Features:

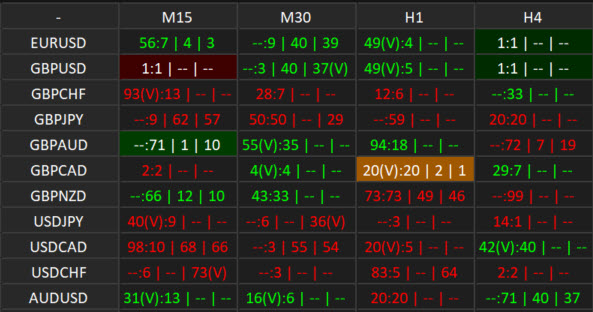

This scanner will show:

- NRTR Trend direction

- Last NRTR Switch (breakout) - number of bars and if it was a high volume bar

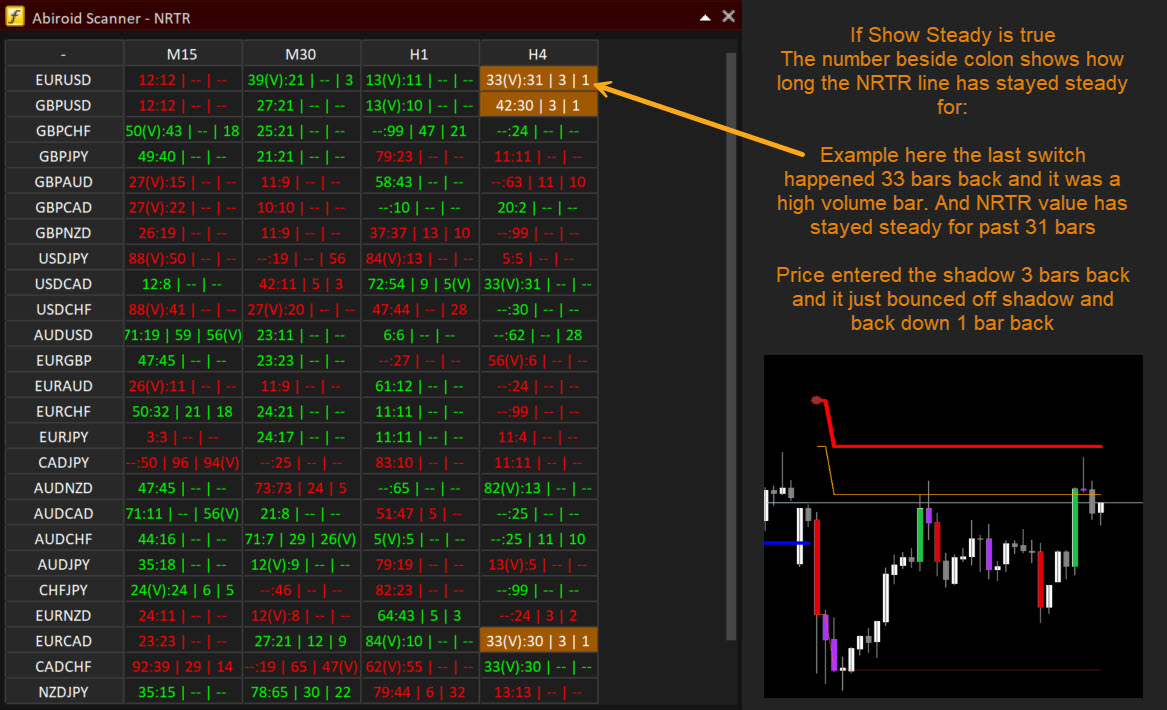

- How many bars has the SR stayed steady for

- When price last entered an NRTR shadow

- When price bounced off the NRTR shadow back inside

- Basket Trade setups

Product available for purchase here:

https://www.mql5.com/en/market/product/138168

You can keep your scanner detailed (if you need all info at once):

Or you can select a lot of settings to false and keep it mini (if only interested in one thing like Shadow Bounce or just NRTR Switch):

Scanner is highly customizable that way.

NRTR Explained:

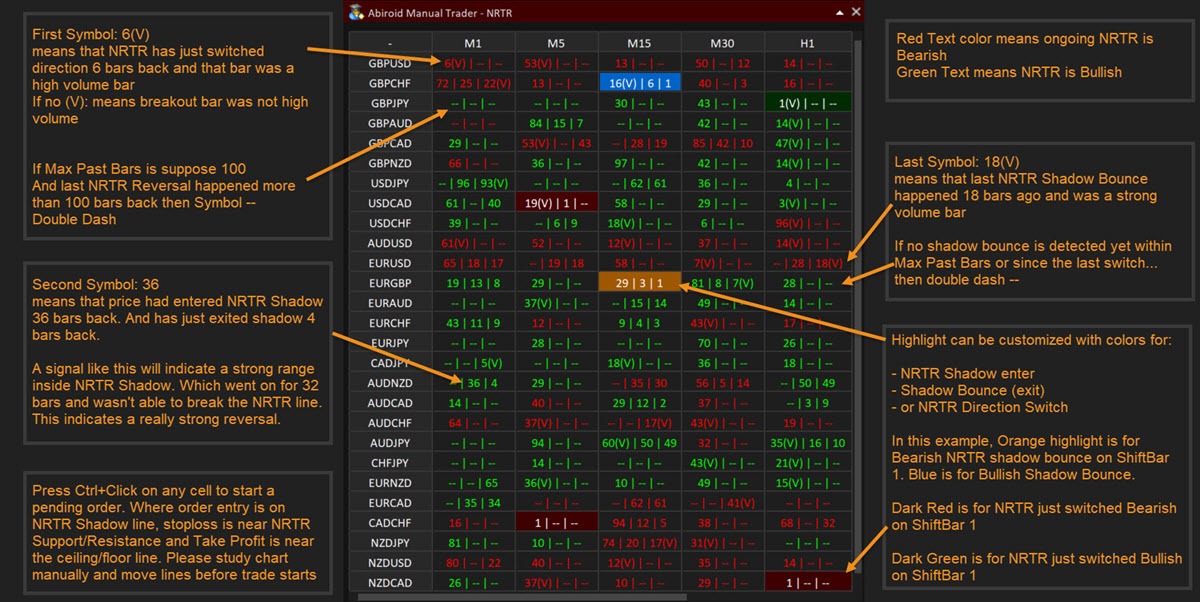

Symbols Explained:

So, using just the numbers on the dash, one can see how a particular pair has been doing.

Basket Trading

If you like to basket trade, then you can set multiple scanners in separate baskets and see how the overall currency is doing:

JPY is rising and AUD is falling.

You can also set which pairs need to be reversed. To allow basket settings to work. E.g. If it's a USD basket, then you will need EURUSD signals to be reversed. So it aligns with USD basket signals. All reversed pairs will have an exclaimation like: "!EURUSD". Non-reversed pairs will just be like "EURUSD".

You can specify your own custom pairs list. Make sure that pair name is exactly like in market watch. And pair is available in Market watch. If Custom pair list is blank, it will use all pairs available in Market watch.

So, suppose if you see that AUD is in an overall downtrend, then it won't be a good idea to trade any BUY signals at this point.

E.g:

If Custom List is: EURUSD,GBPUSD,USDJPY,AUDUSD,USDCAD,USDCHF

And Reverse Pair List is: 1,1,0,1,0,0

0 is normal values. And 1 means reverse values.

So it will reverse: EURUSD and GBPUSD and AUDUSD:

This shows that USD is mostly falling.

If you use a currency strength meter like a Pair Strength Analyzer, then you can cross check:

So, with basket trading, signals become more valid. And will give better results.

At this stage, looking at the GBPUSD Buy Signal was very good. It was a high volume candle reversal, and basket trend signalledthat USD was falling:

------>

------>

Trading Style:

Place Pending Orders manually. Scanner is an indicator only. Not an EA :)

There are 2 ways to trade signals:

Trends or Reversals

Trends:

Suppose you want to just do quick scalping along the direction of overall trend, then just wait for price to breakout NRTR SR areas with a strong volume bar:

Example AUDUSD M15:

Overall AUD currency is bearish. And had been slow and ranging. But price picks up and has a high volume breakout downwards.

Since breakout bar was too strong, price will usually self correct by retracing a bit. So, it's always a good idea to place a pending SELL order a bit inside that breakout bar. And look at the past bars to find a good take profit.

If you are scalping, keep an eye on the price and see when it starts slowing and ranging. Always place a very close stop loss when scalping.

Reversals:

When price enters the NRTR Shadow, but doesn't breakout.. instead it forms a range, then that's a good place to wait. Especially if NRTR has stayed steady.

If you are trading conservatively, then look for a high volume bar reversing out of the shadow:

Keep a pending SELL limit order with entry at the shadow line. And stop loss a bit above the NRTR red line. And take profit should be at least 2-3 times that. Somewhere above the red floor line.

Look at the past bars, to see how the pair has been doing. If it usually reaches the floor or ceiling lines or not. And place take profit accordingly.

Also use something for volatility like BBSqueeze, and trade only when good volatility. Very slow ranging market will not give good reversals.

Settings:

Candles Settings and Pairs/Timeframes:

Prefix:

If you want to create a basket List of multiple different scanner windows on chart, then use a unique prefix.

Example: "ABC" is prefix of window1 and "ABCD" is prefix of Window2. These are not unique because the letters "ABC" are repeated. So when Window1 is deleted, the objects on Window2 might also get deleted.

So be careful to not repeat prefixes. And when you place a window on chart, move it before placing the next window. If windows overlap, then when you move the top window, the bottom one will also move with it.

Shift:

It will look for breakouts or shadow bounce for this "Shift" bar and will give alerts for it. Use Shift 0 for current ongoing bar. Shift 1 for last closed bar.

Max Past Bars: Scanner will look for past bars to see if a trend switch has happened. Suppose Max Bars is 100, and if trend switch has happened more than 100 bars ago, then scanner will just show -- (double dash) indicating that trend has been going on for a lot longer.

Refresh After Ticks: Scanner will refresh every given number of ticks. If you have a lot of pairs, don't keep this value too low. If scanner does not refresh fully, then results won't load correctly. Suppose the base chart on which scanner is loaded is EURUSD, then scanner will look for ticks from that base chart.

And it will also refresh every new bar.

Use Template for New Window: Keep any tpl template file name here. And if you click on any symbol/timeframe, it will load the template on new bar.

Display Settings:

You can move the scanner around, but when you re-open settings and press Ok, scanner will go back to the defined X and Y position. So be careful of that. Especially when basket trading.

Attached are some set files for your basket setup: 1USD.set, 1EUR.set etc. Just go to scanner settings and press Load. And select any set file. Make sure to use unique prefixes when saving multiple set files.

NRTR Specific:

Keeping a larger ATR Period or multiplier will give longer trends. So use that for longer term trading.

And keeping kATR (ATR Multiplier) to lower like 2 or 3 will be better if quick scalping.

Shadow ATR Period and Multiplier will keep the shadow at a distance. To check if price indeed has entered a shadow, use the Price Type In Shadow.

NRTR States:

- Switch: Price has broken through the NRTR SR line and trend has switched. Blue line to Red line switch indicates bearish move and Red to Blue switch indicates Bullish move.

- In Shadow Start: Price has entered the NRTR Shadow and is in a range now

- Shadow Bounce: Price has exited the NRTR shadow inwards. Meaning price has respected the SR areas and has bounced off the shadow line.

Price Type In Shadow: For finding out if price is inside Shadow or not, it will use this setting. It can be Open, or Close or High/Low. Recommended is Price Close to make sure that price indeed has entered the shadow properly.

Show Volume:

It will show (V) symbol if the NRTR breakout bar or the Shadow bounce bar is a high volume bar. It uses VolumeCandles.ex4 to look for high/medium volume bars.

Filters:

Note that filters are for Alerts only, Highlights will still be visible.

Steady Bars More Than Num:

This will only show an Alert if NRTR line has stayed steady for a minimum number of bars

Range Inside Shadow more than Bars:

Once price enters the Shadow, it will range for sometime and then bounce. This setting will check that range has been for at least a minimum number of bars.

This is important because it gives better reversal signals. If price has been ranging, means it's been trying to break the NRTR SR line, but ultimately it hasn't broken through. Making it a strong reversal area.

Tolerance in Shadow Bars:

Sometimes price comes out of shadow for 1-2 very small bars, but goes back in to continue the range. So, you can define a tolerance which will ignore a bounce signal if price goes right back into shadow within this tolerance.

Alerts and Highlights:

Scanner highlights and alerts can be programmed based on your strategy:

Default background highlight colors are a bit darker so they don't distract you from the important signals.

For example when trading NRTR Shadow bounces, keep just the shadow bounce highlights more visible like this:

Suppose you are scalping just the NRTR Breakouts, then you can keep shadow signals false and get a more minimalist scanner like this:

Here it only highlights NRTR Switch and how many bars has NRTR stayed steady for after last switch. You can turn off the steady bars signals too.

Conclusion:

Best timeframes will be at least M15+. Preferably H1 or H4. Because in lower timeframes there is a lot of noise. And reversals aren't always predictable. Lower timeframes should be for quick scalping only. And you should keep a close eye on trade.

But recommended timeframe is H1.

Known Issues:

If a new scanner window is created, it will become the top window. When you move a botton window, the chart scrolls when moving it. This has to do with MT4 chart events. It seems only one window can be at the top.

NRTR can be a bit heavy, especially if you have too many pairs, timeframes and Max Past bars. When the scanner refreshes first time, it will take 6-7 seconds depending on how many pairs/TFs etc. So chart might freeze during a refresh.

So, it is recommended not to use it too heavily if you have multiple charts open. It will also depend on your system RAM.

Changelog:

v1.0 Base version

v1.1 Added Filters for Alerts