Current dynamics Nasdaq 100 FUNDAMENTAL AND TECHNICAL ANALYSIS for 24.09.2020

Dear friends, let's stay in touch

In order not to miss the following market overview, as well as to be aware of the news of the project SeniorTrder 🤝 add me in friends list in mql5 and Subscribe to our telegram channel 👉Telegram Channnel https://t.me/SeniorTrader_Channel

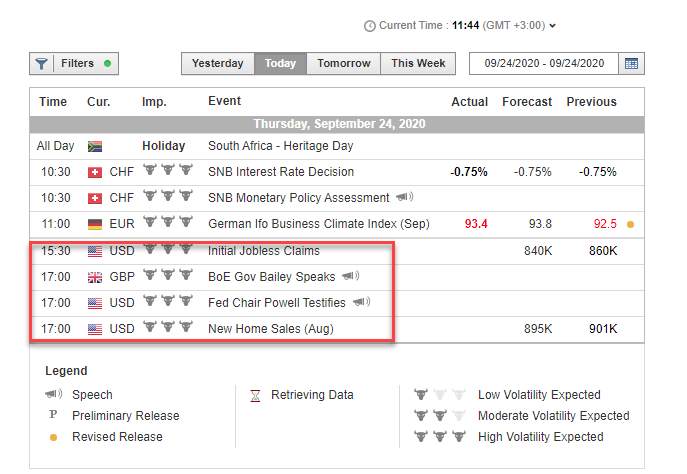

Important news for today

Current dynamics Nasdaq 100

One of the leading US indices, the Nasdaq 100, continues to correct downward, trading at 10770.0.

Most analysts agree that the protracted fall of the leading US tech index is largely due to technical reasons. Despite the fact that there are concerns in the markets about an increase in the growth rate of cases of COVID-19, the fundamental background remains favorable. The largest US companies continue to publish positive reports. Yesterday, Nike Corporation reported a nearly double quarter-on-quarter revenue growth of $ 10.59 billion from $ 6.31 billion in the prior period. Profit of Cintas Corp. Reached $ 1.75 billion, which exceeded analyst expectations of $ 1.69 billion.

Most of the components are declining, and among them stand out: Tesla (-10.34%), Align (-4.42%), Pinduoduo (-4.25%) and Apple (-4.19%). The biggest gains were made by Western Digital (+ 6.72%), Zoom Video (+ 1.61%), Lululemon Athletica (+ 1.01%) and Micron (+ 0.30%).

Support and resistance levels

The index quotes continue to trade within the global ascending channel and are correcting downward, breaking the initial retracement level of 23.6% Fibonacci. Technical indicators turned around and gave a sell signal. On TF H4, H1, M30 there is a downtrend, on TF D1 200 MA the uptrend is still preserved.

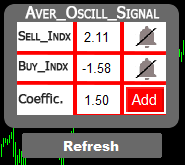

Overbought / oversold iPump indicator shows

- overbought 0.69%

although the average value after which there were price reversals was 2.11%

Therefore, to sell along the trend, you need to wait for the price to rise to values of about 2%.

Resistance levels: 11050.0, 12400.0.

Support levels: 10650.0, 10230.0.

And at this the review came to an end. I wish you profitable trades, remember that your success should not depend on any one trade, you need to try to be in the black at the distance, and for this it is enough to earn only 3 out of 10 trades, how? - your reward to risk ratio should be more than one to three. Therefore, always remember about the 📈

risk (use EasyTradePad for easy calculate risk and placing orders) , consider it correctly and then your trading will be successful! Wish you a successful trading day your SeniorTrader.

In order not to miss the following market overview, as well as to be aware of the news of the project SeniorTrder 🤝 add me in friends list in mql5 and Subscribe to our telegram channel 👉Telegram Channnel https://t.me/SeniorTrader_Channel

Tools that I use in trading

Easy Trade Pad

Free version https://www.mql5.com/en/market/product/54895 (work only EURUSD)

Full version https://www.mql5.com/en/market/product/47587

iPump indicator

The iPump indicator was used for this analysis

https://www.mql5.com/en/market/product/39895

Indicator defining the trend, levels, overbought / oversold

EA Pump and Dump Pro

EA Pump and Dump Pro -multifunctional Expert Advisor using trading tactics - buying in areas of strong oversold, selling in overbought areas.

https://www.mql5.com/en/market/product/51395

https://www.mql5.com/en/market/product/51395

Using averaging and piramiding strategy for overclocking a deposit.

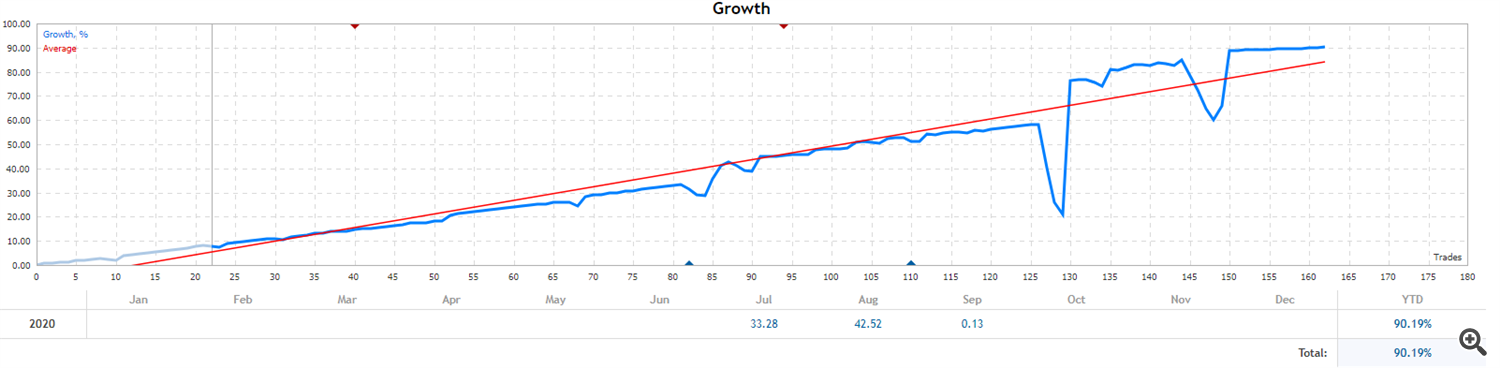

EA Long Term Strategy

https://www.mql5.com/en/market/product/35069

Trading strategy with fix stop loss ( safe strategy).

The entry point is looked for based on several indicators using trend control.

#Nasdaq 100 24.09.2020 Fundamental and Technical Analysis