GBP/USD: upcoming events of the economic calendar and prospects

As we noted in our today's Fundamental Analysis, if investors mainly expect the Fed to slow down the monetary tightening cycle, then the Bank of England - a further increase in interest rates by 1.0%, and to the level of 4.50% by the summer (now the interest rate of the Bank of England is at the level of 3.50%). In this sense, today market participants will follow the speech of Fed Chairman Jerome Powell at the international symposium on central bank independence, organized by the Central Bank of Sweden, which will begin at 14:00 (GMT). Now it is important for market participants to hear the opinion of Fed Chairman Powell on the prospects for monetary policy. If he also takes a tough stance on this issue, then the dollar will have a chance to regain its recently lost ground.

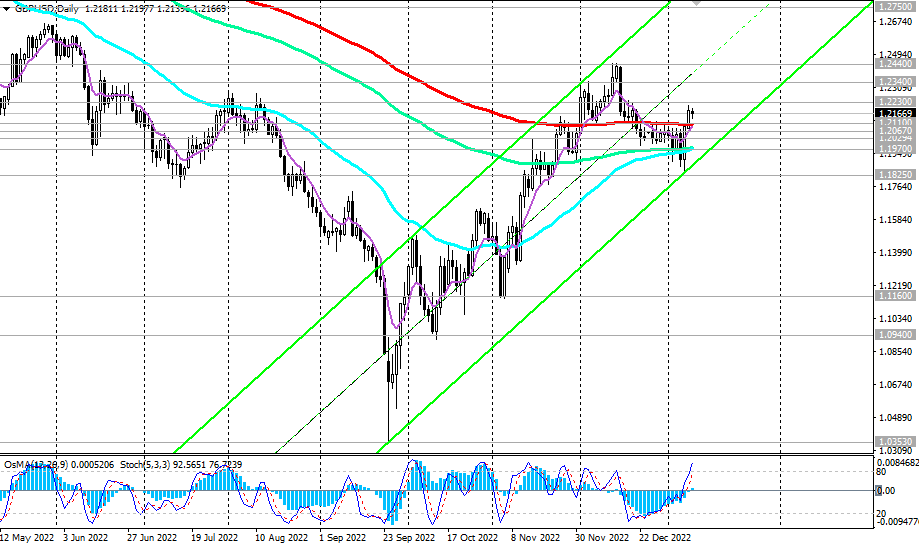

The GBP/USD pair is declining today after a significant increase in the previous 2 trading days. Yesterday the pair came close to the long-term resistance level 1.2230, a break of which would open the way for the pair towards the key resistance levels 1.2750, 1.2900, which separate the pair's long-term bullish trend from the bearish one.

The scenario for the resumption of decline and return to the zone of the long-term bear market will be associated with the breakdown of the key support level of 1.2110. Above it, long positions remain preferable.

Support levels: 1.2110, 1.2100, 1.2067, 1.2030, 1.2000, 1.1970, 1.1900, 1.1825, 1.1800

Resistance levels: 1.2230, 1.2300, 1.2340, 1.2400, 1.2440, 1.2500, 1.2750, 1.2800, 1.2900

- details - https://www.instaforex.com/ru/forex_analysis/331871/?x=PKEZZ

- or https://www.instaforex.com/forex_analysis/331871/?x=PKEZZ

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- link to third party Live-monitoring –> myfxbook.com/members/FxForward

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading