I have developed 30+ trading systems based on various methods but most of them are variation of fibonacci. I am going to share my experience of the problems i faced when i continued to trade those systems.

At very beginning of my trading career, I was trading manually without using any automated system like MT5. My friend introduced me to MT5 and since my profession was Information technology, I studied MQL5 and built a trading system for myself. I will discuss on next article about what was my goal from a trading system, but now i am going to share about problems i faced on trading strategies with risk and money management and what i learnt from it

1. A trading strategy does not work perfect with a single order entry and exit

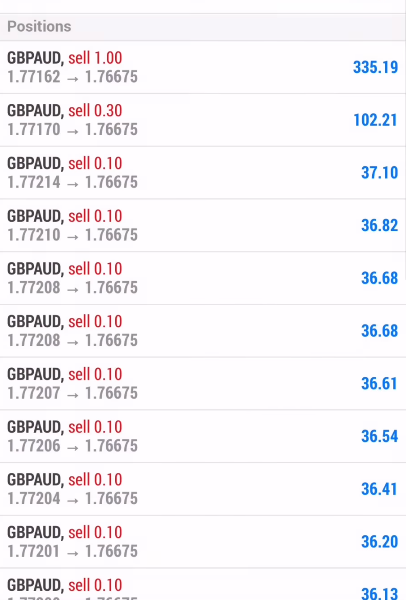

I saw various videos on Youtube where traders scatter their order with 1 lot but they do not place a single order, I scratched my head why not place all orders one time? It is because it helps them with managing risk

First of all i denied this concept and found it too complex, but later after failing many times, i found this is the only method which helps with more accuracy. It is always possible that price may go agaisnst your perfect level. Even you have 98% accuracy on your system, that 2% time failure will demotivate you and with big capital, there is chances of having big demotivation when you lose money

So Finally i accepted this method and it helped me exit a failed trade cost to cost and made my decision making insight more powerful at live market.

2. A trading strategy does not work with fixed inputs

If it was possible that i found a working strategy, i could have created an EA and i would be making money while sleeping, but its not easy. I will explain you why. When i manually traded a strategy for 3 months, I grown my account, but what i learned form it it will amaze you. I found that a strategy's parameter keep adjusting based on some undefined statistics which i dont know. on week 1 testing, everything worked perfect but on week 2 TP was not hitting, despite a reversal from my levels. This made my account lose some money temporarily. Due to overconfidence on my system, I did not modify anything on my strategy but on every trade on every symbol, my TP was not being hit. I explored and found that TP was being missed and it was reversing 25% early from my main TP. Once i lost 17% of capital, I adjusted this 25% change and all was fine and account started to grow again. This taught me that Algos in market keeps shifting its parameter from time to time due to some reason and a trader is required to follow that too.

Its very stressful to backtest a system manually which can not be automated or if you lack skills to automate it or if you think its going to take too much time or effort to automate it.

But when you are manually trading a semi automated system and it stopped giving profit in few weeks of use, then you think what is wrong. The answer is you need to keep back testing every week and adjust parameter based on market behavior. Its a very slight modification which may be needed. For example : i given example of TP being missed and reversed 25% early so modification was easy for me,

3. A trading strategy needs a breathing area on stop loss

Sometime trader mistakes by adding SL very close but this is not a good practice, I advise to reduce lot size and add SL far away which is rare to be hit because price mostly slips, even on perfect levels, which some trader call a scenario of SL Hunting