You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

EUR/USD: ranging within 1.10/1.13 area for direction

H4 price is located near and above 100 period SMA and 200 period SMA for the primary bullish market condition with the secondary ranging within 1.1057 support level and 1.1342 resistance level.

RSI indicator is estimating the secondary ranging to be continuing.

EUR/USD Intra-Day Fundamentals: U.S. Personal Consumption Expenditures and 12 pips price movement

2016-03-28 13:30 GMT | [USD - Core PCE Price Index]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Core PCE Price Index] = Change in the price of goods and services purchased by consumers, excluding food and energy.

==========

==========

EURUSD M5: 12 pips price movement by U.S. Personal Consumption Expenditures news event :

A false warning signal for the speculative JPY longs (based on the article)

BNP Paribas publish the article today about "a warning signal for the speculative JPY longs which are running at the highest level since 2011 according to our positioning indicator" - just because "Japanese investors purchasing some JPY 2.3 trn in foreign dent on the week ended March 18."

Let's evaluate this information.

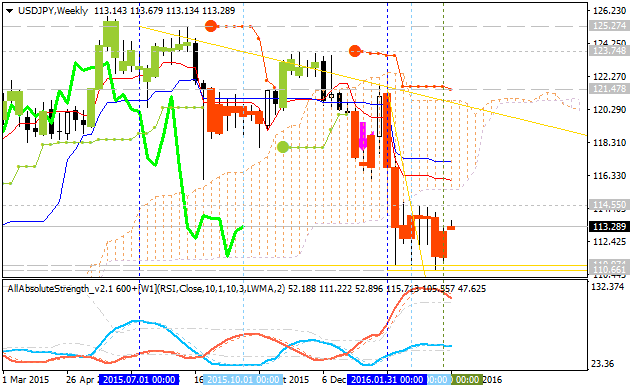

Daily price. If we look at the daily chart so the price is located to be below Ichimoku cloud in the primary bearish market condition within 114.55 key bullish reversal resistance level and 110.66 key bearish continuation support level. But the price broke symmetric triangle pattern to above together with Chinkou Span line to be going to cross the price to above for good possible breakout with the reversal of the price movement to the primary bullish market condition. So, the most likely scenario for daily price is the bear market rally to be continuing with the good breakout possibility: the key resistance level at 114.55 will likely to be broken with the possible reversal to the bullish trend.

Weekly price is on bearish market condition as well to be located below ichimoku cloud for the ranging within the same key s/r levels: 114.55 and 110.66. Chinkou Span line together with Absolute Strength indicator are estimating the trend to be ranging bearish. So, there are 3 most likely scenarios for weekly price movement for the next few months:

Thus, I do not see any technical reason for such a warning which BNP Paribas made about strengthening JPY against USD: the situation is going to be made in exact opposite way: bear market rally with the possible bullish reversal for D1 timeframe, and ranging rally to be started on weekly timeframed chart for example.USD/JPY Intra-Day Fundamentals: Japan Household Spending and 10 pips price movement

2016-03-29 00:30 GMT | [JPY - Household Spending]

if actual > forecast (or previous one) = good for currency (for JPY in our case)

[JPY - Household Spending] = Change in the inflation-adjusted value of all expenditures by consumers.

==========

(1) "Expenditures for Two-or-more-person Households

The average of monthly consumption expenditures per household for February 2016 was 269,774 yen, up 1.6% in nominal terms and up 1.2% in real terms from the previous year."

(2) "Income and Expenditures for Workers' Households

The average of monthly income per household stood at 478,624 yen, down 2.0% in nominal terms and down 2.4% in real terms from the previous year.

The average of consumption expenditures per household was 297,662 yen, up 2.2% in nominal terms and up 1.8% in real terms from the previous year."

==========

USDJPY M5: 10 pips price movement by Japan Household Spending news event :

GBP/USD Intra-Day Fundamentals: BoE Financial Policy Committee and 16 pips price movement

2016-03-29 11:00 GMT | [GBP - BoE Financial Policy Committee]

[GBP - BoE Financial Policy Committee] = policy changes taken and commentary about the economic conditions comments.

==========

"In an environment of low inflation and continued weakness in investment and productivity growth, prospects for global nominal growth are subdued. This raises questions about resilience to future adverse shocks, particularly for EMEs where debt levels continue to rise and terms of trade have deteriorated. In this environment, the re-acceleration of credit growth in China is concerning. In some advanced economies, lower nominal interest rates associated with weak growth prospects are restraining profitability in banking systems that are still in post-crisis repair and pose challenges for some banking business models. Globally, bank equity prices have fallen significantly and a material proportion of banks are now trading below book value."==========

GBPUSD M5: 16 pips price movement by BoE Financial Policy Committee news event :

EUR/USD Intra-Day Fundamentals: Fed Chair Yellen Speech and 14 pips price movement

2016-03-29 17:30 GMT | [USD - Fed Chair Yellen Speech]

[USD - Fed Chair Yellen Speech] = "Economic Outlook and Monetary Policy" speech at the Economic Club of New York luncheon.

==========

EURUSD M5: 14 pips price movement by Fed Chair Yellen Speech news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.29 17:59

2016-03-29 17:30 GMT | [USD - Fed Chair Yellen Speech]

[USD - Fed Chair Yellen Speech] = "Economic Outlook and Monetary Policy" speech at the Economic Club of New York luncheon.

"The FOMC left the target range for the federal funds rate unchanged in January and March, in large part reflecting the changes in baseline conditions that I noted earlier. In particular, developments abroad imply that meeting our objectives for employment and inflation will likely require a somewhat lower path for the federal funds rate than was anticipated in December.

Given the risks to the outlook, I consider it appropriate for the Committee to proceed cautiously in adjusting policy. This caution is especially warranted because, with the federal funds rate so low, the FOMC's ability to use conventional monetary policy to respond to economic disturbances is asymmetric. If economic conditions were to strengthen considerably more than currently expected, the FOMC could readily raise its target range for the federal funds rate to stabilize the economy. By contrast, if the expansion was to falter or if inflation was to remain stubbornly low, the FOMC would be able to provide only a modest degree of additional stimulus by cutting the federal funds rate back to near zero.9

One must be careful, however, not to overstate the asymmetries affecting monetary policy at the moment. Even if the federal funds rate were to return to near zero, the FOMC would still have considerable scope to provide additional accommodation. In particular, we could use the approaches that we and other central banks successfully employed in the wake of the financial crisis to put additional downward pressure on long-term interest rates and so support the economy--specifically, forward guidance about the future path of the federal funds rate and increases in the size or duration of our holdings of long-term securities. While these tools may entail some risks and costs that do not apply to the federal funds rate, we used them effectively to strengthen the recovery from the Great Recession, and we would do so again if needed."======

14 pips price movement for EURUSD was immediate effect after Fed Chair Yellen Speech. The medium term situation related to this Speech after publishing it on Federal Reserve website are the following:

1. EURUSD M5: 82 pips price movement by Fed Chair Yellen Speech news event :

2. GBPUSD M5: 106 pips price movement by Fed Chair Yellen Speech news event :

3. USDJPY M5: 55 pips price movement by Fed Chair Yellen Speech news event :

4. GOLD (XAU/USD) M5: 1,406 pips price movement by Fed Chair Yellen Speech news event :

S&P 500 price went to uptrend based on Fed Chair Yellen Speech published:

As we see from M5 chart so the price broke 100/200 period SMA area for the bullish breakout and with 2054.72 as the new resistance level.

The intra-day H4 price is having the chance to continuing with bullish trend in case the price breaks 2056.31 resistance level.

And we can see the same situation with same key resistance level for daily price: the bullish trend will be re-started in case the price breaks 2056.31 resistance on close daily bar.

2016-03-30 13:15 GMT | [USD - ADP Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government.

==========

"Private-sector employment increased by 200,000 from February to March, on a seasonally adjusted basis."==========

EURUSD M5: 29 pips range price movement by ADP Non-Farm Employment Change news event :

What’s Expected:

Why Is This Event Important:

Signs of sticky price growth may encourage the ECB to endorse a wait-and-see approach at April 21 interest rate decision, and President Mario Draghi may adopt a less-dovish tone over the coming month as the series of non-standard measures work their way through the real economy.

However, waning confidence accompanied by subdued factor-gate prices may drag on the CPI, and a softer-than-expected reading may generate a near-term pullback in EUR/USD as it fuels bets for a more accommodative policy stance.

How To Trade This Event Risk

Bullish EUR Trade: Core Rate of Inflation Edges Higher

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD.

- If market reaction favors a bearish Euro trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish EUR Trade: Euro-Zone CPI Report Misses Market Expectations- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bullish Euro trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily