Hello traders,

We are pleased to announce a significant update to our Expert Advisor (EA), available through the MQL5 Market, which introduces a new risk management tool designed to protect your capital and enhance long-term profitability: the Currency Exposure Filter.

The Hidden Risk in Multi-Pair Trading

Many forex traders diversify across different currency pairs to spread risk. However, this approach can lead to unintended over-exposure to a single currency direction.

Consider this scenario:

-

Sell AUD/USD (selling AUD)

-

Buy EUR/AUD (selling AUD)

-

Sell AUD/JPY (selling AUD)

These appear as three distinct trades, but they result in triple exposure to AUD weakness. If the AUD strengthens unexpectedly, all three positions could incur significant losses simultaneously.

What is the Currency Exposure Filter?

The Currency Exposure Filter is an intelligent risk management tool that prevents over-concentration in any single currency direction. It analyzes each potential trade to determine:

-

Which currency you are buying.

-

Which currency you are selling.

-

The number of existing positions in the same currency direction.

How It Works

Before opening a new position, the filter performs the following checks:

-

Currency Direction Analysis: For a EUR/AUD buy signal:

-

Buying EUR ✓

-

Selling AUD ✓

-

-

Exposure Count: Counting current positions selling AUD:

-

AUD/USD sell = 1 AUD sell position

-

AUD/JPY sell = 2 AUD sell positions

-

-

Risk Decision: With a setting of Max Currency Exposure = 2:

-

A new EUR/AUD buy would create a third AUD sell position.

-

The trade is blocked ❌ to prevent over-exposure.

-

Real-World Demonstration: Backtest Results

To demonstrate the effectiveness of this feature, we conducted backtests with various settings.

-

Backtest Period: January 1, 2020 - July 26, 2024

-

Initial Capital: $100,000

-

EA Settings: Default settings, varying only the filter parameters.

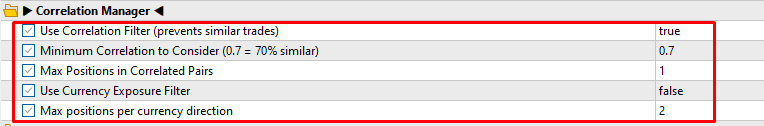

Scenario 1: Default Settings (Filter OFF)

-

Use Currency Exposure Filter: false

Without the filter, the EA operates as in previous versions, with no limit on trades in a single currency direction.

The results show high profit potential but significant drawdown when the market moves against concentrated positions.

[Image 2: Default Backtest Results]

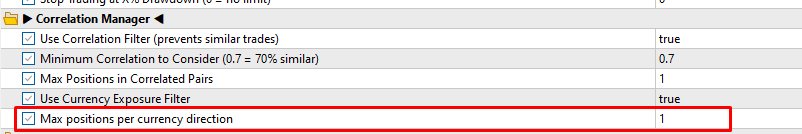

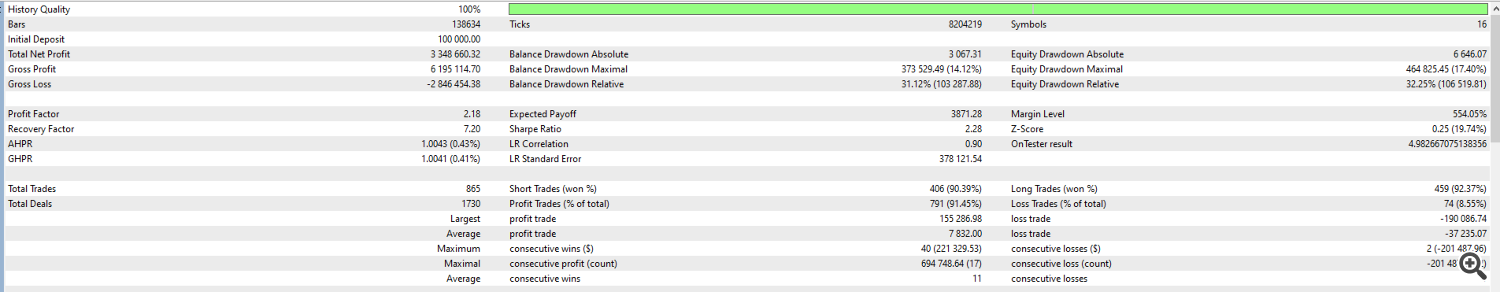

Scenario 2: Filter ON, Max 1 Position/Direction

-

Use Currency Exposure Filter: true

-

Max Currency Exposure: 1

This conservative setting ensures the EA never opens more than one buy or sell position for the same currency.

[Image 3: Input Settings with Max Exposure = 1]

The results demonstrate a significant reduction in drawdown, offering enhanced account protection at the cost of lower profits due to skipped trading opportunities.

[Image 4: Backtest Results with Max Exposure = 1]

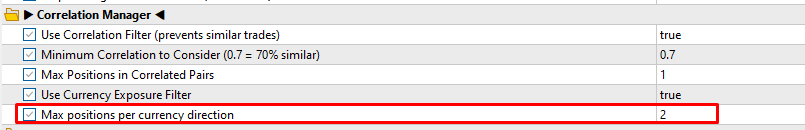

Scenario 3: Filter ON, Max 2 Positions/Direction (Recommended)

-

Use Currency Exposure Filter: true

-

Max Currency Exposure: 2

This setting balances safety and profitability, allowing the EA to capitalize on opportunities while controlling concentrated risk.

[Image 5: Input Settings with Max Exposure = 2]

The results show controlled drawdown with attractive profit levels, making this our recommended starting setting.

[Image 6: Backtest Results with Max Exposure = 2]

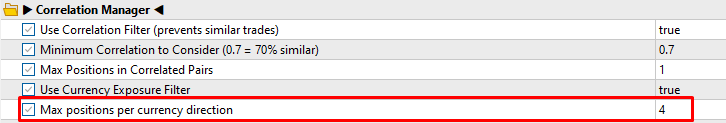

Scenario 4: Filter ON, Max 4 Positions/Direction

-

Use Currency Exposure Filter: true

-

Max Currency Exposure: 4

This setting provides more flexibility, approaching default behavior while maintaining a basic layer of protection.

[Image 7: Input Settings with Max Exposure = 4]

The results indicate higher profits than Scenarios 2 and 3, but with increased drawdown, suitable for traders with higher risk tolerance.

[Image 8: Backtest Results with Max Exposure = 4]

Important Note: Risk vs. Reward Trade-Off

Enabling the Currency Exposure Filter reduces drawdown, enhancing account protection. However, this may lower profits by skipping trades that exceed the risk limit. Disabling the filter or setting a high limit increases trading opportunities and potential profits but also raises the risk of higher drawdown. Choose the setting that aligns with your risk appetite.

Integration with the Correlation Filter

The Currency Exposure Filter complements our existing Correlation Filter, creating a robust dual-layer protection system:

-

Correlation Filter: Prevents excessive trades on highly correlated pairs (e.g., EUR/USD and GBP/USD).

-

Currency Exposure Filter: Limits over-exposure to a single currency (e.g., selling AUD).

Get Started Today

The Currency Exposure Filter is now available in the latest update of our EA, accessible via the MQL5 Market. We recommend starting with the Max Exposure = 2 setting and adjusting based on your risk tolerance. Download the update from the MQL5 Market to integrate this feature into your trading strategy.

Effective risk management prioritizes long-term profitability and capital protection over short-term opportunities. Sometimes, the best trade is the one you avoid.

Happy trading!