Before you start (Must Read!)

Welcome to the Drawdown Manager (DDM), an expert advisor utility designed to assist traders in the strategic management of equity drawdowns. Drawdowns, a decline from peak to trough in the value of an investment or trading account, can be particularly challenging and risky, especially for strategies that utilize grid systems or martingale approaches. The DDM offers a solution to mitigate these risks by providing an intelligent system to manage and exit positions in a drawdown scenario effectively. The use case for the DDM lies in its ability to detect and counteract unfavorable equity dips automatically, thus helping traders to stick to their risk management plans and preserve capital. It is worth mentioning that DDM will not place any automated trades, yet will leverage on any existing or future trades, and use the built in algorithm to cut loses, against the winners.

Risk Management Disclosure

The Drawdown Manager (DDM) is a sophisticated tool designed to aid traders in managing equity drawdowns by attempting to balance and mitigate losses through intelligent trade management. However, it is essential to understand that the efficacy of drawdown management is contingent upon numerous market conditions and the specifics of your trading strategy. The DDM does not guarantee the prevention of losses, particularly in highly leveraged positions where market volatility can exponentially magnify both gains and losses. High leverage can lead to rapid losses that exceed the account balance and the DDM's capacity to manage in real-time. As such, users should employ the DDM within a comprehensive risk management strategy and not rely on it as a failsafe measure against all forms of drawdown. It is the trader's responsibility to set appropriate leverage levels and to understand that the DDM operates within the constraints of the market and the parameters set by the user. All trading strategies and tools carry the risk of loss, and the DDM is no exception. Traders should always be prepared for the possibility of financial loss, regardless of the tools in use.

The Drawdown Manager Method

Grid, martingale, and position traders are no strangers to the anxiety that comes with watching a trend move against their positions, leading to multiple trades deep in drawdown. Often after such heavy trends, the market enters a period of consolidation, ranging for some time. During this phase, the market may either reverse, potentially favoring the initial trading strategy, or continue in the opposite direction, exacerbating the drawdown. The Drawdown Manager is your strategic ally in these critical moments. It empowers traders to harness any floating or realized profits by intelligently closing portions of the losing positions. This method effectively reduces the burden of negative trades and can make it easier to close the entire cycle profitably if the price retraces. Conversely, should the market persist in the opposite direction, the DDM ensures that your open positions have a reduced volume, thus lessening the impact and keeping the drawdown within more manageable levels. By configuring the DDM to act on specific profit thresholds, traders can mitigate risk and navigate through market fluctuations with greater confidence and control.

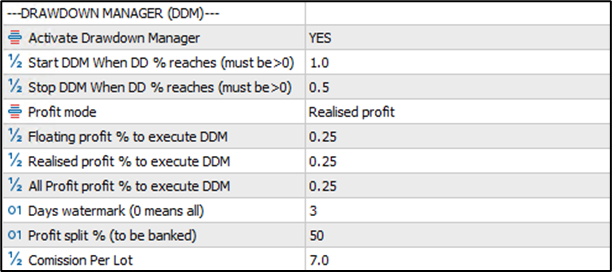

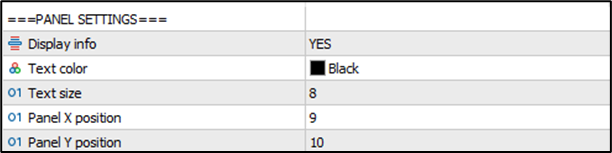

Panel Settings:

You can customize whether to have a display on the chart or not, the text color and size, and the panel position by adjusting the X and Y values.

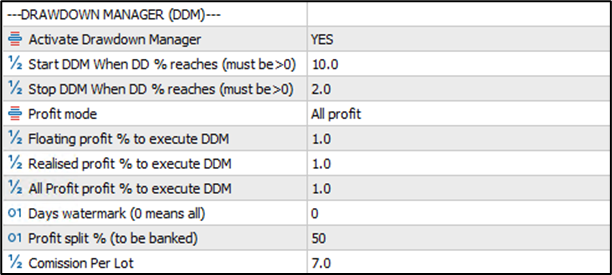

Drawdown Manager Settings:

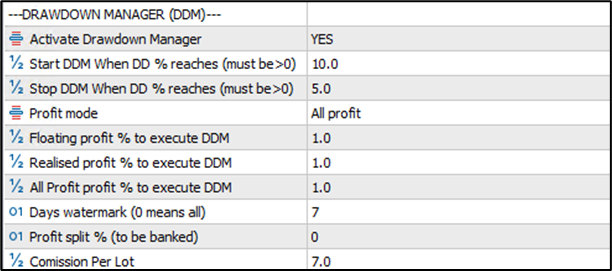

Activate Drawdown Manager: Toggle this to YES for the DDM to operate automatically, adhering to the parameters you’ve set up. Selecting NO means the DDM won’t run on its own, but you can still manage it manually via the panel.

START Auto DDM when DD% reaches: Input the specific percentage of your account drawdown at which point you want the DDM to begin working automatically.

STOP Auto DDM when DD% reaches: Set the drawdown percentage at which you want the DDM to cease automatic operations.

Profit mode: Choose how the DDM will act in terms of profits to manage losing trades. The options are:

Floating profit: The DDM will employ profits from currently open, but not yet closed, profitable trades.

Realized profit: The DDM will use profits from trades that have been closed at a gain.

All profit: The DDM will use a combination of both floating and realized profits to tackle losing trades.

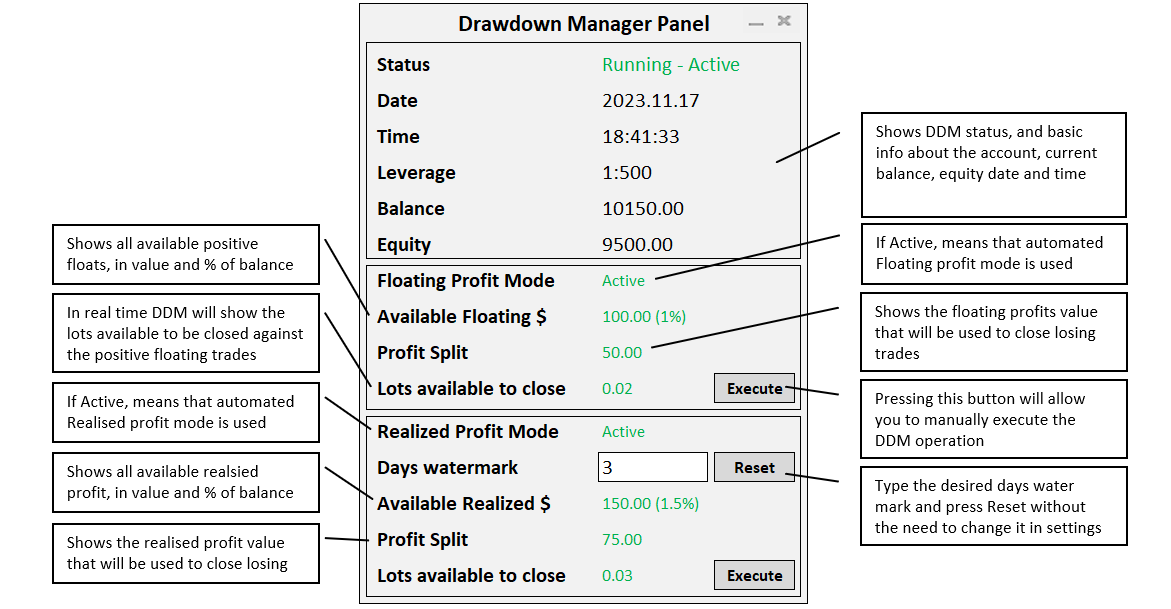

Floating Profit % to Execute DDM: Set this percentage to define the threshold of floating profit — profit from currently open positions that are yet to be closed — relative to your account balance. When this percentage is reached, the DDM will activate, identifying the largest losing trade to reduce or close using the available floating profit.

Realized Profit % to Execute DDM: This is the percentage of realized profit — profit from positions that have already been closed — you wish to allocate to offset losing trades. Once your account's realized profit hits this percentage, DDM will take action, targeting the most significant losing trade to lessen or clear with the realized profit.

All Profit % to Execute DDM: When using the all profit mode, input here the combined percentage of both floating and realized profit relative to your balance. Reaching this combined profit percentage prompts the DDM to commence its search for the losing trade that will be partially or entirely offset by this cumulative profit.

Days Watermark: This setting is crucial when you're utilizing the realized profit mode within the DDM. It allows you to specify the time frame for the DDM to consider when evaluating realized profits. For instance, setting this value to '3' directs the DDM to factor in all realized profits from the last 3 days and apply them in mitigating negative positions. A setting of '0' is an instruction for the DDM to take into account the entirety of realized profits on the account, without any time restriction. This flexibility enables you to align the DDM's operations with your strategic trading review periods and risk management protocols.

Profit Split: This setting allows you to determine the portion of profits from positive trades to allocate towards mitigating losses. For instance, by setting this to 50%, you direct the DDM to use only half of the profits for offsetting losing positions, while securing the remainder as your earnings. A value of 0 indicates that all profits should be utilized in addressing losing trades, which may be particularly useful in scenarios of significant drawdowns.

Commission per lot: In this section you need to input your broker commission per lot, so that the DDM consider it in the calculation when closing positive trades, against negative trades.

Drawdown Manager Panel:

Drawdown Manager comes with a very handy panel, that gives crucial visibility, yet in the most simplistic form. Let us delve in it:

When you decide to execute the drawdown management manually using the Execute buttons in the panel, you will get confirmation messages as below, sharing the full details of the operation and as you to approve before proceeding, which is extremely handy specially if you have lots of grid positions open.

Confirmation message floating profit execution:

Confirmation message realised profit execution:

Strategies and Set files

Strategy 1 - Aggressive Drawdown Management

For account reaching heavy drawdowns, (above 10%), this set file will allow Drawdown Manager use 1% of both floating and realised profit attained the past 7 days of trading to reduce the volume of the losing trades. Once the Drawdown have reduced to 5%, the DDM will stop.

Strategy 2 - Defender Drawdown Management

If you want to control any build up of drawdowns, you can start the process early on, this set is for you. It will initiate the DDM the moment drawdown reaches 1%, and will stop with it is back 0.5%. It will use 50% of realised profits in the past 3 days to offset losing trades. This strategy, COULD be safer, but it will limit your profits early on as 50% of your profits are going to be used to offset losing trades.