AI as a Trading Co-Pilot: Integrating Smart Money Concepts into an Interactive Dashboard

It's such a difficult job. Many things seem impossible and like they'll never happen. But I've always wondered: what if AI, known for its intelligence, could actually enter the marketplace?

It doesn't just help, but also provides hands-on lessons, technical analysis guidance, and even acts as a digital mentor for anyone wanting to learn trading. AI not only teaches but also provides advice, warnings, and information to prevent us from making hasty, potentially wrong decisions.

This time, I want to share what I've been working on. It could be called a revolution: how AI can act as a co-pilot in market analysis , preventing us from constantly misreading price movements.

This project successfully combined AI with technical analysis based on the Smart Money Concept (SMC) . The result is that the AI can visualize its thoughts on a chart and provide concrete examples directly on the screen.

And this is what I often do: I ask AI , ask it to analyze the market, then it answers not only with words, but also with clear visuals.

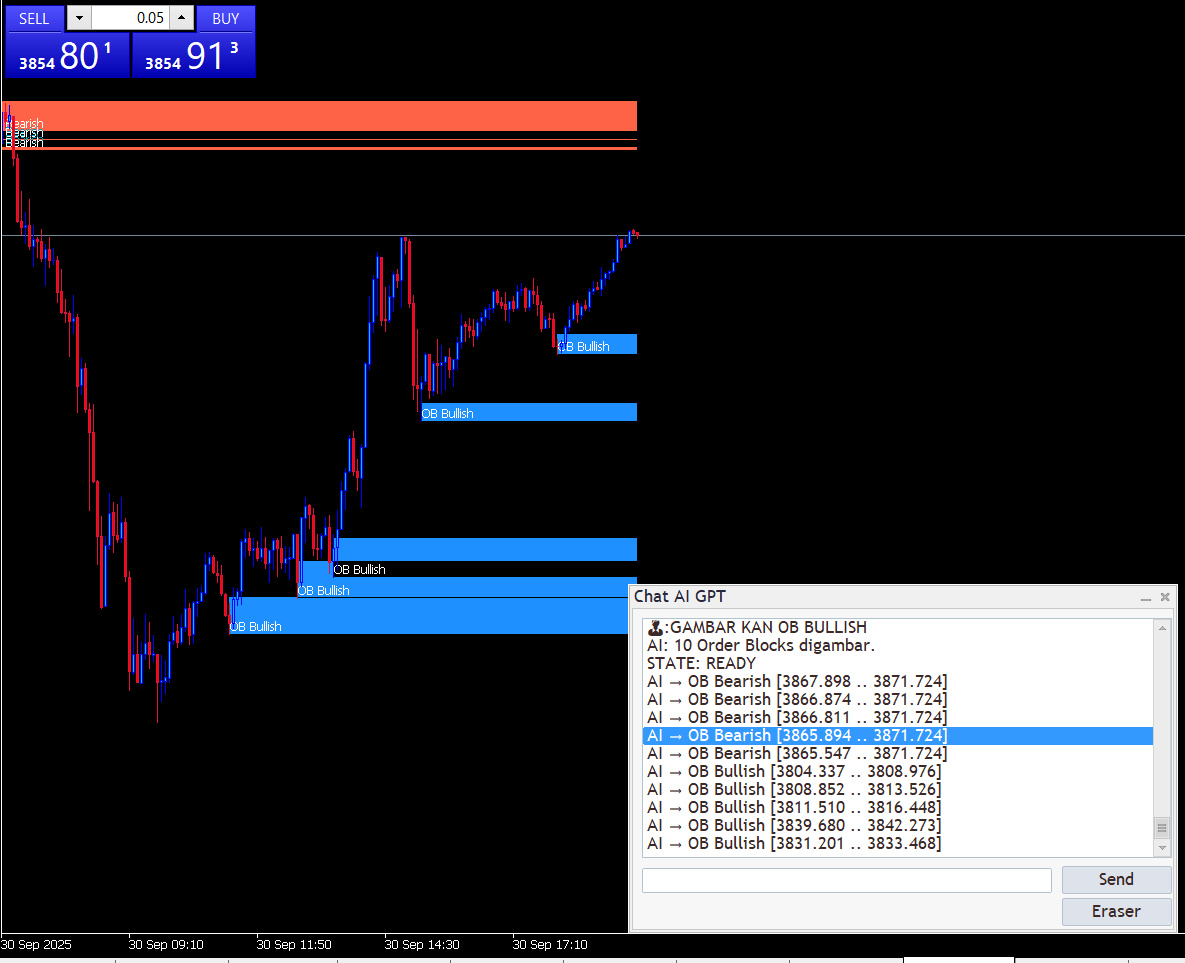

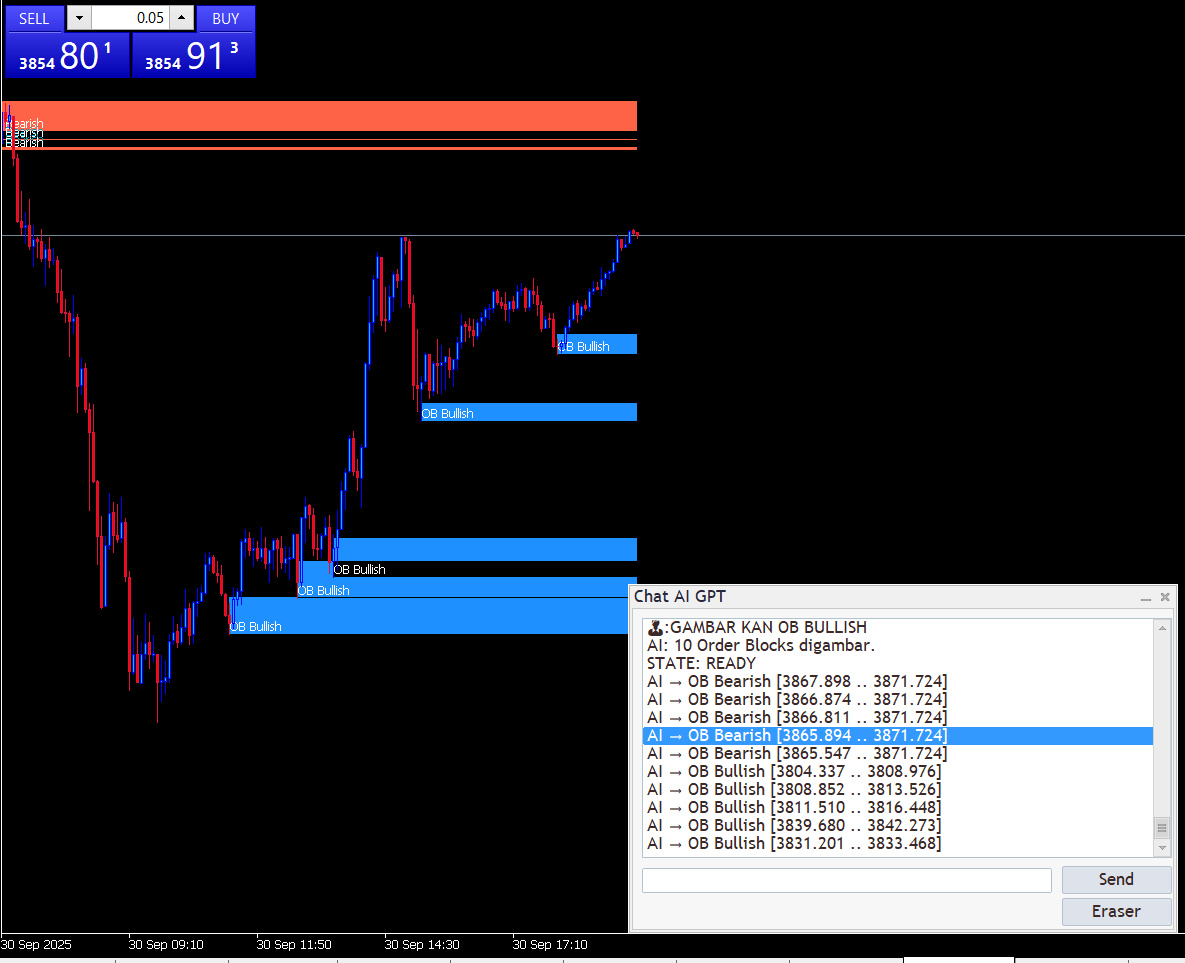

🔹 First Step: Detect Order Block (OB)

Why this photo is important: The OB is the main foundation of the SMC. Traders need to know the supply/demand areas that form the basis of price action. This photo illustrates how our algorithm automatically marks bullish/bearish OB levels, complete with their status.

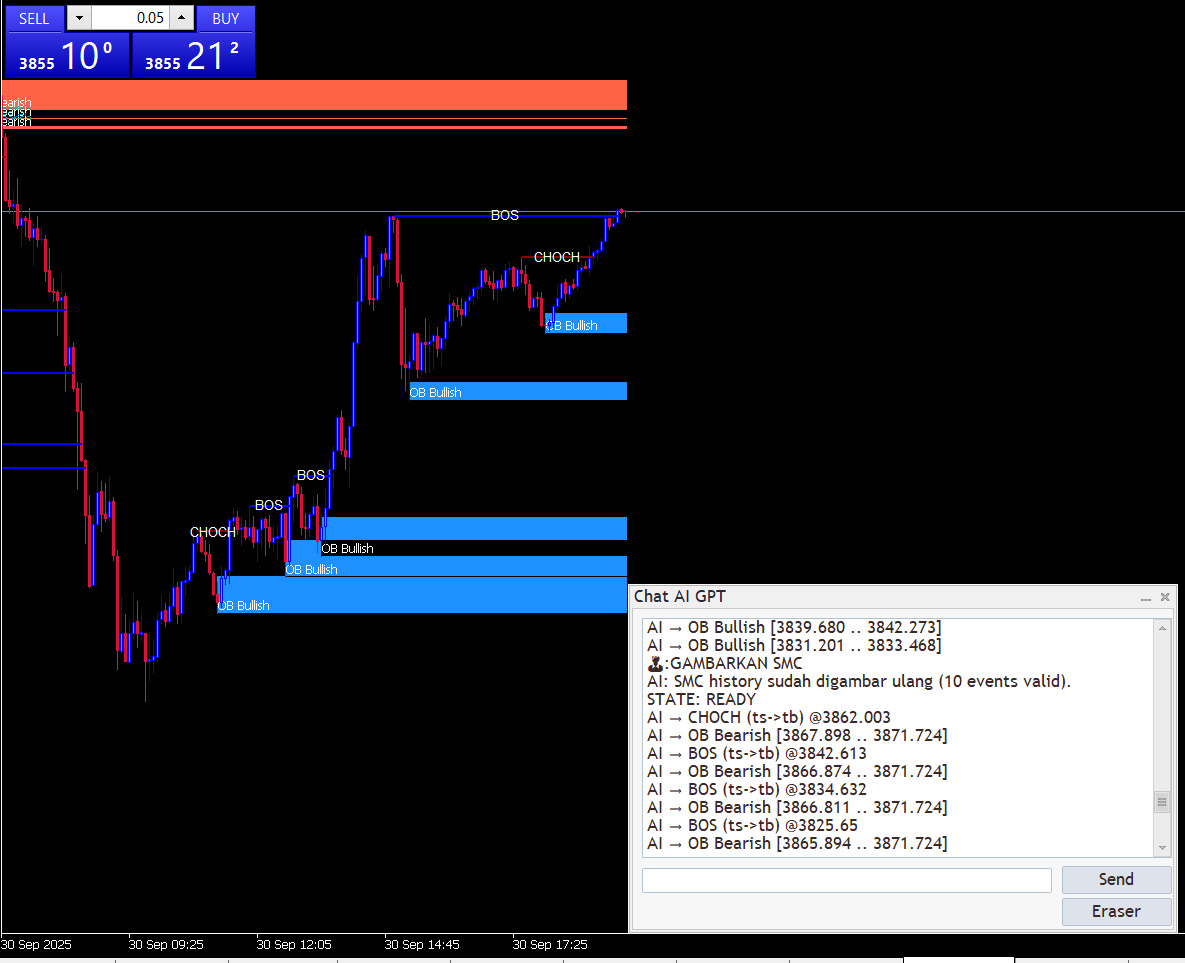

🔹 Step Two: Market Structure with BOS & CHoCH + OB

Why this image is important: BOS (Break of Structure) and CHoCH (Change of Character) are signals of trend direction. Without them, the OB is meaningless. This image shows the BOS/CHoCH lines drawn automatically by our server, so traders can clearly see when a trend is continuing or changing.

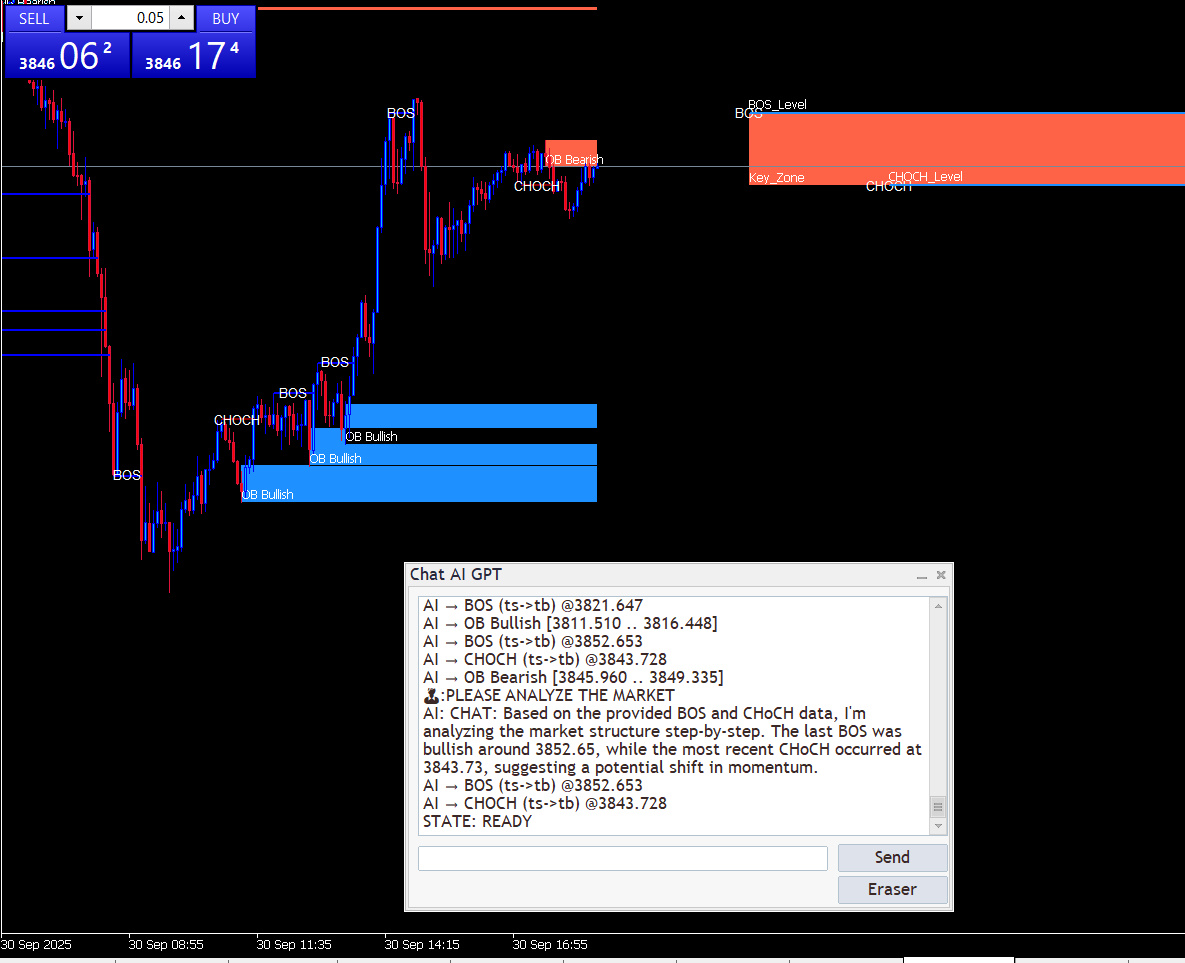

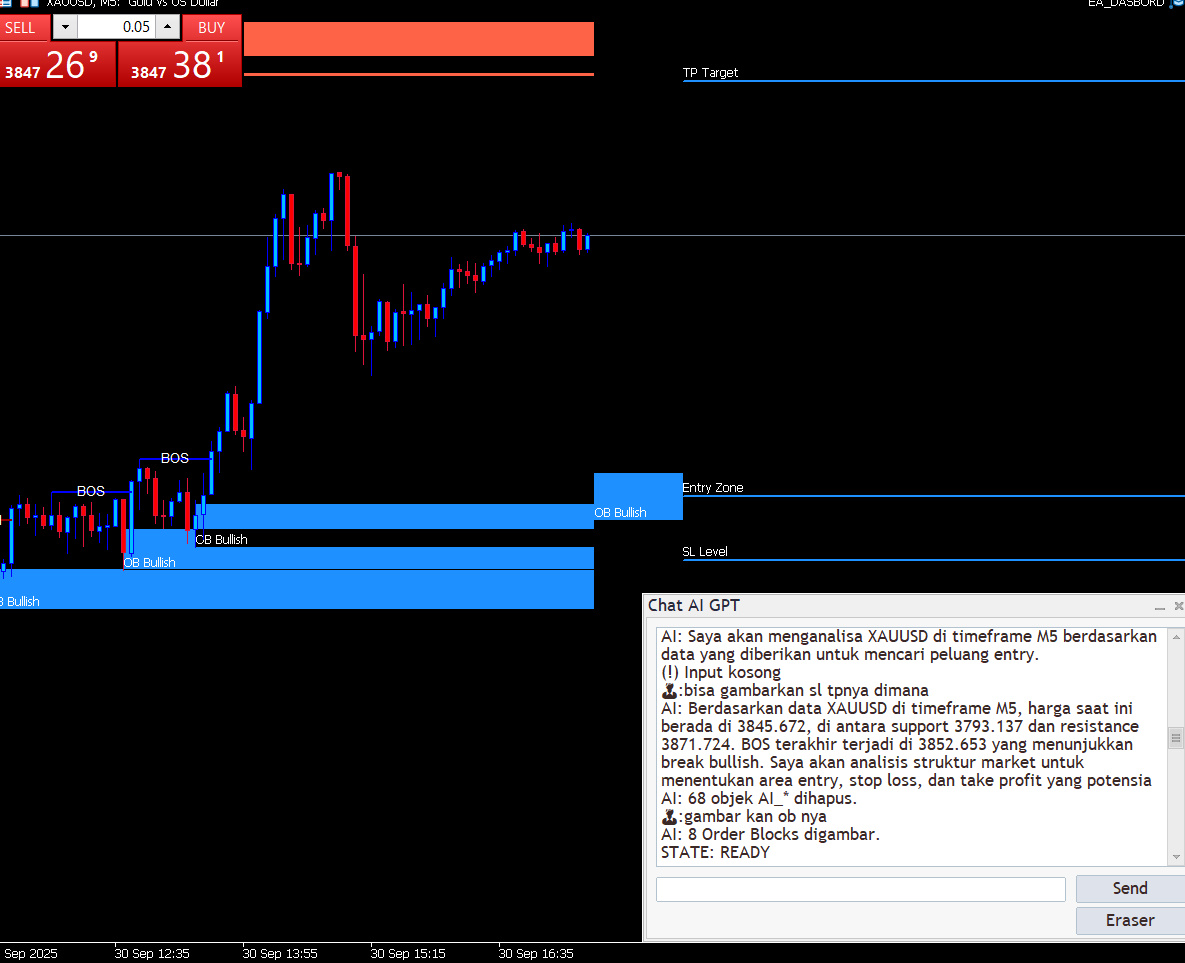

🔹 Step Three: Live AI Analysis on the Chart

[  ]

]

Why this photo is important: AI not only draws, but also explains it in natural language:

-

What is the final structure,

-

Which areas are relevant,

-

Risk management that must be considered.

🔹 Step Four: Entry Zone & Trading Signal

[Photo 4 –  ]

]

Why this photo is important: Traders need clarity on where a reasonable entry point is . This photo shows ENTRY/SL/TP lines automatically drawn on the chart, instead of manually calculated.

AI provides a JSON (structured) plan:

" AI: Based on XAUUSD data on the M5 Timeframe, the current price is at 3845.672, between support at 3793.137 and resistance at 3871.724. The last BOS occurred at 3852.653, which indicates a bullish break. I will analyze the market structure to determine potential entry, stop loss, and take profit areas. "

🔹 Step Five: Asking About Liquidity Areas

[Photo 5 – Liquidity Area]

Why this photo is important: Many retail stop-loss orders are clustered in a specific area ( liquidity pool ).

📌 Conclusion

With this dashboard innovation:

-

Traders no longer draw manually → all automatic (OB, BOS, CHoCH, SR, Liquidity).

-

AI becomes a trading partner → you can chat with it, ask for analysis, or simply ask for confirmation.

-

Learn + practice directly → replay market for practice, live mode for real execution.

-

Risk management discipline → AI always reminds SL, RR, and capital management.

-

Multi-Timeframe Analysis → Traders can directly request analysis from M15, H1, to H4 without opening additional charts.

The end result: charts are no longer just candlestick images, but a learning space + a modern trading execution space , where AI is present as a digital mentor.

Conclusion

Trading isn't about predicting the future, but about discipline, risk management, and the ability to read market structure . AI isn't here to replace traders, but rather to be a digital partner and mentor that can help us think more objectively.

With this AI + SMC integration, we're no longer walking alone. AI can draw, offer advice, and even warn us when our decisions are too hasty.

So, don't think of trading as just "price guessing." Think of it as a continuous learning process , where technology can be a loyal co-pilot on our journey to consistency.

Ultimately, the choice remains with the trader. AI merely shows the way — we decide when to act. 🚀