Join our fan page

- Views:

- 17032

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

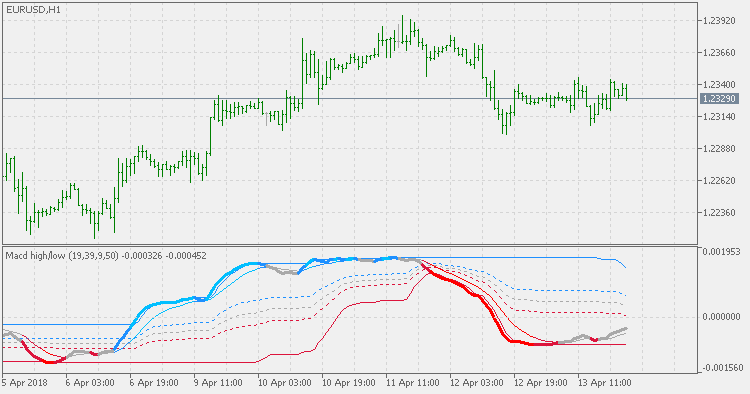

MACD (invented by Gerald Appel back in 1970) is one of the widely used indicators.

Usually it is used in combination of a zero line and a signal line.That is a good approach but the zero line part has it's issues. One of the main issues is that the zero line after big changes in the market is too far from the MACD value if the market turns back.

This version is keeping the signal line intact but is changing how the zero line handling and is adding levels that are not usually known to MACD. It uses the highest high and lowest low of MACD (nnn) bars back to calculate a sort of dynamically changed zero line, early levels up and down and trend confirmation levels up and down. By adding these non-fixed levels, the MACD becomes faster in response to market changes and the MACD trend assessment has less false signals.

Asymmetric bands

Asymmetric bands

Asymmetric bands indicator is one of the ways to avoid a lag when there is a trend reversal (since the opposite side band is too far from the current price).

Synthetic smoothed RSI

Synthetic smoothed RSI

This version of Synthetic RSI is using Ehlers smoothed RSI in calculation instead of using "regular" RSI and that makes the resulting synthetic RSI even smoother.

Nonlinear regression

Nonlinear regression

This indicator is a MetaTrader 5 version of nonlinear regression. Nonlinear regression is very "fast" when responding to sudden market changes so the default calculation period is set to somewhat longer period than it is usual for similar type indicator. Because of that some experimenting with period is advised based on your trading strategy and trading style.

Smoother momentum

Smoother momentum

Smoother momentum is one of the possible ways to solve the main issue of the Momentum indicator - the values it displays are far from being smooth, and that can cause a lot of false signals in a lot of cases - regardless of the calculation period that is used.