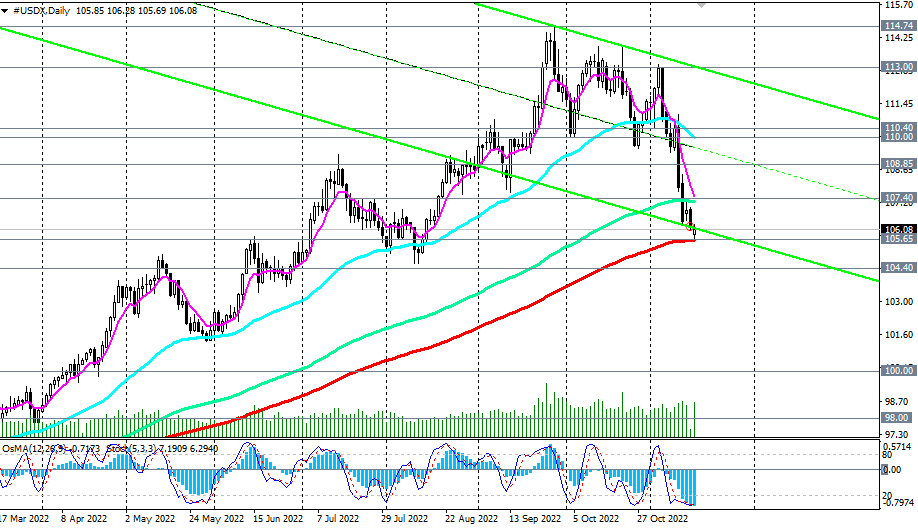

The dollar, and with it its DXY index, remain under the negative impression of the publication last week of weaker-than-expected US CPI indices. If next month the consumer price index will bring another surprise, indicating a downward trend in inflation in the United States, then the next increase in the Fed's interest rate will not be +0.75%, but +0.50%, and maybe +0.25%

From a technical point of view, a breakdown of the support levels 105.65 and 104.40 will open the way for the dollar index towards the values 100.00, 99.00, 98.00. In an alternative scenario, a breakout of the resistance level 107.40 will be the first signal for the revival of the bullish dynamics of the dollar and CFD #USDX, and a confirmatory breakout of the resistance level 108.85. The next growth target after that is the resistance levels 110.00, 111.00.

*) for the most important events of the week, see the Most important economic events of the week 11/14/2022 – 11/20/2022

Support levels: 105.65, 105.00, 104.40

Resistance levels: 107.00, 107.40, 108.00, 108.85, 109.00, 110.00, 110.40, 111.00

- see details -> https://www.instaforex.com/ru/forex_analysis/327327/?x=PKEZZ

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading