You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

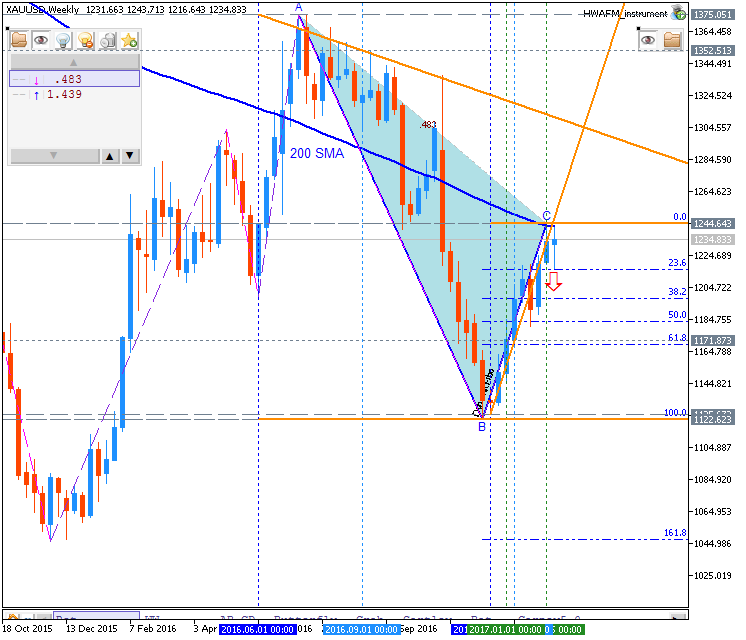

Gold short now

Mauro Giuseppe Tondo, 2017.02.02 10:49

Gold

short now 1216.50 target 1170.70 stop 1220

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.11 08:06

Weekly Outlook: 2017, February 12 - February 19 (based on the article)GDP data from Japan and Germany, Inflation data from the UK and the US, Janet Yellen’s testimony before the US Senate, US retail sales, Crude Oil Inventories, Building Permits, Philly Fed Manufacturing Index and Employment figures from the US, The UK and Australia. These are the main events on Forex calendar.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.12 09:19

Markets To Watch In The Week Ahead (based on the article)

"The April crude oil contract rallied sharply from Wednesday's low at $51.86 on news that the OPEC measures to reduce production are actually working. Crude sill closed the week a bit lower so this week's close will be important."

"The Comex gold futures have rallied $100 from the mid December lows and have retraced 50% of the decline from the July highs. The former support, line a, is now important resistance. It is in the 1284 area along with the weekly starc+ band and the 61.8% resistance level."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.18 18:33

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)

GOLD (XAU/USD) - "Highlighting this week’s economic docket was Fed Chair Janet Yellen’s semi-annual Humphrey Hawkins testimony before congress. The remarks casted a slightly more hawkish outlook as Yellen warned of the risks of keeping rates too low for too long and while we’ve heard this commentary before, it’s becoming increasingly more relevant as U.S. economic data continues to heat up. That said, market expectations remains steady for a June rate hike with Fed Fund Futures pricing a 73% chance. Expectations for a hike at the May meeting have climbed to 56% - although it’s important to keep in mind the central bank has never hiked on an off-presser meeting (who knows, it’s the year of the ‘unprecedented’ – maybe they break suit?). For gold, look for a creep higher in interest rate expectations & strength in the greenback to curb demand for the yellow metal."Forum on trading, automated trading systems and testing trading strategies

Gold moving upwards.

Thomas Lawson, 2017.02.26 15:39

Gold is resting at the 61.8% fib level 1255.12. Most likely it will move higher to the 78.6% fib level 1291.01.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.26 13:27

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)GOLD (XAU/USD) - "U.S. economic data picks up next week with traders eyeing the release of Durable Goods Orders, the second read on 4Q GDP and the Core Personal Consumption Expenditure (PCE) - the Fed’s preferred gauge on inflation. Keep in mind we have a host of voting FOMC speakers on tap next week with Dallas Fed President Robert Kaplan, Philadelphia Fed President Patrick Harker, Fed Governor Lael Brainard, Fed Governor Jerome Powell, Fed Vice-Chair Stanley Fischer and Chair Janet Yellen slated for commentary. Continued strength in US data may further the argument for a March rate-hike as a growing number of central bank officials favor normalizing monetary policy “sooner rather than later.” That said, a fresh batch of hawkish commentary may curb demand for gold prices which have surged more than 9.4% year-to-date."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.02 08:50

Gold: bounced from 200-day SMA to 10-day EMA to below for the daily bearish trend to be resumed (adapted from the article)

D1 price is located near and below 200 SMA on the border between the primary bearish and the primary bullish trend on the chart for 10 EMA to be crossing to below with 1,226 support level as the nearest daily target to re-enter:

- "Technically, gold prices have declined substantially after trading to yearly highs earlier in the week at $1,264.06. Now, prices are trading back below their 10 day EMA (exponential moving average), which is found at $1,244.54. A daily close below this average should be considered as a bearish turn in the market, and traders should note that gold prices have not closed below this line since January 30th of this year. If prices decline further, on continued US Dollar strength, gold traders may begin looking for support near the February 21st low of $1,226.23."

- "It should also be noted that the US Dollar remain well above their 10 day EMA at 101.20, which should be considered as a value of ongoing support. In the event that the US Dollar turns lower on today’s news, traders should look for the market to trade back toward this average. In a bearish US Dollar scenario, prices should form a long wick reconfirming the previous point of resistance referenced at 101.69. Also in the event that the US Dollar gives back its previous gains, traders should reasonably expect gold prices to rally eliminating its prior daily losses."

If the price breaks 1,264 resistance level so daily bullish reversal will be started.If price breaks 1,226 support so the bearish trend will be resumed.

If not so the price will be ranging within the levels waiting for direction.

SUMMARY: ranging

TREND: waiting for directionForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.04 11:41

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)GOLD (XAU/USD) - "Logic would dictate that a rate hike from the Fed would drive the dollar higher and gold, which yields nothing, lower. That pattern has been seen in the price action of the past couple days. However, if we pan out we can view how the two recent Fed rate hikes were followed by rising gold prices. It is clear from the chart below that increasing rates and even the recent increase in rate hike expectations has driven gold price higher."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.06 15:46

GOLD (XAU/USD): Bad news for gold when interest rates go up (based on the article)

Daily price is on secondary correction within the primary bullish trend on the chart: price was bounce from 1,263.79 resistance to below for the support level at 1,222.84 to be testing for the correctional trend to be continuing with 1,188/1,171 bearish daily reversal target.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.09 10:20

GOLD (XAU/USD) - ranging correction with descending triangle pattern to be formed with 1,206 support level (based on the article)

Daily price is located above Ichimoku cloud and below 200-day SMA in the bullish area of the chart with the secondary ranging condition.

If the price breaks 200-day SMA value at 1,263.79 to above so the primary bullish trend will be resumed.

If daily price breaks 1,206.59 support level to below so the bearish reversal may be started.

If not so the price will be on ranging waiting for the direction of the trend.