Description of superbot parameters.

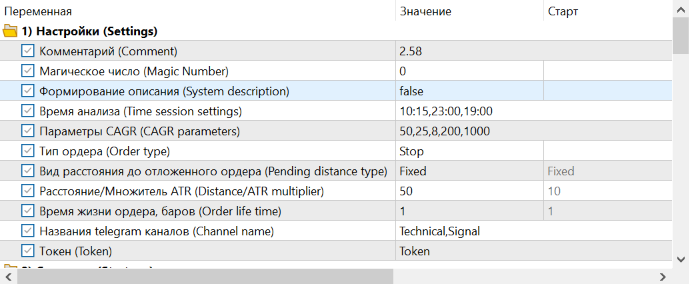

Block #1: Settings

| Parameter | Description |

|---|---|

| Comment | Text note that is duplicated in each transaction |

| magic number | Numerical label with which the robot marks its trades |

| Description formation | If true, a text description of the strategy is generated during a single test. Works only in the paid version. |

| Analysis time | Temporary restrictions on the work of the robot. In the example, "10:15,23:00,19:00", 10:15 is the start time, 23:00 is the end time, 19:00 is an ignored time (multiple entries can be separated by commas). |

| CAGR parameters | CAGR - compound annual growth rate (average annual return taking into account reinvestment). Used when optimizing based on a custom criterion. In the example " 50,25,8,200,1000 " 50 - yield in %, 25 - maximum drawdown in %, 8 - number of years, 200 - minimum number of trades, 1000 - maximum number of trades |

| Order type | market - market, stop - stop order, limit - limit order |

| Type of distance to a pending order | fixed - a pending order is placed at a fixed distance in points, ATR - distance is calculated as a fraction of the ATR(14) value on the daily timeframe |

| Distance/ATR multiplier | Distance in points to a pending order or share of ATR(14) on a daily timeframe |

| Order lifetime, bars | The lifetime of a pending order in bars. After the appearance of the bar corresponding to the account, the order is deleted if it did not work |

| Names of telegram channels | In the first place, the name of the technical channel is indicated (it receives information about the triggering of stop trades, updating the account maximum, and when the profit factor of individual strategies decreases), the second one indicates the name of the signal channel (information about transactions will be sent to it) |

| Token | The telegram bot token is indicated |

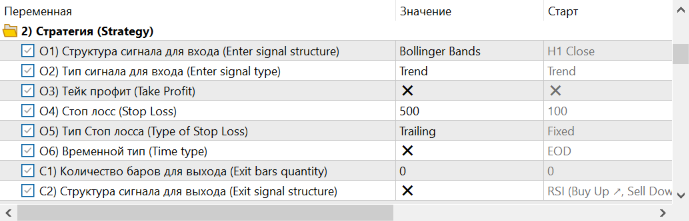

Block #2: Strategy

| Parameter | Description |

|---|---|

| O1) Signal structure for entry | The price or indicator is selected, which will form a channel for generating a trading signal |

| O2) Entry signal type | trend - trendy (during the breakdown, we trade in the direction of the breakdown), reverse - reverse (we trade against the breakdown), back reverse - reverse reverse (we trade in the direction of return inside the channel), Pullback - trade against the return inside the channel, Shot - trade against the prick of the shadow of the level candle |

| O3) Take profit | The size of the take profit in fractions of the stop loss. If x - not used, Partial 3/1, Partial 2/1 - partial closure |

| O4) Stop loss | Stoploss size in points if type is selected Fixed or Trailing |

| O5) Stop loss type | Fixed - fixed in points, Trailing - trailing in points, ATR Fixed - fixed based on daily ATR(14), ATR Trailing - trailing based on daily ATR(14), SAR Trailing - trailing based on Parabolic SAR |

| O6) Temporary type | EOD - intraday strategy, EOW - intra-week strategy, X - strategy is not limited in time |

| C1) Number of bars to exit | Trade lifetime in bars. If 0, then not active |

| C2) Signal structure for output | Selecting a signal for closing a deal and deleting pending orders |

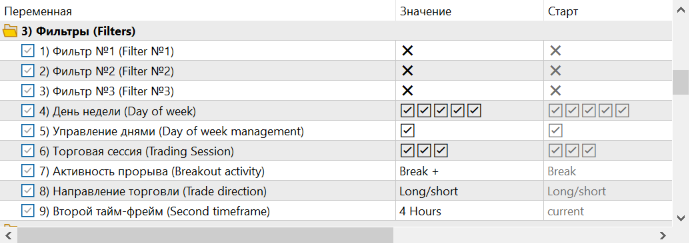

Block #3: Filters

| Parameter | Description |

|---|---|

| 1) Filter #1 2) Filter #2 3) Filter #3 | Selecting a filter from the list |

| 4) Day of the week | [v][v][v][v][v] - 5 days of the week. If [V] - day selected, X - not selected |

| 5) Day Management | If [v] - trade only on selected days, if X - do not trade on selected days |

| 6) Trading session | [v][v][v] - the robot session is divided into 3 parts. For example [v]XX - the robot opens a deal in the first third of the session |

| 7) Breakout Activity | Break - trade only breakout, Break+ - torugem and breakout and position relative to the level (works for trend and reverse signals) |

| 8) Direction of trade | long/short - both purchases and sales, Long - shopping only short - sales only |

| 9) Second time frame | Additional time frame for technical indicators of the strategy |

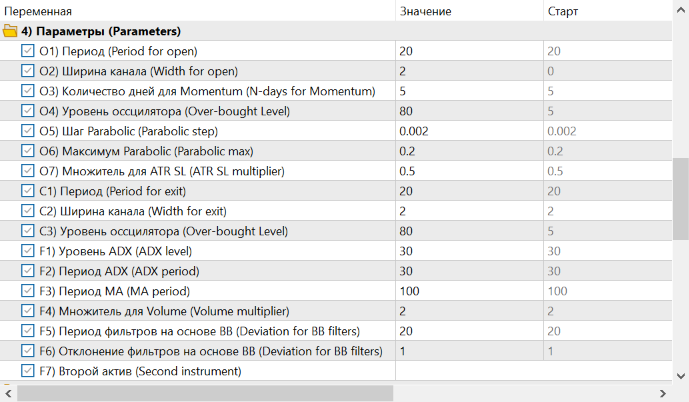

Block #4: Parameters

| Parameter | Description |

|---|---|

| O1) Period | Period in bars for indicators that generate a signal to open a position |

| O2) Channel width | Channel width for ATR based channels + this is the standard deviation for Bollinger Bands + this is the price difference in % for the Momentum signal |

| A3) Number of days for Momentum | Number of days to generate a signal based on momentum |

| O4) Oscillator overbought level | Overbought level for WPR, CCI, RSI indicators to open a position |

| O5) Step Parabolic | Parabolic step for signal generation and stop loss |

| O6) Maximum Parabolic | Maximum Parabolic for signal generation and for stop loss |

| O7) Multiplier for ATR SL | Stop loss multiplier based on daily ATR(14) |

| C1) Period | Period in bars for indicators that generate a signal to close a position |

| C2) Channel width | Standard Deviation of Bollinger Bands to close a position |

| C3) Oscillator Overbought Level | Overbought level for WPR, CCI, RSI indicators to close a position |

| F1) ADX level | ADX filter level |

| F2) ADX period | ADX filter period |

| F3) MA Period | Period for SMA, EMA, SMMA, LWMA, TEMA, DEMA, FAMA filters |

| F4) Multiplier for Volume | Multiplier for the Volume filter. For example, if 2 is specified, then the volume on the candle on which there was a breakdown should be 2 times larger than on the previous one. |

| F5) Filter period based on BB | Period for filters BB flat, BB trend |

| F6) Filter rejection based on BB | Filter deflection BB flat, BB trend |

| F7) Second Asset | If you specify the name of an additional asset, then the filters will analyze the data not of the main asset, but of the secondary one. |

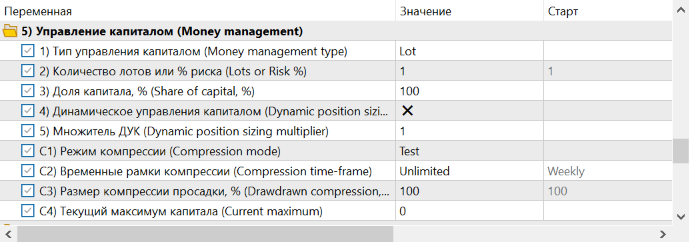

Block #5: Money Management

| Parameter | Description |

|---|---|

| 1) Type of money management | lot - the robot trades with a fixed volume, risk - volume is calculated based on risk in % |

| 2) Number of lots or % risk | Volume value in lots or % risk |

| 3) Share of capital, % | The share of capital that the robot can use. For example, if 50 is specified, then with a capital of 100,000 rubles, the robot will use only 50% * 100,000 = 50,000 rubles for risk-based volume calculation |

| 4) Dynamic money management | If a X - not used, Filters - to calculate the position volume, filters are used based on indicators and price patterns, DOW - the DOW filter (days of the week) is used to calculate the position volume |

| 5) DUK multiplier | How many times the volume increases if the filter confirms the trading signal |

| C1) Compression mode | test - automatic volume calculation (for testing), Real - for manual control (for real account) |

| C2) Compression timing | Weekly - weekly scale (volume is restored at the beginning of the week), Monthly - monthly scale (volume is restored at the beginning of the month), Unlimited - unlimited (volume does not regenerate on its own) |

| C3) Drawdown compression size, % | Drawdown target value in percent |

| C4) Current capital maximum | The size of the current maximum account for manual control in the mode Real |

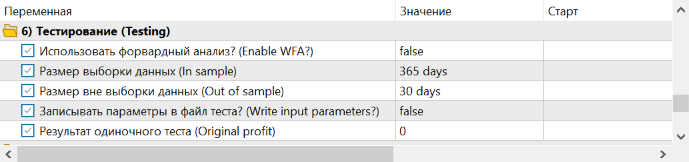

Block #6: Testing

| Parameter | Description |

|---|---|

| Use forward analysis? | true - turn on test mode, false - disable |

| Sample window size | IS window size (In sample) |

| Window size outside the data sample | OOS window size (out of sample) |

| Write parameters to test file? | If true, then the parameters that were received during reoptimization will be added to the report file |

| Single test result | Specifies the result of a single test in the tester to compare the result after the test with the original result |

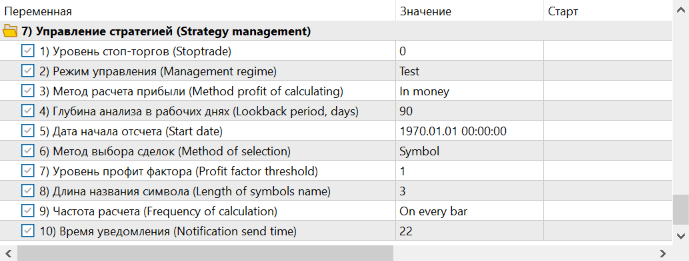

Block #7: Strategy Management

| Parameter | Description |

|---|---|

| 1) Stop level | The amount of capital below which trading stops |

| 2) Control mode | When "Test" the calculation of the profit factor is not carried out (for testing), Real - is carried out (for real trading) |

| 3) Profit calculation method | in money - trailing profit is calculated in money, in pips - in points |

| 4) Depth of analysis in working days | Depth of account history analysis for calculating the moving profit factor in working days |

| 5) Start date | The date from which the analysis of the trading history will start. Necessary when changing strategy |

| 6) Deal selection method | symbol - by instrument name, Magic number - by magic number |

| 7) Profit factor level | The level of the profit factor, when crossing from top to bottom, a signal will be given about the need to replace or re-optimize the strategy |

| 8) Symbol name length | The length of the name of the trading symbol (for the futures market) for the robot to monitor futures of the same underlying asset with different expiration dates |

| 9) Calculation frequency | On every bar - the moving profit factor will be calculated on each bar, On friday - only on Fridays at the set time (see below) , On every day - every day at the set time (see below) |

| 10) Notice time | Time (server) at which the moving profit factor of the strategy will be calculated |