Alphabet AI MT4/5 How to start working? & Frequently Asked Questions

In the world of Forex trading, finding effective strategies to maximize profits and minimize risks is critical. Two popular approaches are using the multi-layer perceptron (MLP) strategy and mean reversion which are implemented in our Alphabet AI trading advisor.

⭐️⭐️⭐️⭐️⭐️ MT4 Version Available Here: https://www.mql5.com/en/market/product/108004

⭐️⭐️⭐️⭐️⭐️ MT5 Version Available Here: https://www.mql5.com/en/market/product/108005

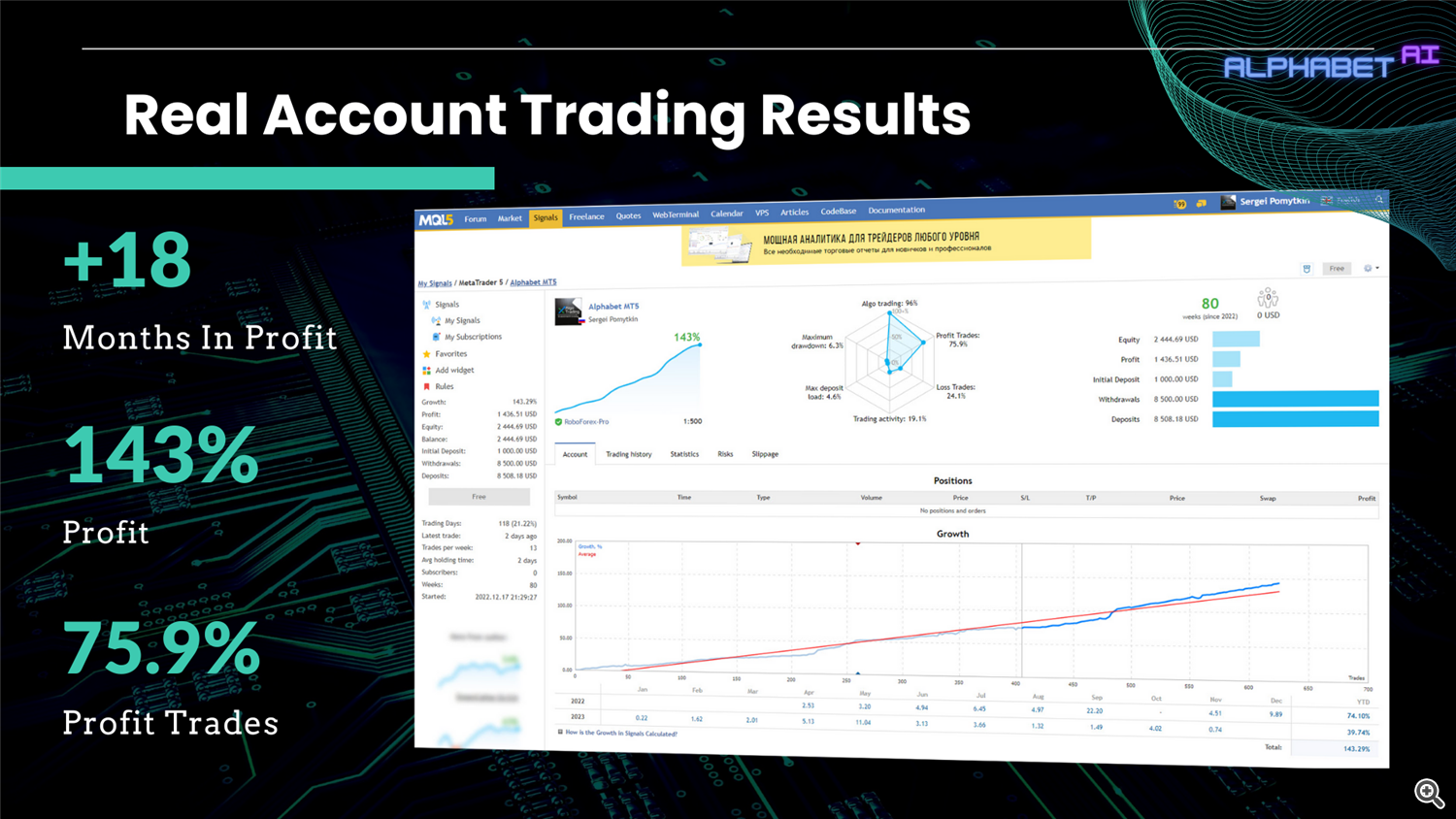

✅ Live Signal: https://www.mql5.com/en/users/delmare/seller

In this article, we will look at the benefits of combining these two strategies in trading advisors and how this can improve your trading performance.

Multilayer Perceptron Strategy.

A multilayer perceptron is a type of artificial neural network that can learn and recognize patterns in data. It has the ability to analyze complex relationships and make predictions based on historical price data. By training the MLP model on Forex market data, it can reveal hidden patterns and trends, providing valuable information for making trading decisions.

Mean reversion strategy.

Mean reversion is a trading strategy based on the belief that prices tend to revert to their mean or mean over time. It involves identifying situations where prices deviate significantly from their mean and taking positions in anticipation of a reversion to the mean. Mean reversion strategies can be effective in range-bound markets or during periods of extreme prices.

Combining strategies.

By combining the MLP strategy with mean reversion, traders can benefit from the strengths of both approaches. An MLP strategy can identify long-term trends and forecast future price movements, while a mean reversion strategy can exploit short-term price deviations from the average.

Advanced trading signals.

The MLP strategy can generate trading signals based on its forecasts, indicating when to enter or exit trades. These signals can be further refined by incorporating mean reversion principles. For example, if the MLP predicts a long-term uptrend, the mean reversion strategy can be used to determine the right times to buy during short-term price declines.

Management of risks.

Effective risk management is critical in trading. By combining these strategies, traders can employ risk management techniques that take into account both long-term trends and short-term deviations. This can help set stop loss levels, profit targets and position sizing, providing a balanced approach to risk management.

Testing and optimization.

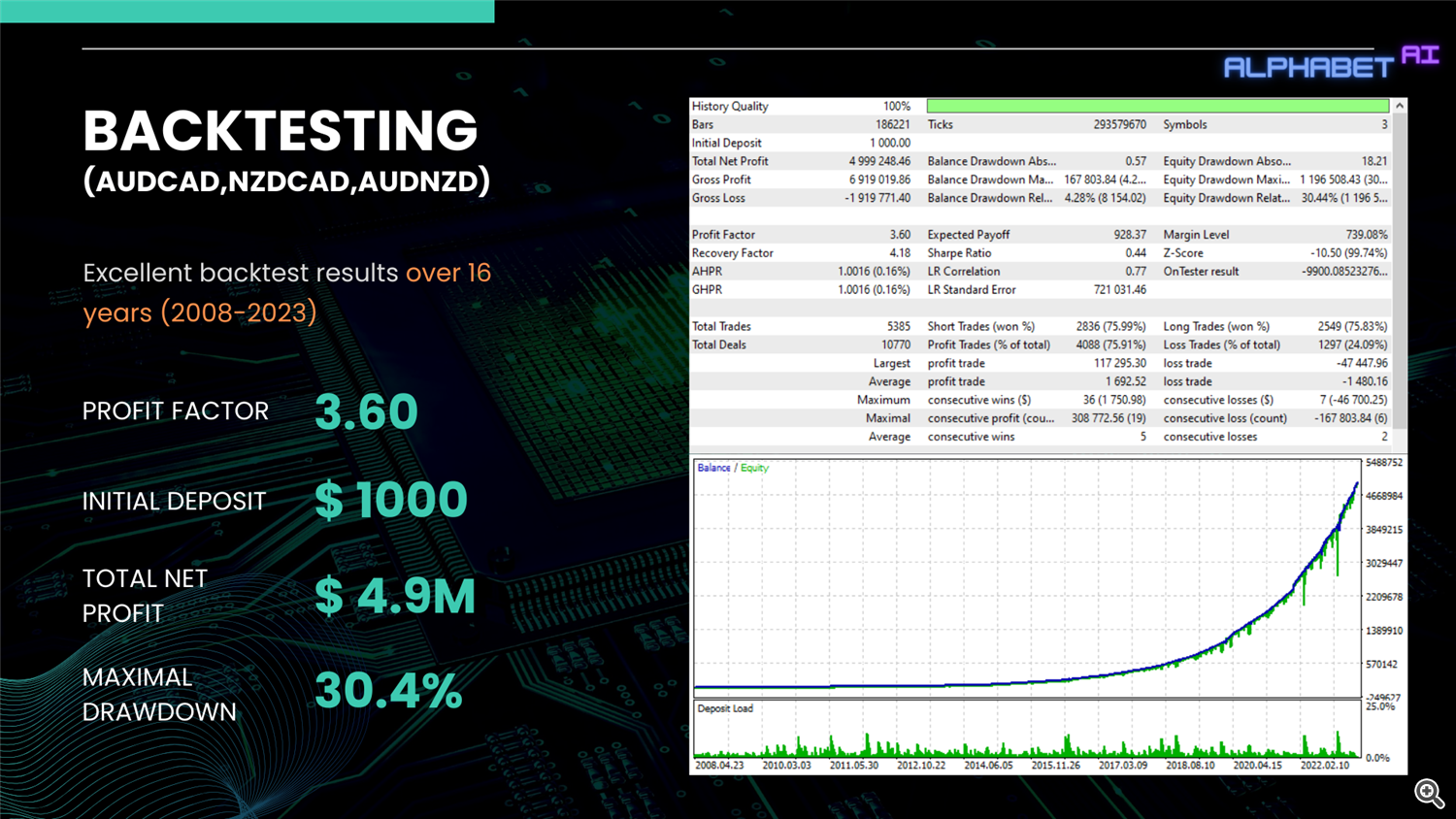

Before implementing a combination strategy, it is important to test and optimize the model using historical data. This helps evaluate its performance, adjust parameters and identify potential weaknesses. Through rigorous testing and optimization, traders can fine-tune the strategy to suit their risk tolerance and trading preferences.

Conclusion.

The combination of a multi-level perceptron strategy with mean reversion in trading advisors offers a powerful approach to Forex trading. By using the MLP model's predictive capabilities and mean reversion principles, traders can improve their trading signals and improve their overall trading performance. However, to ensure the strategy is effective, it is important to conduct thorough testing, optimization and risk management. Remember, no strategy guarantees success, and constant monitoring and adaptation are the keys to successful trading.

Frequently Asked Questions

How to start working?

- The advisor must be linked ONLY to one M30 chart, AUDCAD is recommended, enter trading pairs in the “Symbol List” line, set the risk parameter or a fixed lot.

- If your broker uses a suffix or prefix (for example, AUDCAD.m), you should indicate this in the Suffix and Prefix parameter.

For convenience, you can download the ready-made set file that I use on my signal.

What type of account is best to use?

For the advisor, select the hedging account type. The advisor is NOT sensitive to spread or slippage, and is suitable for most existing brokers and account types. To get the maximum benefit, we recommend using an account with a low spread, fair commission (Raw, ECN) and a leverage of at least 1:100.

Which broker is better to choose and why do different brokers have different results?

Broker details may vary - ticks, spread and swap. This is why the results from different brokers may differ slightly, but in general this does not greatly affect the final result.

How often does the advisor open orders?

The advisor does not trade every day, but only when there are signals and favorable conditions for entering a trade, so trades may not be opened for a long time, so do not be alarmed. Also, it will not automatically open trades once you attach it to a chart.

How many activations will I receive?

The advisor comes with 10 activations. This means that you can activate the advisor on 10 different devices, say your VPS and home computer.

MT4 or MT5. Which version is better?

Alphabet AI MT4 and MT5 versions are 100% identical. Choose which version you like best and suits you.

Is it possible to buy an expert somewhere else?

No, Alphabet AI is only available on MQL5, so if you purchase it anywhere else, it will not be a genuine product and is most likely counterfeit and will not be guaranteed to work.

Important!

The advisor was tested and optimized on historical data from Dukascopy using the Tick Data Suite program, which allowed it to achieve 99.9% accuracy.

We recommend using the MT5 version for realistic backtesting.

Why am I getting different/worse backtest results?

Quality of market data provided by your broker (this varies from broker to broker)

Each broker's swaps and spreads may affect the test results.

Is live trading the same as backtesting?

If you have quality data provided by the broker, yes, it is exactly the same as real trading.

What is the minimum starting balance?

The minimum recommended starting balance is $100-200 for each currency pair traded, if you have selected all 3 pairs then a minimum of $300-500 is recommended.

Can an expert work together with other experts?

Yes, but make sure all your advisors have a different magic number.

How can I increase my profits?

You can increase your profit either by increasing the fixed lot or by increasing the risk percentage in the settings. But by doing so, you also increase your risks, you must remember this.

How to check that the advisor is ready to work?

First, the Algo Trading button at the top of the Metatrader terminal should be green (enabled).

Then in the EA settings, in the “General” section, check the “allow trading algorithms” checkbox.

My trading pairs have a prefix or suffix, what should I do?

Enter the corresponding symbols in the Suffix and Prefix lines. For example, if your trading symbol looks like “AUDCAD.m”, then enter the name of the pair “AUDCAD” in the Symbol List column, and the suffix “.m” in the column, the same thing if currency pairs have a prefix. Dots, commas, dashes and other symbols must be written.

What if my account is in a currency other than the US dollar?

It doesn't matter what currency your account is in, the advisor handles it automatically.

Input Details

Detailed description of the main input parameters of the Alphabet AI advisor:

Symbol List

The list of traded pairs should be entered separated by commas, for example: “AUDCAD,AUDNZD,NZDCAD”. If your symbols have a suffix or prefix (AUDCAD.m), then the suffix and prefix must be specified separately in the parameter below.

Symbol Suffix

If your broker's list of symbols has a suffix, for example: AUDCAD.m, then the suffix should be entered separately in this field (.m)

Symbol Prefix

If your broker's list of symbols has a prefix, for example: proAUDCAD, then the prefix should be entered separately in this field, (pro).

Lot-sizing Method

This parameter allows you to select the lot calculation method.

Fixed lot: Fixed lot (lot is set in the Fixed Lot parameter below)

Dynamic Lot based on Balance: Dynamic lot based on the current balance (if selected, set the calculated balance below in the Balance/Equity Lot Calculation parameter)

Dynamic Lot based on Equity: Dynamic lot based on current equity (if selected, set the calculated balance below in the Balance/Equity Lot Calculation parameter)

Very High Risk Set (High, Mid, Low): An easier to understand risk calculation, choose based on your preferences.

Fixed lot

Set a fixed lot if the calculation method is selected (Fixed lot).

Balance/Equity Lot Calculation, % of balance/equity (0-off)

Set the settlement balance if the Dynamic Lot based on Balance/Equity calculation method is selected.

This means that the advisor considers a trading lot of 0.01 for every n-balance entered by you in the risk parameter. That is, with a value of 500, the trading lot will be 0.01, when the balance reaches $1000, the lot will be 0.02, when the balance reaches $1500 it will be 0.03, and so on.

Stop Out, % of balance (0-off)

This parameter sets the maximum permissible level of risk (drawdown), i.e. upon reaching which, all transactions will be closed according to the market. All trades of all traded pairs are taken into account.