Last Thursday, EU and UK Brexit negotiators were still able to settle the final issues on a trade agreement that would allow the UK to leave the EU without tariffs on goods produced in the UK or EU. Fisheries laws will be reviewed annually and the UK will provide a transitional period of 5 and a half years to develop new rules on this issue.

The pound is definitely getting support from the positive Brexit news. The publication last week of the final estimate of the UK GDP for the 3rd quarter also had a positive effect on the pound quotes. British GDP growth in the third quarter of 2020 amounted to 16.0% against the forecast of +15.5% and a fall of -19.8% in the previous quarter. On an annualized basis, the indicator was -8.6% against the forecast of -9.6% and -21.5% in the 2nd quarter.

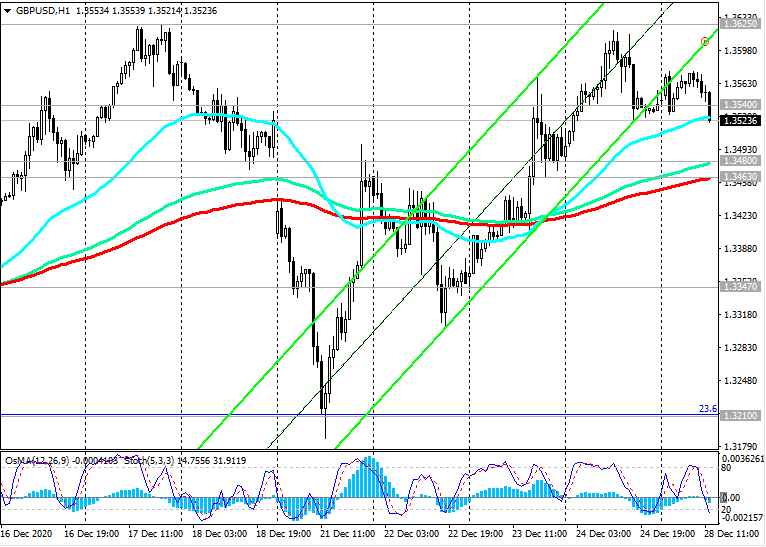

Meanwhile, the pound is weakening, and the GBP / USD pair is declining at the beginning of today's European session, traded near the 1.3520 mark at the time of publication of the article, declining towards the nearest support levels 1.3480, 1.3463 (see "Technical Analysis and Trading Recommendations").

The trade agreement between the UK and the EU will begin to be implemented upon preliminary application, but will still need to be approved by both parties in parliaments after January 1, and new surprises are not excluded here.

Today and tomorrow the publication of important macro statistics in the economic calendar is not planned. In the last week of the year, which will also be short and poor in economic news, market volatility may rise again on news about Brexit and the US stimulus package. Positive news on these issues is likely to have also positive impact on the markets and, accordingly, additional pressure on the dollar.

*) for trading, I choose THIS BROKER and use VPS (to receive a bonus, enter the promo code - zomro_17601)