Upon becoming profitable, traders should begin to think about the most advantageous income tax strategy to use. The written and signed statement in the attached file at the bottom of this post is a redacted copy of my actual U.S. IRS Code Section 1256 Election. For income tax purposes in the U.S., forex profits and losses are lumped in with futures profits and losses in terms of tax treatment. As a default provision (where the taxpayer makes no election), IRS Code Section 988 will be applied to futures and forex profits and losses. Pursuant to Section 988, all such profits will be taxed as ordinary income and all such losses will be deductible as ordinary losses. However prior to the start of a trading/tax year, a forex and/or futures trader is allowed to opt out of Section 988 and into Section 1256.

Why did I elect into Section 1256? Because even if I had been scalping in 2022, I was entitled to a 60/40 split of profits. 60% of profits are treated as long-term capital gains, while 40% of profits are treated as short-term capital gains. In the U.S., the maximum long-term capital gains tax rate is 20%. So, that's a 20% or less tax rate applied to most of the profits and the ordinary tax rate (generally higher) applied to less of the profits. As a caveat, Section 1256 only allows a maximum of 3000 USD of total losses to be deducted.

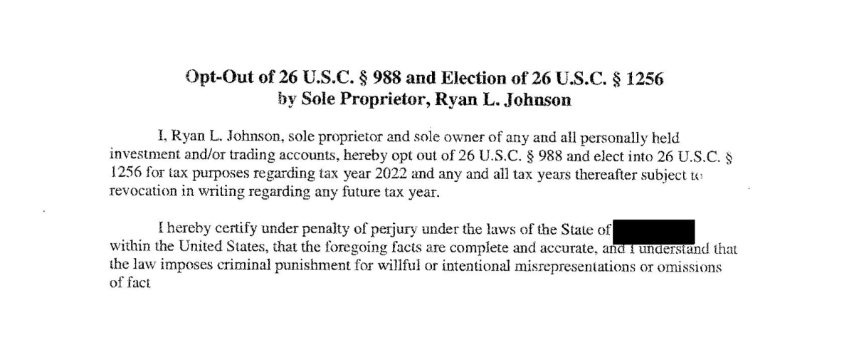

Although the election must be made before any trade is placed within the tax year at issue, that election only need be memorialized internally. Whether a given taxpayer is a commodity pool operator or a sole proprietor (like most retail traders), it's a very good idea to draft, sign, date, and get witnessed, a formal statement. The attached file can be used as a template for readily drafting such a statement. It's no coincidence that the above Election is dated December 31, 2021. Again, the Election need not be filed with any governmental agency, but the taxpayer should keep it safely stored in case of an IRS audit, etc. If the taxpayer files a tax return via software, that software will likey ask a simple question about electing out of 988 upon entering trading profits.

Essentially, a trader must estimate her/his likelihood of profitability in advance of any given trading/tax year. Obviously, this is much easier for a trader who is continuing to employ a profitable strategy from a prior year... or at least, trading a quantified and empirically tested strategy. Conversely, a trader who is not yet profitable has little incentive to opt into Section 1256. Of course, the IRS Standard Deduction must also be considered... especially by traders in lower ordinary tax brackets.

Author: Ryan L Johnson

Nothing in this post may be construed to be legal nor tax advice. The author is not a licensed tax attorney nor a certified public accountant. For any and all questions and/or concerns regarding legal and/or tax advice for your specific tax situation, you must consult a licensed and/or certified tax professional in your specific jurisdiction.