You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.01 16:15

EUR/USD Intra-Day Fundamentals: ISM Manufacturing PMI and 23 pips price movement

2016-06-01 14:00 GMT | [USD - ISM Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

"The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The May PMI® registered 51.3 percent, an increase of 0.5 percentage point from the April reading of 50.8 percent. The New Orders Index registered 55.7 percent, a decrease of 0.1 percentage point from the April reading of 55.8 percent."

==========

EUR/USD M5: 23 pips price movement by ISM Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.02 11:36

Trading the News: ECB Minimum Bid Rate (based on the article)

Daily price is on bearish for the ranging near bullish reversal within narrow support/resistance levels:

If the price breaks 1.1242 level on close daily bar so the bullish reversal of the price movement will be started on the secondary ranging way. If not so the price will be continuing on the bearish ranging within the levels.

M30 price is located above 200 period SMA for the bullish market condition within 1.1219 resistance and 1.1190 support levels.

If the price breaks 1.1190 support level to below so the secondary correction within the primary bullish condition will be started.

If the price breaks 1.1149 support level so we may see the bearish reversal of the price movement.

If the price breaks 1.1219 resistance so the intra-day bullish trend will be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.02 14:10

EUR/USD Intra-Day Fundamentals: ECB Minimum Bid Rate and 10 pips price movement

2016-06-02 11:45 GMT | [EUR - Minimum Bid Rate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Minimum Bid Rate] = nterest rate on the main refinancing operations that provide the bulk of liquidity to the banking system.

==========

"At today’s meeting, which was held in Vienna, the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively."==========

EUR/USD M5: 10 pips price movement by ECB Minimum Bid Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.02 16:14

EUR/USD Intra-Day Fundamentals: FOMC Member Powell Speaks and 42 pips range price movement

2016-06-02 12:35 GMT | [USD - FOMC Member Powell Speaks]

[USD - FOMC Member Powell Speaks] = speech about the role of regulation in the banking system at the Prudential Regulation Conference, in Washington DC.

==========

EUR/USD M5: 42 pips range price movement by FOMC Member Powell Speaks news event

If the price breaks 1.1149 support level so we may see the bearish reversal of the price movement.

If the price breaks 1.1219 resistance so the intra-day bullish trend will be continuing.

M5 price broke 1.1190 support level, and 1.1151 support is testing by the price for right now. So, this is the following secondary and primary situation to be started:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.03 12:05

Trading News Events: U.S. Non-Farm Payrolls (adapted from the article)

Bullish USD Trade- "Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD."

- "If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position."

- "Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit; set reasonable limit."

Bearish USD TradeDaily price is located near and above SMA with period 200 (200 SMA) for the bullish market condition with the ranging within the following support/resistance levels:

RSI indicator is estimating the secondary correction to be continuing up to the possible bearish reversal on the secondary ranging way.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.03 15:43

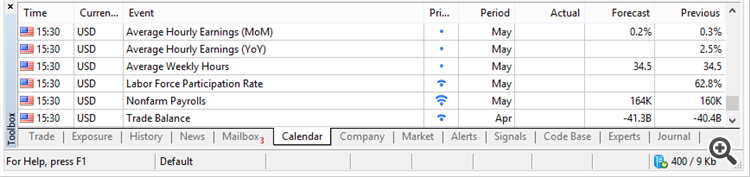

EUR/USD Intra-Day Fundamentals: U.S. Non-Farm Payrolls and 180 pips price movement

2016-06-03 12:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

"The unemployment rate declined by 0.3 percentage point to 4.7 percent in May, and nonfarm payroll employment changed little (+38,000), the U.S. Bureau of Labor Statistics reported today. Employment increased in health care. Mining continued to lose jobs, and employment in information decreased due to a strike."

==========

EUR/USD M5: 180 pips price movement by U.S. Non-Farm Payrolls news event

H4 intra-day price is breaking 200 period SMA together with 1.1297 resistance level to above for the reversal of the price movement from the ranging bearish to the primary bullish market condition. If the price breaks this 1.1297 level on close H4 bar so the price will be started with the intra-day bullish reversal.

Daily price is located near and above SMA with period 200 (200 SMA) for the bullish market condition with the ranging within the following support/resistance levels:

RSI indicator is estimating the secondary correction to be continuing up to the possible bearish reversal on the secondary ranging way.

Daily price is breaking 1.1226 resistance level to above on open D1 bar for now. If the price breaks this level on close daily bar so the daily bullish trend will be continuing on this pair, otherwise - we may see the ranging bullish market condition.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.06 12:35

Intra-Day Fundamentals: Signals from Federal Reserve chair Janet Yellen about the US central bank's next rate-hike after payroll data shocks

2016-06-06 16:30 GMT | [USD - Fed Chair Yellen Speaks]

[USD - Fed Chair Yellen Speaks] = Speech about the economic outlook and monetary policy at the World Affairs Council of Philadelphia's luncheon.

==========

==========

Credit Agricole:

==========

Live blog and video of Janet Yellen’s speech in Philadelphia:

"The overall labor market situation has been quite positive. In that context, this past Friday’s labor market report was disappointing. Payroll gains were reported to have been much smaller in April and May than earlier in the year, averaging only about 80,000 per month. And while the unemployment rate was reported to have fallen further in May, that decline occurred not because more people had jobs but because fewer people reported that they were actively seeking work."

==========

EUR/USD M5: 68 pips range price movement by Fed Chair Yellen Speaks news event

==========

USD/JPY M5: 72 pips range price movement by Fed Chair Yellen Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.09 09:22

EUR/USD Fundamentals: ECB President Draghi Speaks and 10 pips ranging price movement; 1.1410 resistance level to be broken for the daily bullish trend continuation

2016-06-09 07:00 GMT | [EUR - ECB President Draghi Speaks]

[EUR - ECB President Draghi Speaks] = The speech at the Brussels Economic Forum.

==========

"The objective of the ECB is defined as delivering a rate of inflation below but close to 2% over the medium term. But the medium term is not a fixed period of time. When faced with adverse shocks, the pace at which monetary policy can bring inflation back to the objective depends on two factors: the nature of the shock itself, and the conditions in which monetary policy operates."

"Summing up, there is a large degree of interaction between monetary policy and other policies that may in principle be geared towards different objectives. Such interactions do not prevent a determined central bank from achieving its objective. But they do affect the time frame over which we can do so. What this implies is that, for stabilisation to occur no more slowly than is strictly necessary, all policy areas have a role to play."

==========

EUR/USD M5: 10 pips ranging price movement by ECB President Draghi Speaks news event

==========

Daily price is on primary bullish market condition for 1.1410 resistance level to be tested for the bullish trend to be continuing. Ascending triangle pattern was formed by the price to be crossed to above for the 1.1410 level to be broken for the bullish trend continuation with 30-day high at 1.1616 as a possible bullish target.

SUMMARY : bullish