You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.03 05:45

USD/JPY Intra-Day Fundamentals: BOJ Gov Kuroda Speaks and 11 pips price movement

2016-02-03 02:30 GMT | [JPY - BOJ Gov Kuroda Speaks]

BOJ Gov Kuroda speaks speak at the Kisaragi-kai meeting, in Tokyo: Introduction of "Quantitative and Qualitative Monetary Easing with a Negative Interest Rate".

==========

USDJPY M5: 11 pips price movement by BOJ Gov Kuroda Speaks news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.12 05:56

USD/JPY: to a near-term 'turning point' - Morgan Stanley (based on the article)

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.14 18:14

Weekly Outlook for USD/JPY by Morgan Stanley (based on the article)

USD/JPY: Bearish trend to be continuing.

"We think the BoJ may try to use verbal intervention to stop the appreciation of the JPY. Domestic fund managers have seen their foreign holdings depreciate due to a combination of a stronger JPY and weaker global equity markets. This deterioration has occurred when holdings of foreign assets are at record highs, which could mean that stops are triggered and repatriation of holdings is forced. The BoJ attempted to push back against this by introducing negative rates, but failed. We believe the BoJ will act as a circuit breaker, stopping the JPY appreciating this week."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.15 09:04

USD/JPY Intra-Day Fundamentals: Japan Gross Domestic Product and 35 pips price movement

2016-02-09 00:30 GMT | [JPY - Gross Domestic Product]

if actual > forecast (or previous one) = good for currency (for JPY in our case)

[JPY - Gross Domestic Product] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

USDJPY M5: 35 pips price movement by Japan Gross Domestic Product news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.20 09:30

Week Ahead: High Volatility, limited GBP downside risk from the current levels - Crédit Agricole (based on the article)

What to watch:

USD - "Next week’s PCE data will be key. Only a considerably weaker than expected outcome may lower rate expectations further."

GBP - "Growth data should become a more important currency driver anew. Hence next week’s GDP data will be closely watched. We see limited GBP downside risk from the current levels."

JPY - "It remains to be seen if weaker inflation data will drive the JPY lower. This is due to increased uncertainty about the BoJ’s policy stance being efficient in bringing inflation back to target."Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.20 15:48

Fundamental Analysis: Weekly Trading Forecast for USD/JPY (based on the article)

USDJPY

"Impressive Yen appreciation leaves momentum firmly in its favor, and however much they try Japanese officials seem unlikely to reverse the trend. Absent a substantive improvement in global financial market conditions and/or aggressive rhetoric from the upcoming G20 meeting, we think the USD/JPY will trade to further lows through the coming week of trading."

Forecast for USD/JPY

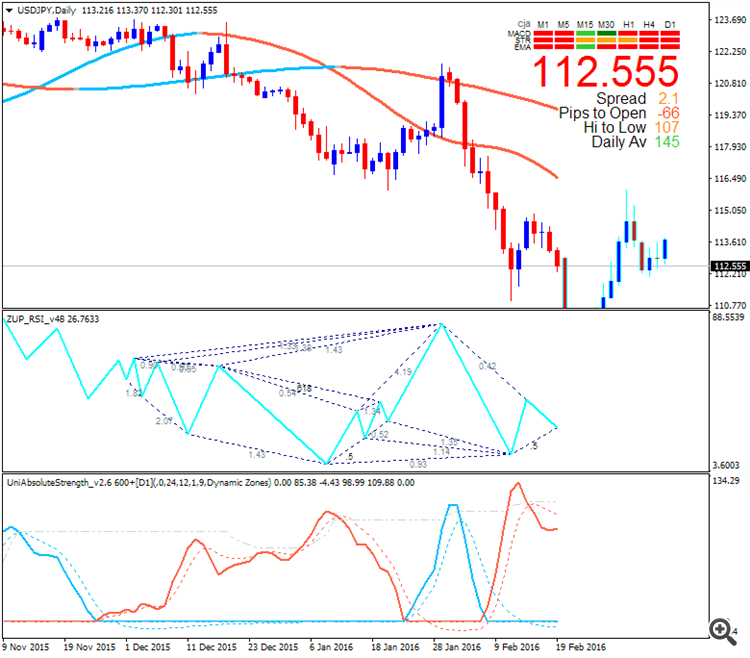

USD/JPY: ranging bearish. The price for the pair is located below 100 period SMA and below 200 period SMA for the primary bearish market condition with the secondary ranging within key support/resistance levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.26 10:11

Intra-Day Fundamentals: CNY Swift Global Payments CNY and 72 pips price movement for majors

2016-02-26 01:00 GMT | [CNY - Swift Global Payments]

==========

EURUSD M5: 19 pips price movement by Swift Global Payments CNY news event :

USDJPY M5: 33 pips price movement by Swift Global Payments CNY news event :

GBPUSD M5: 11 pips price movement by Swift Global Payments CNY news event :

USDCHF M5: 9 pips price movement by Swift Global Payments CNY news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.03 17:21

USD/JPY Intra-Day Fundamentals: ISM Non-Manufacturing PMI and 22 pips range price movement

2016-03-03 15:00 GMT | [USD - ISM Non-Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Non-Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry.

==========

"The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 53.4 percent in February, 0.1 percentage point lower than the January reading of 53.5 percent. This represents continued growth in the non-manufacturing sector at a slightly slower rate. The Non-Manufacturing Business Activity Index increased to 57.8 percent, 3.9 percentage points higher than the January reading of 53.9 percent, reflecting growth for the 79th consecutive month at a faster rate.The headline figure for the survey is the seasonally adjusted Markit/CIPS UK Services Business Activity Index, a single-figure measure designed to track changes in total UK services activity compared with one month previously. Readings above 50.0 signal growth of activity compared with the previous month, and below 50.0 contraction. The seasonally adjusted Business Activity Index fell to 52.7 in February, from 55.6 in January. This signalled the slowest rise in service sector activity since March 2013. Moreover, the Index was below its long-run trend level (since July 1996) of 55.2. Nevertheless, services output has risen continuously for 38 months, the second-longest sequence of expansion in the survey history."==========

USD/JPY M5: 22 pips range price movement by ISM Non-Manufacturing PMI news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.10 06:01

USD/JPY Intra-Day Fundamentals: China CPI and 18 pips range price movement

2016-03-10 01:30 GMT | [CNY - CPI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers.

==========

Consumer prices in China were up 2.3 percent on year in February, the National Bureau of Statistics said.==========

USDJPY M5: 18 pips range price movement by China CPI news event :