According to Statistics New Zealand data published earlier this month, the country's GDP grew in the 3rd quarter by +2.0% (against the expected +0.9% and +1.7% earlier) and by +6.4 % in annual terms (against the expected +5.5% and +0.4% earlier).

This is a fairly solid increase in the New Zealand GDP. Its growth means an improvement in economic conditions, which makes it possible to tighten monetary policy, which, in turn, usually has a positive effect on the quotes of the national currency. High inflation (Economists believe New Zealand inflation will remain well above the RBNZ's target range of 1%-3% through at least the end of 2023) and the country's near-record low unemployment support the case for more aggressive action by the Reserve Bank New Zealand. If interest rates in New Zealand rise even more (and now the RBNZ interest rate is at 4.25%, going almost in line with the Fed rate and remaining one of the highest among the Central Banks of the most developed economies), this will have an additional upward pressure on the national currency.

During a press conference following the November meeting on monetary policy, the head of the Reserve Bank of New Zealand, Adrian Orr, supported the central bank's decision to raise the official monetary rate (OCR) by 75 basis points. At the same time, the bank's management stated that “we really want to get to the point where we can be sure that inflation will be defeated. Further tightening of monetary conditions is needed.”

Economists expect a further increase in the RBNZ interest rate, to at least 5.5% in 2023, and this is one of the main fundamental factors suggesting further strengthening of the New Zealand currency.

In this situation, we should expect the growth of the NZD/USD pair, especially if the Fed continues to slow down the tightening cycle of its monetary policy.

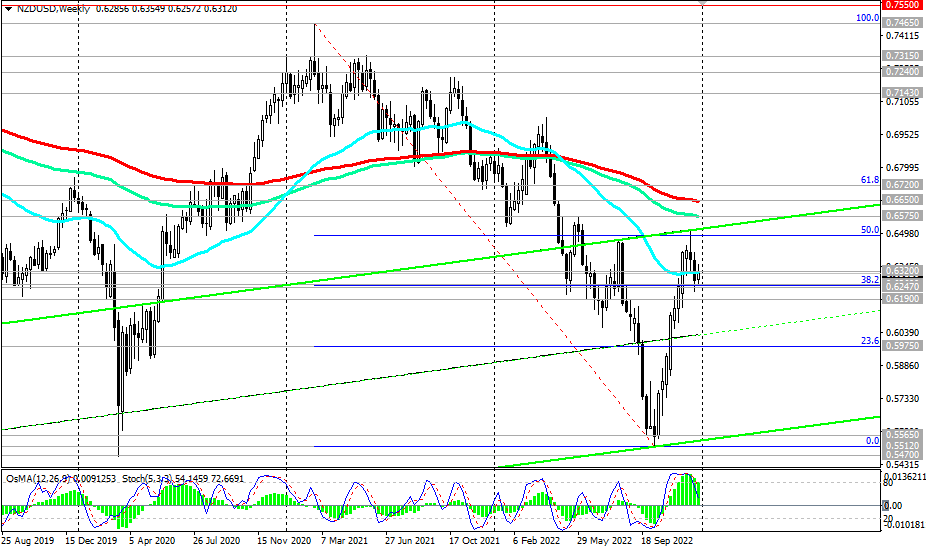

At the moment, the NZD/USD pair is trading in the medium-term bull market zone, having managed to overcome the strong resistance level of 0.6260 last month. A confident breakdown of the long-term resistance level of 0.6320 will create prerequisites for further growth of the pair towards the key resistance level of 0.6650, which separates the long-term bull market from the bear market.

Support levels: 0.6295, 0.6260, 0.6247, 0.6190

Resistance levels: 0.6320, 0.6348, 0.6354, 0.6400, 0.6488, 0.6500, 0.6575, 0.6650, 0.6720

- details - https://www.instaforex.com/ru/forex_analysis/331133/?x=PKEZZ

- or https://www.instaforex.com/forex_analysis/331133/?x=PKEZZ

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- link to third party Live-monitoring –> myfxbook.com/members/FxForward

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading