You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

GBP/USD Intra-Day Fundamentals: UK Construction PMI and 34 pips price movement

2016-04-04 09:30 GMT | [GBP - Construction PMI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Construction PMI] = Level of a diffusion index based on surveyed purchasing managers in the construction industry.

==========

"At 54.2 in March, the seasonally adjusted Markit/CIPS UK Construction Purchasing Managers’ Index® (PMI®) posted above the neutral 50.0 value for the thirty-fifth month running. However, the latest reading was unchanged since February and indicated the joint-slowest rate of output growth since June 2013. Sub-sector data highlighted that faster rises in commercial work and civil engineering activity were offset by another slowdown in residential building. The latest increase in housing activity was only marginal and the weakest recorded since January 2013."

==========

GBPUSD M5: 34 pips price movement by UK Construction PMI news event :

AUD/USD Intra-Day Fundamentals: Australia Trade Balance and 25 pips price movement

2016-04-05 02:30 GMT | [AUD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

==========

AUDUSD M5: 25 pips price movement by Australia Trade Balance news event :

AUD/USD Intra-Day Fundamentals: Reserve Bank of Australia Interest Rates and 42 pips price movement

2016-04-05 05:30 GMT | [AUD - Cash Rate]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

AUDUSD M5: 42 pips price movement by Reserve Bank of Australia Interest Rates news event :

GBP/USD Intra-Day Fundamentals: UK Services PMI and 20 pips price movement

2016-04-05 09:30 GMT | [GBP - Services PMI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

"The Business Activity Index rose to 53.7 in March, from February’s 35-month low of 52.7. This signalled a faster rate of growth in output, but the second-weakest in six months. Moreover, the Index remained below its long-run average of 55.2, and the average for the first quarter of 2016 (54.0) was the lowest of any quarter since Q1 2013."

==========

GBPUSD M5: 20 pips price movement by UK Services PMI news event :

USD/CAD Intra-Day Fundamentals: Canadian international merchandise trade and 36 pips price movement

2016-04-05 13:30 GMT | [CAD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

"Canada's exports fell 5.4% to $43.7 billion in February, after reaching a record high in January. Export prices decreased 3.2% and volumes were down 2.2%. Imports declined 2.6% to $45.6 billion, as prices were down 1.4% and volumes decreased 1.2%. Consequently, Canada's merchandise trade deficit with the world widened from $628 million in January to $1.9 billion in February."

==========

USDCAD M5: 36 pips price movement by Canadian international merchandise trade news event :

EUR/USD Intra-Day Fundamentals: U.S. Trade Balance and 14 pips price movement

2016-04-05 13:30 GMT | [USD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

"The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $47.1 billion in February, up $1.2 billion from $45.9 billion in January, revised. February exports were $178.1 billion, $1.8 billion more than January exports. February imports were $225.1 billion, $3.0 billion more than January imports."

==========

EURUSD M5: 14 pips price movement by U.S. Trade Balance news event :

NZD/USD Intra-Day Fundamentals: GlobalDairyTrade Price Index and 37 pips price movement

2016-04-05 15:27 GMT | [NZD - GDT Price Index]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - GDT Price Index] = Change in the average price of dairy products sold at auction.

==========

==========

NZDUSD M5: 37 pips price movement by GlobalDairyTrade Price Index news event :

USD/CNH Intra-Day Fundamentals: Caixin Services PMI and 45 pips price movement

2016-04-06 02:45 GMT | [CNH - Caixin Services PMI]

if actual > forecast (or previous one) = good for currency (for CNH in our case)

[CNH - Caixin Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

"March survey data pointed to a modest rebound in overall Chinese business activity, driven by slightly stronger growth of services activity and a renewed expansion of manufacturing output. The stronger performance of the service sector was highlighted by the Caixin China General Services Business Activity Index posting at 52.2, up from 51.2. That said, the reading continued to point to a modest rate of expansion that was slower than the series average. Meanwhile, manufacturing output returned to growth after an 11-month sequence of stagnant or reducedproduction, though the rate of growth was only marginal."

==========

USDCNH M5: 45 pips price movement by Caixin Services PMI news event :

AUD/USD Intra-Day Fundamentals: RBA Assistant Governor Christopher Kent Speaks and 23 pips price movement

2016-04-06 08:00 GMT | [AUD - RBA Assist Gov Kent Speech]

[AUD - RBA Assist Gov Kent Speech] = speaking about economic forecasting at the University of Tasmania, in Hobart.

==========

==========

AUDUSD M5: 23 pips price movement by RBA Assistant Governor Christopher Kent Speaks news event :

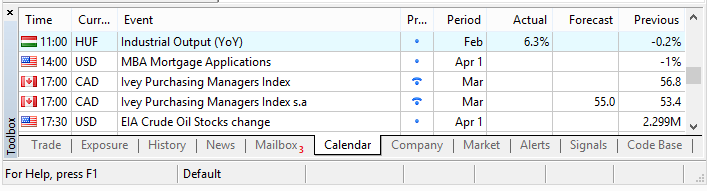

Trading the News: Canada Ivey Purchasing Manager Index (PMI) (based on the article)

What’s Expected:

Why Is This Event Important:

A meaningful pickup in business spending may prompt BoC Governor Stephen Poloz to adopt a hawkish tone for monetary policy, and the central bank may show a greater willingness to move away from its easing cycle following the ‘insurance’ rate-cuts from 2015.

However, subdued confidence paired with the slowdown in global trade may drag on private-sector activity, and a dismal PMI print may spur a further advance in USD/CAD as it fuels speculation for lower borrowing-costs.

How To Trade This Event Risk

Bullish CAD Trade: Ivey PMI Advances

- Need to see red, five-minute candle following the release to consider a short trade on USD/CAD.

- If market reaction favors a bullish loonie trade, sell USD/CAD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish CAD Trade: Headline, Core CPI Miss Market Expectations- Need green, five-minute candle to favor a long USD/CAD trade.

- Implement same setup as the bullish Canadian dollar trade, just in reverse.

Potential Price Targets For The ReleaseUSD/CAD Daily

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q2'16 - levels for USD/CAD

Sergey Golubev, 2016.04.06 12:48

USDCAD M5: 24 pips price movement by Canada Ivey Purchasing Manager Index news event :