Join our fan page

- Views:

- 2238

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Provided for educational purposes; not trading advice. Backtests on EURUSD under my conditions were unprofitable.

The strategy follows the following logic:

- First the strategy marks the high and the low of the first 4H candle, using the New york time zone.

- After the first 4H candle is formed the strategy waits for a 5 Minute candle to close outside the Range.

- If a 5 Minute candle closes above the High and then a 5 Minute candle closes back in the Range, there is a sell signal.

- If a 5 Minute candle closes below the Low and then a 5 Minute candle closes back in the Range, there is a buy signal.

There was one vague rule the strategy did not follow regarding the orderblock. To avoid trades after the price has overextended beyound the range, a time filter was introduced and if the price stayed above the high or below the low for more than 75 Minutes the trade is marked as invalid.

It is of utmost importance to specify your own broker's GMT offset times and the dates when the switching from Summer time to Winter time (and vica versa). Since this strategy is based on the New York local time, a single error in this can offset the whole strategy.

Here are the input parameters for the strategy:

- ServerGMTOffsetWinter: The GMT offset of the broker's server in winter time.

- ServerGMTOffsetSummer: The GMT offset of the broker's server in summer time. (Can be the same as Winter offset for brokers with fixed GMT offset)

- ServerSwitchToSummerMonth: The month when the broker switches to summer time zone.

- ServerSwitchToSummerDay: The day of month when the broker switches to summer time zone.

- ServerSwitchToWinterMonth: The month when the broker switches to winter time zone.

- ServerSwitchToWinterDay: The day of month when the broker switches to winter time zone.

- Lots: Lotsize

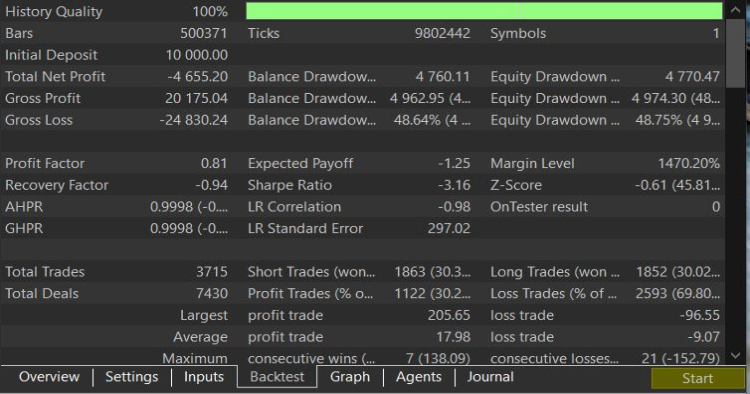

Here are the backtest results of the backtest for EURUSD:

PropGuard MT5 Daily Loss and Max Drawdown Dead-Line Visualizer (Dashboard and Line)

PropGuard MT5 Daily Loss and Max Drawdown Dead-Line Visualizer (Dashboard and Line)

A chart-based risk monitor for prop-firm style rules: draws a live “Dead-Line” price level showing where your Daily Loss Limit or Overall Max Drawdown would be violated, based on equity, open exposure, and optional trailing drawdown.

MT5 Telegram Trade Notifier (Bot API) — Deal Alerts

MT5 Telegram Trade Notifier (Bot API) — Deal Alerts

Utility MT5 EA that sends BUY/SELL deal notifications to Telegram via Bot API (WebRequest)

Wick Rejection Scanner Dashboard (Multi-Symbol / Multi-TF)

Wick Rejection Scanner Dashboard (Multi-Symbol / Multi-TF)

Scan multiple symbols and timeframes for wick-based rejection candles and display the latest signals in a clean on-chart dashboard with strength scoring, signal age, optional markers, and alerts.

News Spread Risk Dashboard (Spike and Gap Monitor)

News Spread Risk Dashboard (Spike and Gap Monitor)

A compact on-chart dashboard that monitors live spread behavior, tracks rolling Min/Max/Avg, and warns on abnormal spread spikes (news, low liquidity, rollover) using adaptive or fixed thresholds with optional alerts.