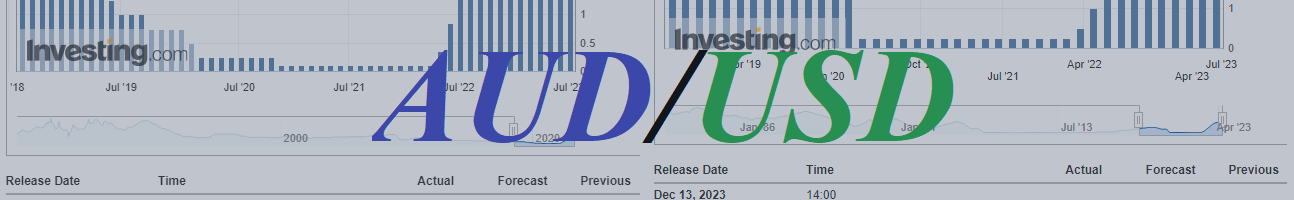

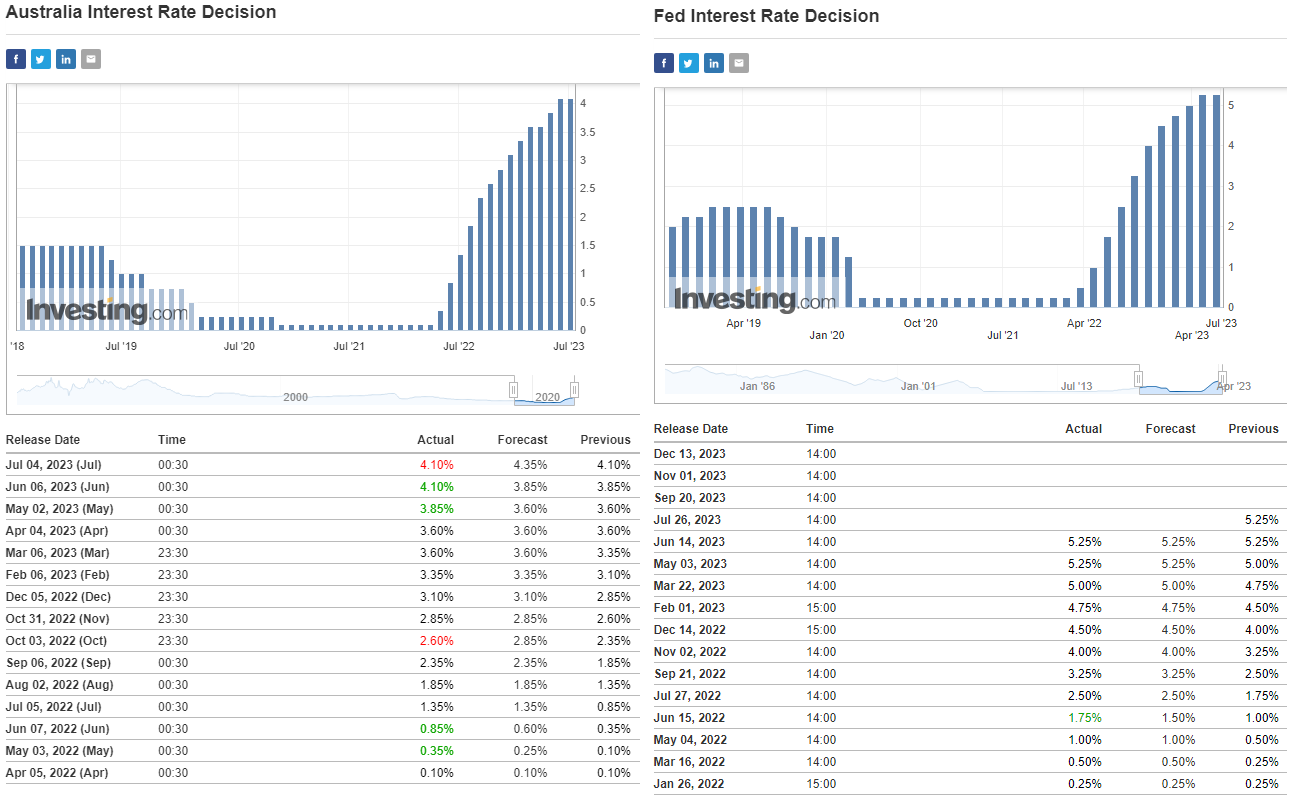

Today ended the regular meeting of the Australian Bank of Australia, following which the leaders of the Australian Central Bank unexpectedly decided to leave the interest rate at the same level of 4.10%.

In an accompanying statement, they did note that “some further tightening of monetary policy may be needed,” but this will depend on how the economy and inflation develop (for more, see “AUD/USD: RBA Surprises Markets with Surprise Decision”).

RBA leaders also stressed the risks of global economic recovery, and yesterday's data from Australia confirmed the trend of further deceleration of inflation in the country: the inflation rate from TD Securities slowed to +0.1% in June (from +0.9% a month earlier) and to + 5.7% in annual terms (from +5.9% in May).

Immediately after the publication of the RBA decision, the Australian dollar fell sharply, and the AUD/USD pair lost almost 50 points in the moment, dropping to an intraday low of 0.6642.

At the time of publication of this article, the AUD/USD pair was in the range between important short-term levels: support 0.6676 and resistance 0.6690, the breakdown of which in one direction or another may determine the direction of further price movement.

In the first case, after the breakdown of the support levels of 0.6676, 0.6642 (today's low), AUD/USD will head inside the downward channel on the weekly chart, towards its lower border, which is currently passing near local lows (since April 2020) and the marks of 0.6200, 0.6285.

The “fastest” signal for the implementation of the downside scenario is a breakdown of the level 0.6664.

However, technical indicators OsMA and Stochastic on the daily chart turned to long positions, signaling the possibility of developing an alternative scenario for the growth of AUD/USD.

In this case, the signal for the resumption of long positions may be a breakdown of the resistance levels of 0.6690, 0.6700. Targets - resistance levels 0.6720, 0.6750, 0.6780. Their breakdown will open the way for further growth to the key resistance levels 0.6975, 0.7040, 0.7060, separating the long-term bear market from the bull market.

Support levels: 0.6676, 0.6665, 0.6642, 0.6600, 0.6565, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6690, 0.6700, 0.6720, 0.6750, 0.6780, 0.6800, 0.6900, 0.6975, 0.7000, 0.7040, 0.7060

- see also “Technical Analysis and Trading scenarios" -> Telegram - https://t.me/traderfxcrypto

- contact - https://t.me/fxrealist

- channel - https://www.mql5.com/en/channels/fxcryptotrader