the greenback as officials expect ‘the evolution of the economy to warrant further gradual increases in the federal funds rate,’ and more of the same rhetoric may produce range-bound conditions in the exchange rate, with the pair with the pair at risk of giving back the advance from earlier this month as risk appetite abates."

AUD/USD - "The coming week is unlikely to alter that view, if only because scheduled economic clues are scant. There’s no first-tier data out of Australia in prospect at all, apart from a look at wage costs on Wednesday. There are a few interesting second-rank reports, notably the ANZ/Roy Morgan look at consumer confidence, and private capital expenditure data. We will also hear from RBA Governor Philip Lowe. He speaks in Sydney on Tuesday."

Brent Crude Oil - "We’ve recently heard figures as high as 92% about how much has been cutrelative to the promised amount. A significant factor to keep an eye on with Oil is not just the lack of price action since January, but rather the rising trend in other commodities like industrial metals. Headlines from Reuter’s this week helped further support Oil on reports that OPEC could extend or deepen supply cut at May meeting if oil stocks are still too high. Naturally, there tends to be a positive correlation to energy products like Oil and industrial metals. In the last week, the famous Dr. Copper (a term coined by the view the Copper holds predictive value in explaining global market demand,) recently surpassed the November peak."

S&P 500 - "Heading into next week, on further strength we will look to the backside of the steeply rising November trend-line as potential resistance; given its angle, depending on the timing, the level comes in at ~2369-2385. On a minor dip, we will look to the Feb ’16 trend-line the market arched over last week as potential support: ~2332-2339."

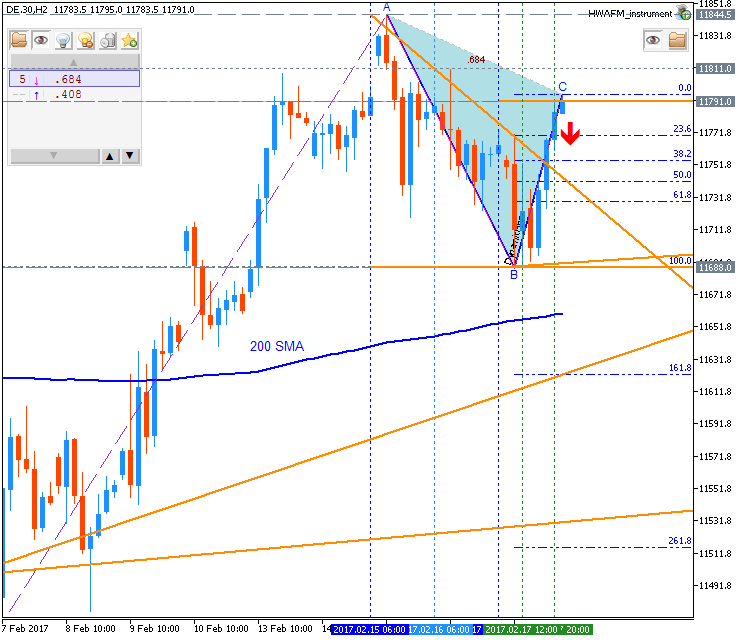

DAX Index - "The DAX posted all of its weekly gains on Monday, and tried to give those back by week’s end before a solid rebound took shape Friday afternoon. Overall, the picture is constructive and we view the DAX as having potential this coming week to take out 11848 and challenge the Jan high of 11893. On a break above, the market will begin facing off against swing highs created during the decline off record highs in 2015. The most notable levels are 11920 and with a strong bid up to 12079. Should we see weakness there is support by way of a trend-line back to the beginning of December."

Nikkei 225 - "We will look to the a top-side trend-line at around 19475 as resistance, with a break above the 2/13 high of 19519 as giving the Nikkei potential to begin an advance towards hitting 20k. It will of course need to break above 19615 for full clearance. On the downside, watch the 2/10 gap-day for a possible fill. On Friday, the market dipped slightly below the gap-day low, but closed back above. A fill of that gap would carry the Nikkei down into the lower trend-line in the 18970 vicinity, with swing lows beneath at 18805 and then 18650. A break below those levels likely means we are seeing some form of risk-off on a global basis. No notable news events on the docket to get excited about."

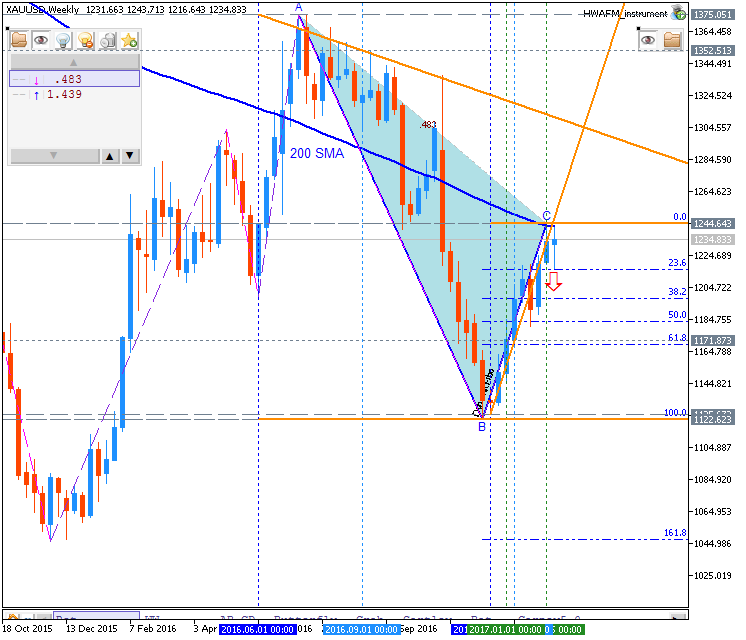

GOLD (XAU/USD) - "Highlighting this week’s economic docket was Fed Chair Janet Yellen’s semi-annual Humphrey Hawkins testimony before congress. The remarks casted a slightly more hawkish outlook as Yellen warned of the risks of keeping rates too low for too long and while we’ve heard this commentary before, it’s becoming increasingly more relevant as U.S. economic data continues to heat up. That said, market expectations remains steady for a June rate hike with Fed Fund Futures pricing a 73% chance. Expectations for a hike at the May meeting have climbed to 56% - although it’s important to keep in mind the central bank has never hiked on an off-presser meeting (who knows, it’s the year of the ‘unprecedented’ – maybe they break suit?). For gold, look for a creep higher in interest rate expectations & strength in the greenback to curb demand for the yellow metal."EURO with valuation problem to be located near and below Yearly Central Pivot waiting for direction (based on the article)

W1 price is located to be below yearly Central Pivot at 1.0984 and above S1 Pivot at 1.0352:

Weekly Outlook: 2017, February 19 - February 26 (based on the article)

A mixed and turbulent week saw the dollar going in all directions. Where will it go? UK GDP data, US FOMC Meeting Minutes, and other events stand out. These are the nain eventa on forex calendar for this week.

Dow Jones Industrial Average, H8 timeframe, bearish developing retracement pattern: