Venzo EA has a unique protection for the strategy of breaking out support and resistance lines.

The algorithm will automatically select all the necessary settings for EURUSD and USDJPY.

You won't need any additional settings (SET Files).

The system will also activate all the necessary protection for your broker if it decides that it is necessary in certain conditions.

You can also choose your own protection from your own interests, if necessary.

The system is very flexible and you can always create your own settings for other pairs if needed.

If you have any additional questions, just email me or my Telegram !

Most popular breakout systems collect all levels indiscriminately.

This can be profitable if you have a great broker with zero spreads.

But most brokers have a small spread and during the breakout it can widen.

A wide spread introduces many inaccuracies and accidents.

This leads to the fact that a wide spread can accidentally hook a pending order and the deal will be opened.

At the same time, a good broker with low spreads will not have such a deal.

That is why Venzo EA constantly monitors and analyzes your broker.

The analysis goes through several points.

- Average broker spread

- Maximum broker spread

- Average slips

- Market volatility

- Rollover filter

- The presence of gaps within the level

- Checking for false levels

All of these checks are optional and increase the accuracy of identifying a support or resistance level.

They allow you to have high accuracy of transactions and increase the recovery factor

This way you can compare your broker and test the system without these protections.

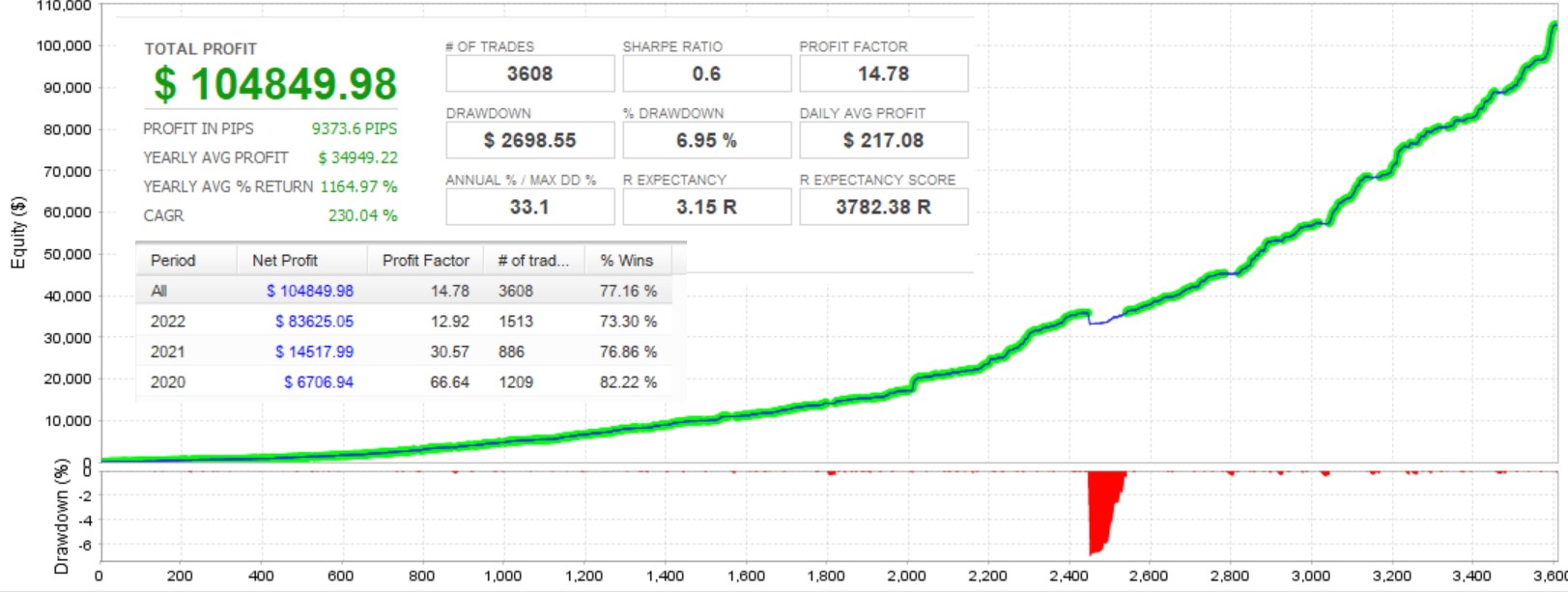

Here is a good example based on ICMarkets

These are the default settings for EURUSD + real fees + swaps + slippage + real spreads

The quality of quotes is 100%, the initial deposit is 1K

We get a result of approximately 105K in 3 years, a drawdown of 6.95%We will now disable the market volatility filter and greedy broker protection

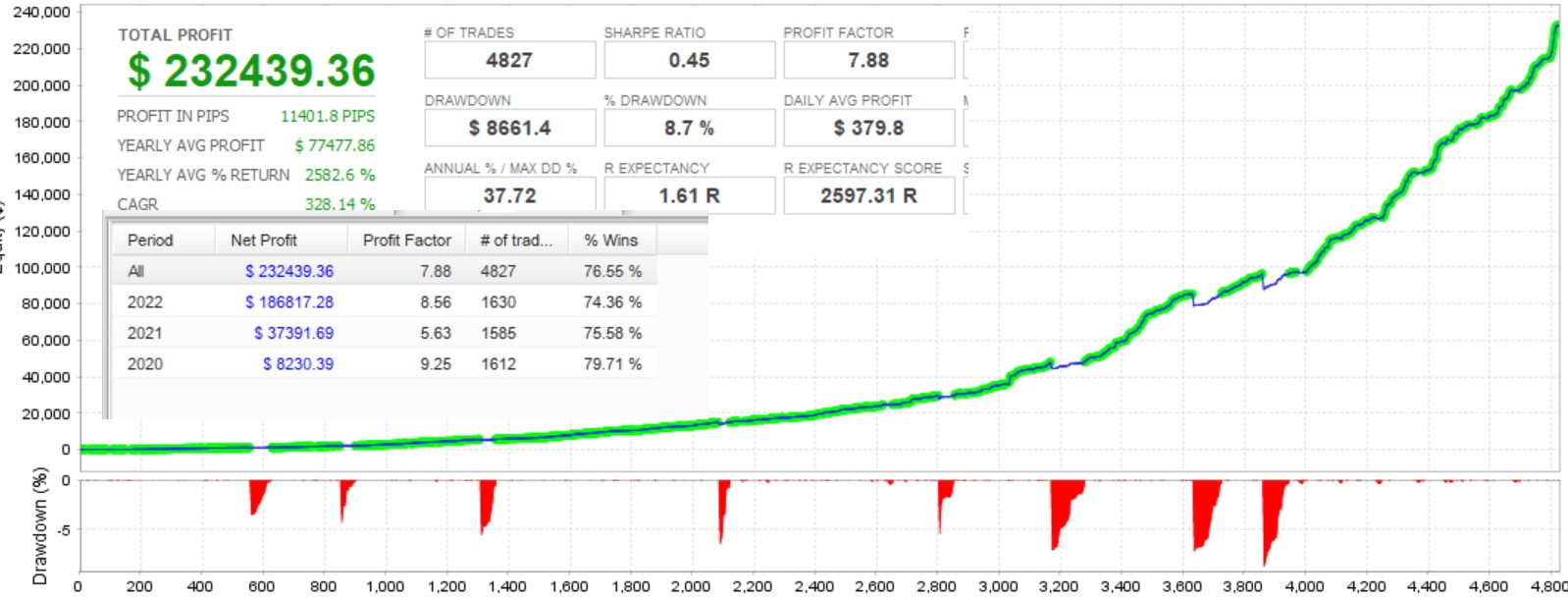

- " GREEDY BROKER DEFENCE " = False

- " VOLTIC FILTER " = False

Thus, we will increase the total number of transactions, but the accuracy of transactions will be reduced

The maximum drawdown also slightly increased due to slippage.

At the same time , the number of unprofitable positions increased to 8 , there was 1

ProfitFactor decreased by 2 times

But the total profit became 232K

Thus, we get more profit for 3 years, but reduce the accuracy of transactions.

This is true for a good broker with low spreads and slippage, and if accuracy is not important to you

Be sure to check this with your broker before just running it on a live account.

If your broker has wide spreads, it is better not to change the protection.