You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Fundamental Weekly Forecasts for EUR/USD, AUD/USD, USD/JPY, USD/CNH and GOLD (based on the article)

EUR/USD - "It would be highly unlikely to see the European Central Bank make any moves that may prove to be too provocative given that portions of the recently triggered package are still on their way to being filtered through the economy, and, frankly, the ECB may be nearing a dearth of ammunition, at least in the near-term. This may simply be a case where the bank sees the risks of any ‘big actions’ far outweighing the potential pay-offs."

AUD/USD - "The near-term outlook for AUD/USD remains mired as the pair preserves the downward trending channel carried over from the previous month, but a series of positive developments out of Australia may threaten the bearish pattern as the pair carves as series of higher highs & lows coming into September. In turn, a break of trendline resistance along with a break/close back above former support around 0.7650 (78.6% retracement) may generate a larger advance in the exchange rate, with the next topside target coming in around 0.7740 (78.6% retracement)."

USD/JPY - "Next week, the finalized print for 2Q GDP for the Japanese economy is expected to see an upward revision to a seasonally adjusted 0.4% q/q up from the preliminary reading of 0.2%. The GDP print will be combined with the Balance of Payments reading that will help traders see how the export-dependent economy is faring in an environment of a rather strong JPY."

USD/CNH - "Although the PBOC’s monetary policy is moderate in general, their next move may depend on key economic indicators. The soaring housing prices, mortgages, and real estate companies’ borrowing have elevated the risk of asset price bubbles.The July New Yuan Loans read shows that mortgages have become the sole driver to bank credit.The August prints to be released next week could give us some clues on the development of the housing sector. The PBOC as well as other financial regulators may respond accordingly to the figures as curbing price bubbles has been set as one primary target of the country."

GOLD (XAU/USD) - "The broader outlook remains unchanged from last week and from a technical standpoint, heading into September trade seasonal tendencies favor strength after next week so we’ll be looking for a low as the monthly opening range takes shape. Price turned higher this week from confluence support where the 50-line of the descending median-line formation converges on the May high and the 100% extension at 1303. Friday’s rally failed just ahead of the July low-day reversal close at 1330 and the risk remains lower near-term while below this mark."

USD/JPY Intra-Day Fundamentals: Bank of Japan Gov Kuroda Speaks and 54 pips range price movement

2016-09-05 02:30 GMT | [JPY - BoJ Gov Kuroda Speaks]

[JPY - BoJ Gov Kuroda Speaks] = Speech at the Kyodo News event, in Tokyo.

==========

From forexlive article: Bank of Japan Governor Kuroda speaking at a ''Kisaragi-kai'' forum sponsored by Kyodo News

==========

USD/JPY M5: 54 pips range price movement by Bank of Japan Gov Kuroda Speech news event

GBP/USD Intra-Day Fundamentals: U.K. Services PMI and 53 pips range price movement

2016-09-05 08:30 GMT | [GBP - Services PMI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

From theguardian article: Biggest ever monthly rise as UK service sector PMI hits 52.9

"The services sector PMI may have come in ahead of expectations at 52.9, resulting in a healthy figure of 53.2 for the economy as a whole, but the blue-chip stock index remains unimpressed. Having started the day flat, the FTSE 100 is has edged down by around 0.2% to 6,880. However, the pound is on the up, reaching a seven-week high of $1.3375 against the dollar."

Dean Turner, economist at UBS Wealth Management, said:

Today’s improvements are in line with the string of robust economic figures we’ve seen throughout August. But, while there is some reason for optimism today, it’s still too early to conclude that the UK has escaped the Brexit vote unscathed.

We still expect growth to slow to zero in the second half of the year, although the current quarter may be a little stronger than anticipated, followed by greater weakness in the fourth quarter.

Now that we’ve seen some resilience in the UK economy, many are questioning whether last month’s Monetary Policy Committee decision was the right one. We believe the Bank of England has taken the correct course of action and expect them to ease further before the year is out.

==========

GBP/USD M5: 53 pips range price movement by U.K. Services PMI news event

AUD/USD Intra-Day Fundamentals: Reserve Bank of Australia Cash Rate and 20 pips range price movement

2016-09-06 04:30 GMT | [AUD - Cash Rate]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

From Financial Times article: RBA keeps benchmark rate on hold

"The Reserve Bank of Australia has kept its benchmark rate on hold at 1.5 per cent, as Glenn Stevens presides over his final policy meeting as governor."

From the RBA’s statement:

Low interest rates have been supporting domestic demand and the lower exchange rate since 2013 is helping the traded sector. Financial institutions are in a position to lend for worthwhile purposes. These factors are all assisting the economy to make the necessary economic adjustments, though an appreciating exchange rate could complicate this.

Supervisory measures have strengthened lending standards in the housing market. Separately, a number of lenders are also taking a more cautious attitude to lending in certain segments. The best available information suggests that dwelling prices overall have risen moderately over the past year and growth in lending for housing purposes has slowed. Considerable supply of apartments is scheduled to come on stream over the next couple of years, particularly in the eastern capital cities.

==========

AUD/USD M5: 20 pips range price movement by RBA Cash Rate news event

What’s Wrong With EUR/USD? (adapted from the article)

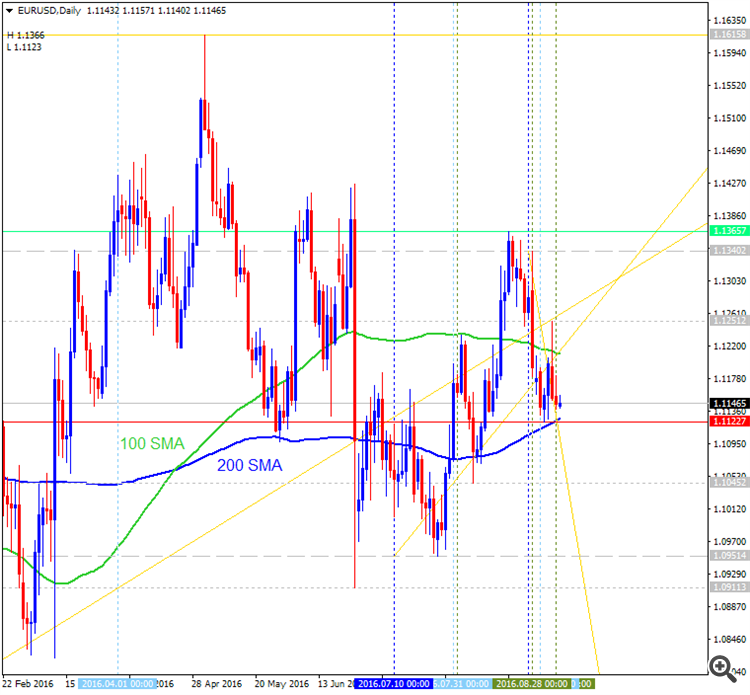

Thus, seems support level at 1.1122 is the key level for the pair to be reversed to the primary bearish trend.Intra-Day Fundamentals - EUR/USD, AUD/USD and USD/CNH: ISM Non-Manufacturing PMI

2016-09-06 14:00 GMT | [USD - ISM Non-Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Non-Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry.

==========

"The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 51.4 percent in August, 4.1 percentage points lower than the July reading of 55.5 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased substantially to 51.8 percent, 7.5 percentage points lower than the July reading of 59.3 percent, reflecting growth for the 85th consecutive month, at a notably slower rate in August. The New Orders Index registered 51.4 percent, 8.9 percentage points lower than the reading of 60.3 percent in July. The Employment Index decreased 0.7 percentage point in August to 50.7 percent from the July reading of 51.4 percent. The Prices Index decreased 0.1 percentage point from the July reading of 51.9 percent to 51.8 percent, indicating prices increased in August for the fifth consecutive month. According to the NMI®, 11 non-manufacturing industries reported growth in August."

==========

EUR/USD M5: 85 pips price movement by ISM Non-Manufacturing PMI news event

==========

AUD/USD M5: 52 pips price movement by ISM Non-Manufacturing PMI news event

==========

USD/CNH M5: 122 pips price movement by ISM Non-Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

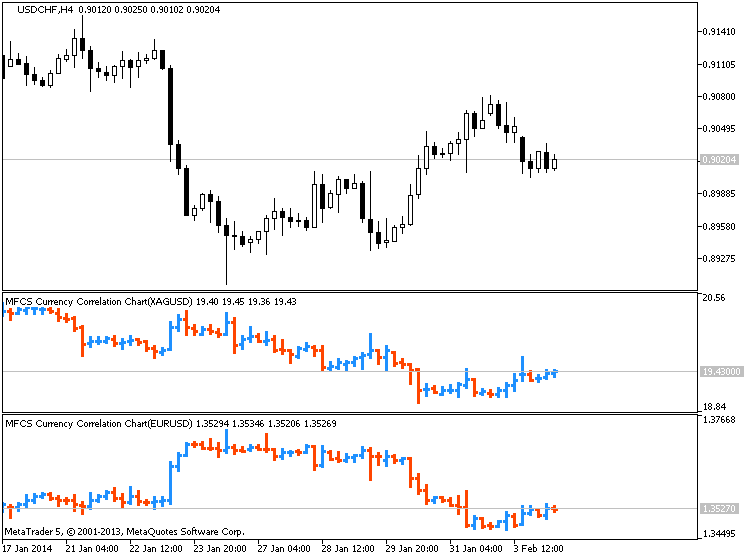

Indicators: MFCS Currency Correlation Chart

Sergey Golubev, 2014.02.04 09:27

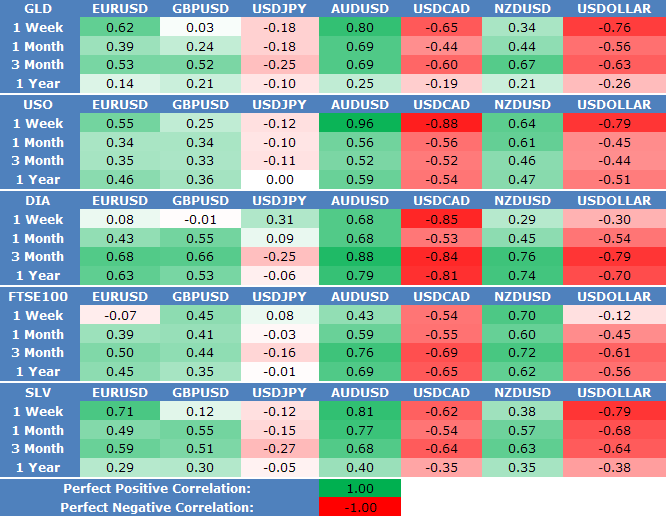

Australian Dollar Strongly Correlated to Gold, Silver, Steel Prices (based on this article)

View forex correlations to the SPDR Gold ETF Trust (GLD), United States Oil Fund ETF (USO), SPDR Dow Jones Industrial Average ETF Trust (DIA), UK FTSE 100 Index, and IShares Silver Trust ETF (SLV) prices:

XAUUSD/AUDUSD :

XAGUSD/EURUSD :

XAGUSD/USDCAD :

AUD/USD Intra-Day Fundamentals: Australian Gross Domestic Product and 28 pips range price movement

2016-09-07 01:30 GMT | [AUD - GDP]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

AUD/USD M5: 28 pips range price movement by Australian GDP news event

GBP/USD Intra-Day Fundamentals: U.K. Factory production and 45 pips price movement

2016-09-07 08:30 GMT | [GBP - Manufacturing Production]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Manufacturing Production] = Change in the total inflation-adjusted value of output produced by manufacturers.

==========

==========

GBP/USD M5: 45 pips price movement by U.K. Factory production news event

S&P 500 Unshortable ? (based on the article)

S&P 500 increased by 0.45% for the month, 0.08% for a week, and it was decreased by 0.06% for the day. H4 intra-day price broke 100-day SMA/200-day SMA levels for the bullish market condition. The price is on testing with 2,185.75 resistance level for the bullish trend to be continuing. Alternative, if the price breaks 2,172.75 support ot below so the bearish trend will be resumed.

S&P 500 daily is on primary bullish market condition located above 100 SMA/200 SMA reversal area for the ranging within the narrow support/resistance levels:

The most likely scenarioo for the movement for September is the following: daily price will be on ranging within 2,191/2,154.