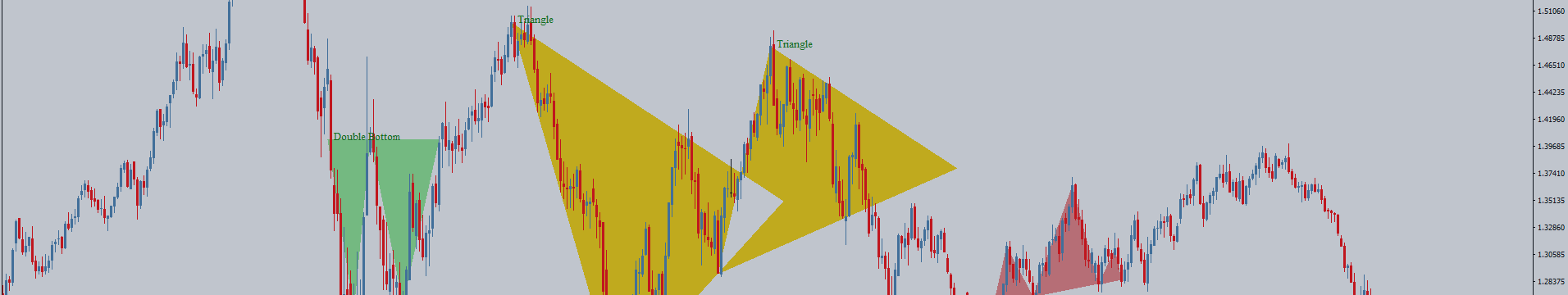

With the advent of technical analysis, zones in which the price behaves in the same way over time have become visible on the charts. These zones began to stand out and be noted. Later, with a zone that was seen earlier on the chart, analysts already knew how price might behave in that zone. This is how the first patterns appeared, that is, price patterns in the Forex market. They are named so because of the similarity with geometric shapes: a triangle, a cube, a rhombus. Over time, clear rules were written for each formation, thanks to which graphical analysis appeared. Now, as before, patterns are used for forecasting. And this is the most accurate element of graphical analysis. It is necessary to find a pattern on the chart and, if it is implemented, it will open a deal and make a profit.

Various trading strategies Forex chart patterns can be built on the basis of the patterns.

Patterns or patterns are groups of candles that form a pattern on a chart. Each pattern tells us how the market should develop in the future. Patterns are used for various strategies in binary options trading as well as in Forex trading. These are the main ones.

A hammer

A pattern that forms at the end of a decline, a long wick, shows us that sellers first pushed the price down and then pushed it up again. If you see the Hammer pattern, then the price should increase.

Hanged

The pattern is the opposite of the Hammer pattern, after the rise, the price bounces back. You need to wait for the next candlestick, which should confirm the price drop.

Shooting Star - Black

Occurs after an increase, a decline in price is expected.

Inverted Hammer - White

Occurs during a recession, the price is expected to rise.