While the British Parliament declares that the quantitative easing program poses a danger, and two members of the Monetary Policy Committee of the Bank of England argue that it is time to discuss the QE rollback, the GBP/USD quotes are falling to a 3-month low. Isn't it a paradox against the backdrop of the hawkish rhetoric of legislators and the Central Bank? I don't think so. Not all variables are taken into account in the exchange rate equation. In particular, the trump cards of the US dollar remained behind the scenes.

According to the House of Lords Economic Affairs Committee, the harm of the quantitative easing program lies in the enormous debt that the BoE has formed, and in the increased risks of increasing the cost of servicing it if the Central Bank has to raise rates in the fight against accelerating inflation. Indeed, consumer prices have already increased by 2.5% and, according to Sir Dave Ramsden, may exceed the Bank of England's forecast of 3% at the end of the year, so it's time to normalize monetary policy. Another MPC member, Michael Saunders, echoes him, arguing that QE will fuel inflation expectations if the rapid economic growth in Britain continues.

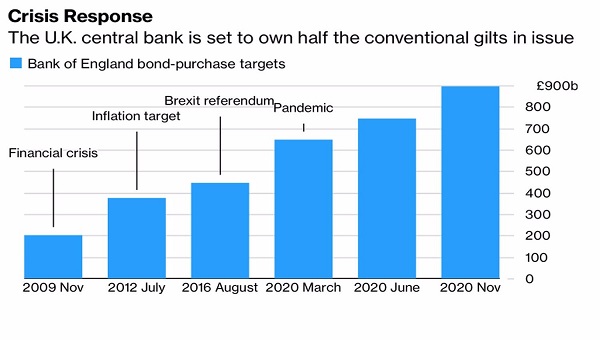

Dynamics of the British quantitative easing program

Indeed, according to the forecasts of Reuters experts, GDP will expand by 2.5% in the third quarter, which is slightly better than in the previous June estimate (+2.4%). In the fourth quarter, the economy will grow by 1.4% QoQ. The reason for fears about a further acceleration of inflation is also a sharp increase in wages for three months, including May, by 7.3% YoY. Although these figures were greatly distorted by the number of dismissed workers, nevertheless, the basic indicators of wage inflation show its growth by 3.9%-5.1%, taking into account bonuses, and by 3.2%-4.4% without taking them into account. Employment in June jumped by 356,000, the number of vacancies increased by 7% MoM, to a record 962,000.

Dynamics of vacancies in Britain

If the economy is doing well, and BoE has hawkish rhetoric, why should the pound not strengthen? Out of the nine members of the Monetary Policy Committee, only two are among the supporters of the removal of monetary incentives. Parliamentary interference in BoE activities can be regarded as a political risk, and Boris Johnson's decision to open the economy amid a worsening epidemiological situation is a game with fire.

Let's not forget about the return of investor interest in the US dollar. The American currency is strengthening against its main competitors amid unrestrained growth in inflation in the United States, which increases the risks of raising the federal funds rate in 2022. As the X hour approaches - the date when the tapering of QE will be announced - the USD index has good chances to continue the rally on rumors about this event.

Technically, the GBP/USD pair is ready to renew the corrective low within the 1-2-3 pattern, which will open the way for it down in the direction of 1.349 and 1.332. We hold short positions formed on the breakout of support at 1.3825 and increase them on pullbacks.

GBP/USD, Daily chart

https://www.mql5.com/en/signals/1065622