We have all seen GBP/USD struggling in recent sessions, sliding towards the 1.34 area.

On the surface, it looks like a normal correction, but behind the candles there is a deeper story.

Markets are not just reacting to inflation data; they are questioning the UK’s fiscal credibility. For us traders, this matters because the bond market and sterling are now moving hand in hand.

Macro Background: The Fiscal Side of the Story

Recent UK data showed producer prices picking up again (+1.9% YoY) while consumer inflation is still around 3.8%. Too high for the Bank of England to cut rates comfortably, but too soft to justify further aggressive hikes. In other words, monetary policy is caught in the middle.

The real pressure, however, comes from public finances.

-

The UK now spends over £100 billion per year just on debt interest.

-

The 10-year gilt yield trades near 4.9%, the highest since 2008.

-

The 30-year yield has surged to 5.6–5.7%, levels not seen since the late 1990s.

Even though demand for gilts remains high (the last £14 billion auction drew record orders above £140 billion), the cost is what matters. Every new issuance locks in higher interest expenses, and that eats into the government’s fiscal space.

For traders, this translates into a simple signal: confidence is shaky, and the pound tends to weaken when long-term yields rise for the “wrong” reasons — not because of growth, but because of fiscal doubts.

A Crisis of Confidence

The 2024/25 fiscal deficit reached £151.9 billion, well above the £137 billion forecast. Revenues disappointed, while spending on welfare, health care, and debt servicing kept climbing. This widening gap feeds into a perception problem: the UK government is seen as lacking a credible plan to stabilise debt dynamics.

Political uncertainty adds to the mix. The recent reshuffle and appointment of Minouche Shafik as economic adviser were not seen as a show of strength but as a defensive move by Chancellor Rachel Reeves. Markets don’t like the idea of a weak Treasury when fiscal discipline is urgently needed.

As a result, investors now demand a higher term premium — the extra yield required to hold long-dated gilts. That is why yields are rising even without new inflation shocks.

The Vicious Circle

The UK is caught in a feedback loop:

-

Higher yields increase the cost of debt.

-

A wider deficit erodes investor trust.

-

Markets demand even higher yields.

This cycle looks very similar to the UK bond crises of the 1990s, but with one critical difference: today, debt-to-GDP is more than twice as high.

What Could Break the Cycle?

The market message is clear: marginal tax changes are not enough. To restore credibility, London must deliver structural spending cuts, especially in welfare and current expenditures. Without that, both gilts and sterling remain under pressure.

The Bank of England also has limited room. With balance sheet reduction ongoing, its ability to smooth long-end yields is constrained. That is why the autumn Budget is the true test. Traders will watch closely: either the government sends a strong signal of fiscal discipline, or markets will keep selling sterling rallies.

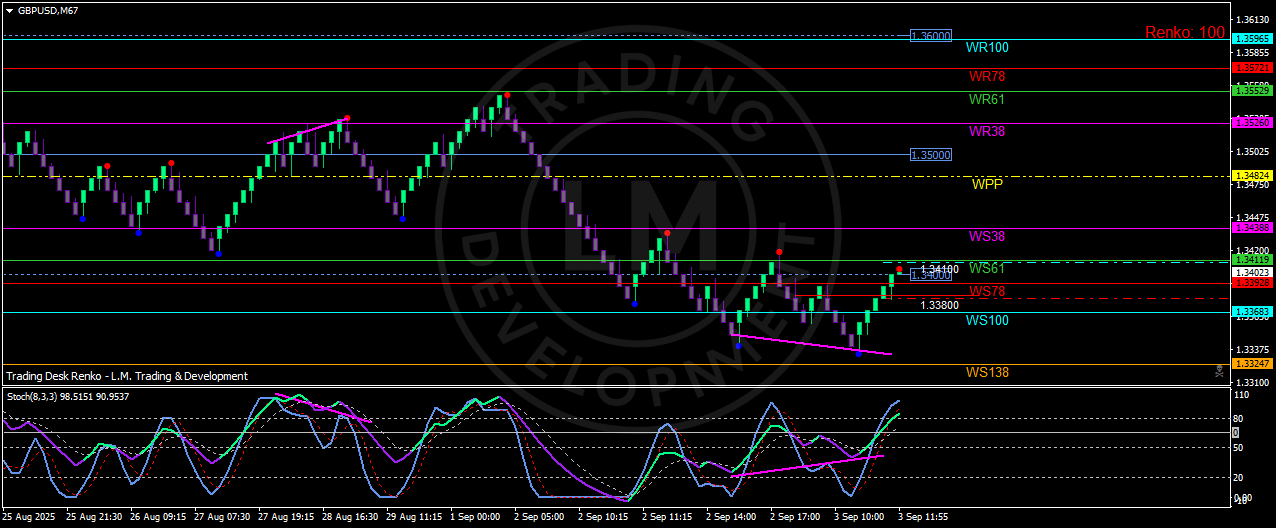

Chart View: GBP/USD with Weekly Pivots

Now, let’s look at the chart side. On a Renko GBP/USD M67 setup with weekly pivot levels, the picture is clear:

-

Resistance levels:

-

1.3500 (psychological + WR38)

-

1.3525–1.3550 (WR61)

-

1.3595–1.3600 (WR100, top range)

-

-

Support levels:

-

1.3400–1.3380 (WS61/WS78 cluster)

-

1.3365 (WS100)

-

1.3325–1.3330 (WS138)

-

The Stochastic (8,3,3) is already deep in overbought (>90), suggesting the current bounce is losing momentum.

Trading Scenarios

-

Bearish bias: As long as GBP/USD trades below 1.3500, sellers remain in control. A rejection here could push the pair back towards 1.3380 and then 1.3325.

-

Bullish scenario: Only a decisive close above 1.3525–1.3550 would unlock further upside towards 1.3600. Until then, rallies are suspect.

-

Neutral setup: Between 1.3380 and 1.3500, the pair remains choppy. Traders may prefer to wait for a breakout confirmation before committing.

Conclusion

The UK is facing fiscal stress that markets can no longer ignore. Gilt yields are rising, not because of booming growth, but because investors demand a higher risk premium. That weighs directly on sterling, and GBP/USD reflects it clearly.

For us traders, the key takeaway is simple: fundamentals and technicals are aligned. Macro doubts weaken the pound, while the chart shows strong resistance near 1.35. Unless London regains fiscal credibility soon, every sterling rally may be an opportunity to fade.

This analysis reflects a personal view for educational purposes only. It is not financial advice