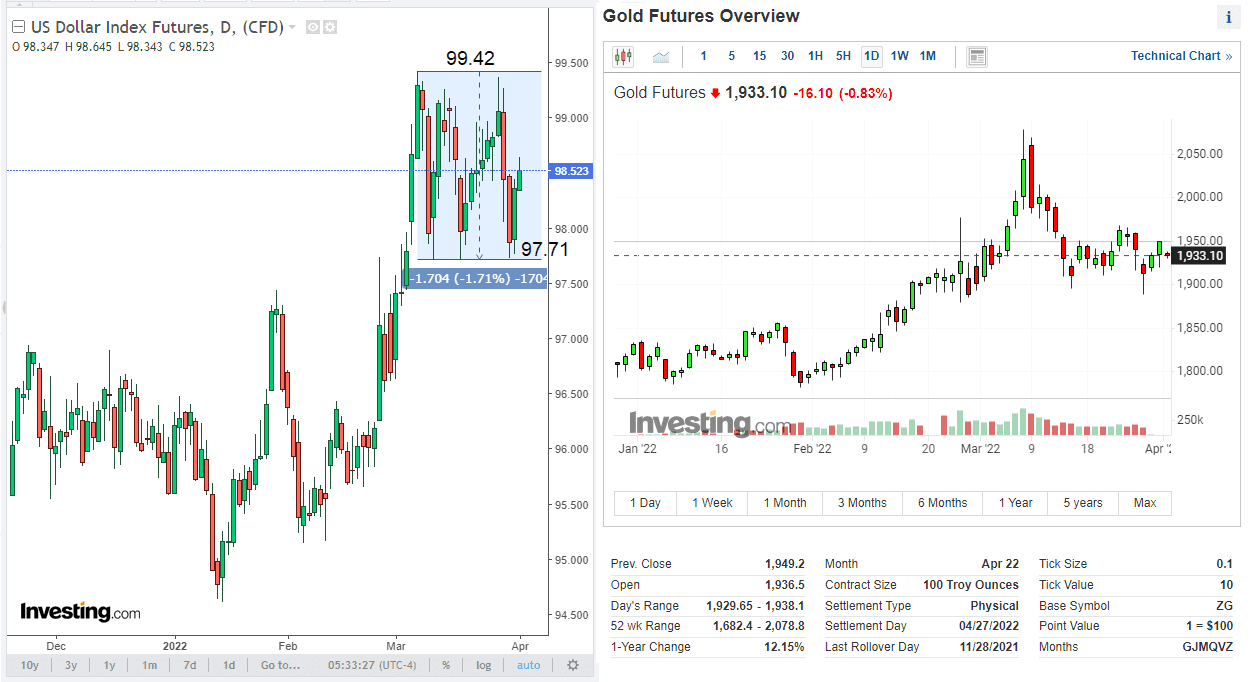

The demand for the dollar as a defensive asset is growing again. Today, the DXY dollar index is growing for the second day in a row. At the time of this writing, DXY futures are traded near 98.53, 80 points above the low reached on Tuesday, when Russian-Ukrainian negotiations ended. The topic of the military conflict in Ukraine remains the main driver of the financial market, while inflation continues to accelerate against the backdrop of rising energy prices.

However, the publication of important economic indicators also continues to be one of the drivers in the financial market. Today, the unconditional focus of market participants will be the publication (at 12:30 GMT) of the official monthly report of the US Department of Labor with data on employment in March. Economists expect wages to rise, jobs to rise by 490,000 and unemployment to fall another 0.1% to 3.7%. These are very strong indicators that should reinforce the market's view that the Fed is determined to tighten its monetary policy, since labor market data (along with inflation and GDP data) are key for the Fed when planning its policy.

If the US Department of Labor data published today coincides with the forecast or turns out to be better than it, then the dollar is likely to strengthen, as the likelihood of a tighter monetary policy by the Fed will increase. As for gold and the XAU/USD pair, you still need to be careful when planning your trade.

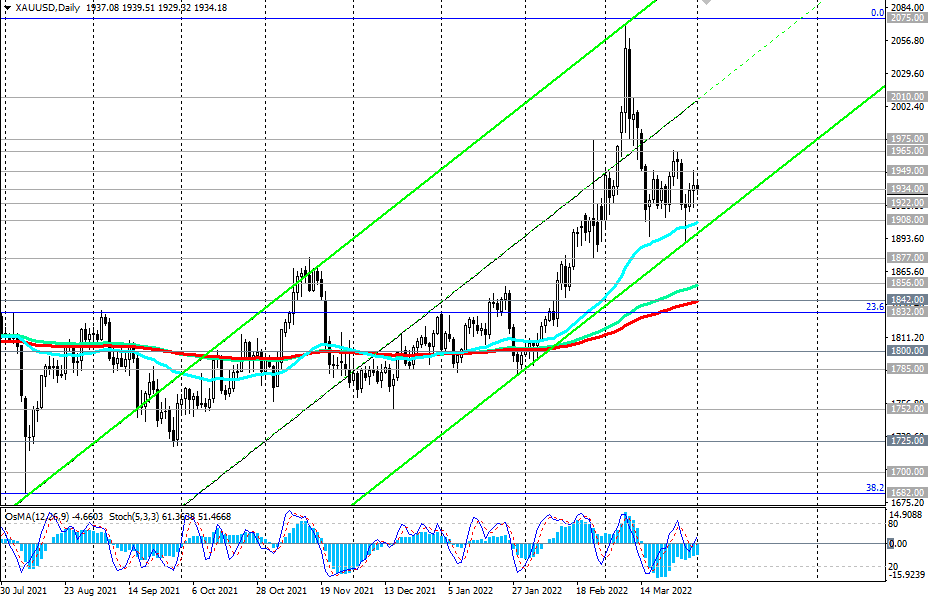

At the time of writing this article, the XAU/USD pair is trading near 1934.00 mark, through which an important short-term support level is passing. Its breakdown may cause the beginning of a downward correction with targets at the support levels of 1922.00, 1908.00.

A deeper correction is unlikely. XAU/USD remains in the bull market zone, moving in ascending channels on the daily and weekly charts. In the current situation, long positions look preferable.

A strong upward momentum prevails. Investors see gold as a hedging and store of value tool, protecting their investment from a variety of risks. The prevailing negative fundamental background on the market creates preconditions for further growth of gold quotes.

Support levels: 1934.00, 1922.00, 1908.00, 1900.00, 1877.00, 1856.00, 1842.00, 1832.00, 1800.00

Resistance levels: 1949.00, 1965.00, 1975.00, 2000.00, 2010.00, 2070.00, 2075.00

*) See also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD