Fundamental analysis of major currency pairs and gold for 07.09.2020

For this analysis I use iPump indicator

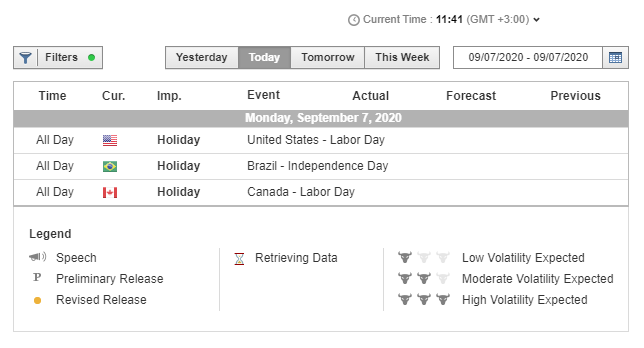

Important news for today

No major news is foreseen therefore the market may be slippery.

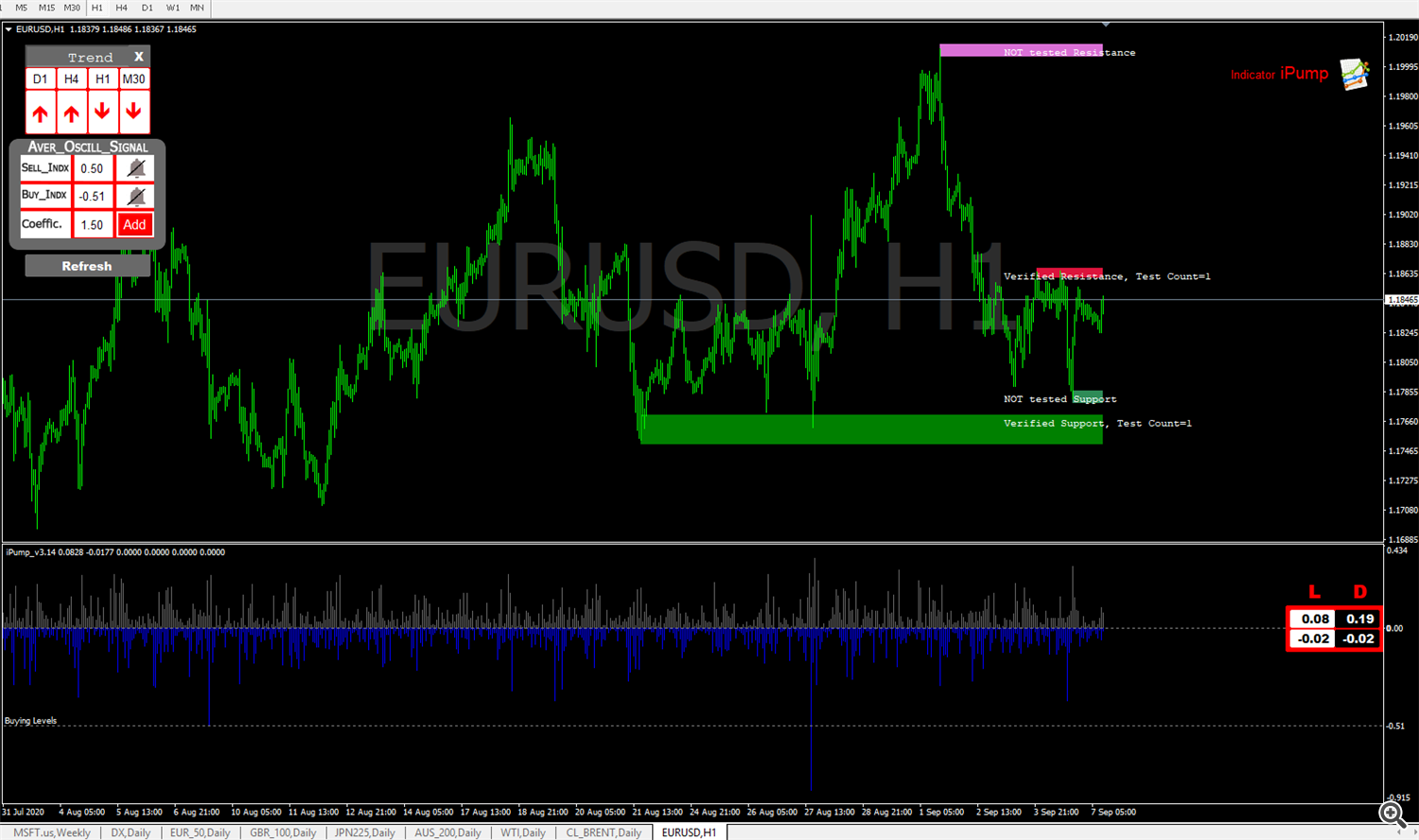

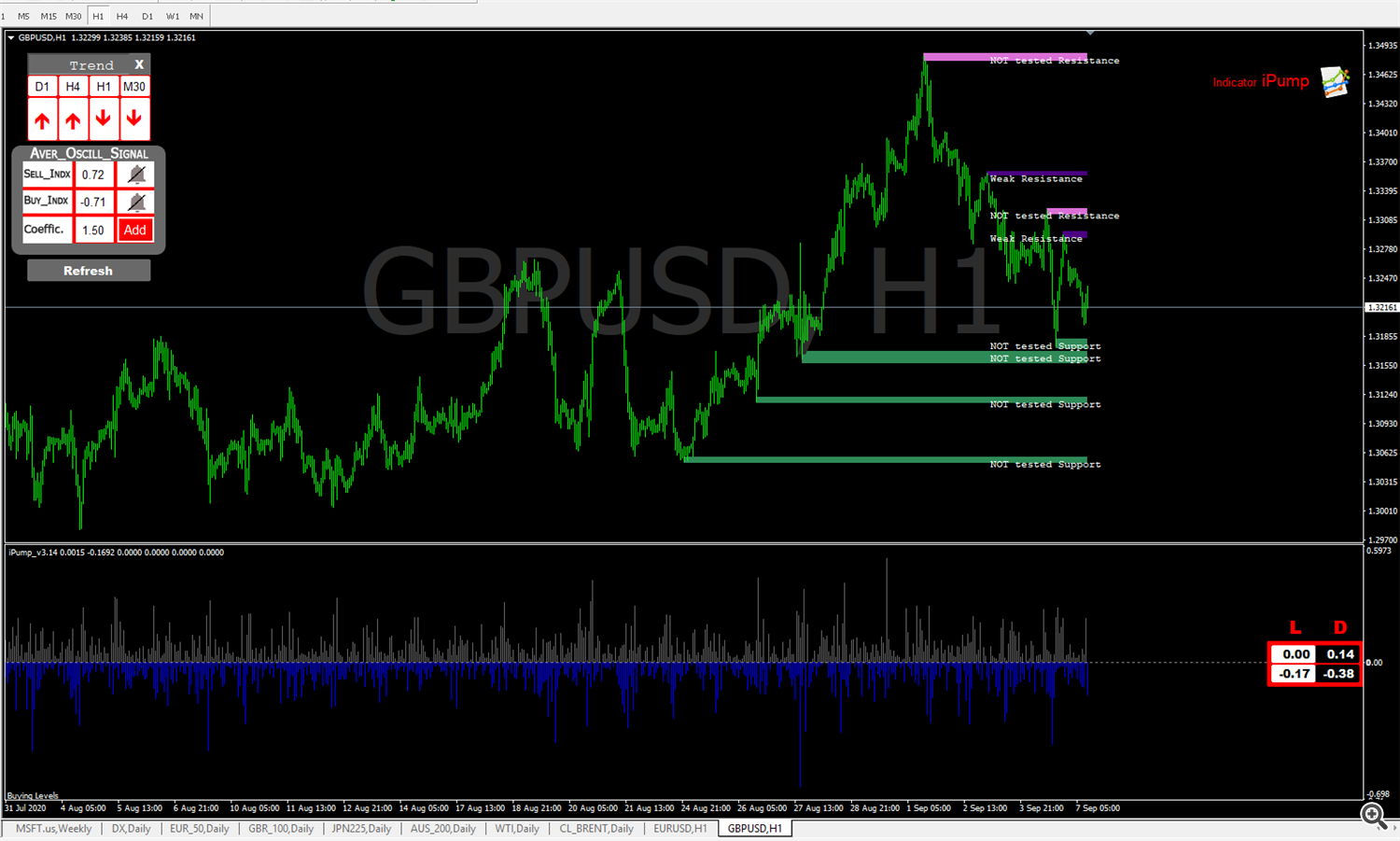

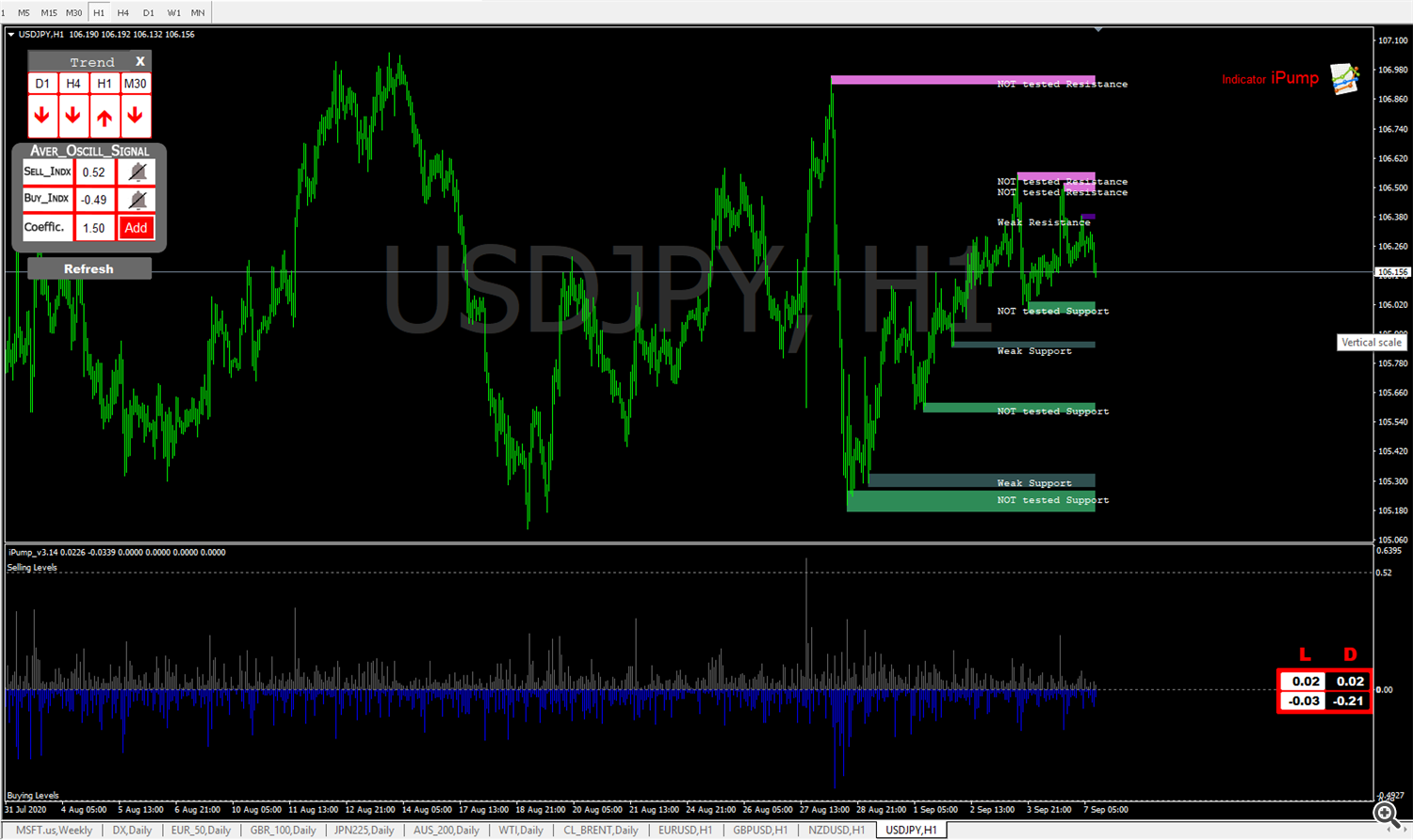

EUR / USD

The European currency is trading slightly lower against the US dollar during today's Asian session after the multidirectional dynamics of the end of last week. Let's remind that on Friday the dollar received support against the background of a sharp drop in quotations on the American stock market. However, with the emergence of ambiguous macroeconomic statistics from the United States, the advancement of the American currency stopped, and by the close of the Friday session, the euro was able to win back most of its losses. Anyway, the published report on the US labor market reflected an increase in the number of new jobs outside of agriculture by only 1.371 million, which was worse than market expectations of 1.400 million jobs. The last report showed an increase of 1.734 million seats. At the same time, the unemployment rate in August fell sharply from 10.2% to 8.4%, which turned out to be much better than the forecasts of a decrease to 9.8%.

The New Zealand dollar is showing mixed trading dynamics against the US currency during today's Asian session, consolidating near the 0.6700 mark, to which the instrument retreated late last week. The US labor market report released on Friday had an ambiguous impact on the instrument's dynamics, but once again emphasized the urgent need for new measures of government support for the American economy. The number of new jobs in August fell sharply from 1.734 million to 1.371 million, which was slightly worse than market forecasts of 1.400 million. At the same time, the rest of the market indicators were very positive. Thus, the average hourly wage in August rose by 0.4% mom, while the unemployment rate fell sharply from 10.2% to 8.4%. Statistics from China provide some support to the instrument on Monday. Export volumes in August increased from 7.2% y / y to 9.5% y / y, which turned out to be much better than market expectations at 7.1% y / y.

The US dollar is trading mixed against the Japanese yen during today's morning session, testing 106.30 for a breakout. The American currency recorded a moderate growth against the Japanese currency at the end of the last week and managed to renew its local maximums since August 28. At the same time, the published controversial report on the US labor market, as well as a sharp collapse of quotations on the US stock market contributed to the recovery of demand for safe assets, which provided some support to the yen. There will be quite a few interesting macroeconomic statistics today, but on Tuesday Japan will publish a large data block, the central place in which will be occupied by updated statistics on GDP dynamics for the 2nd quarter of 2020. The figure is expected to be revised downwards from -7.8% q / q to -8.1% q / q.

Gold prices are slightly increasing during today's Asian trading session, recovering from the bearish end of last week, as a result of which the pair managed to update local lows since August 27. The report on the US labor market, released last Friday, briefly supported the position of the American currency, reflecting a further recovery in the number of jobs in the country. At the same time, the indicators of the number of new jobs again came out worse than market expectations, which is partly due to the inability of US lawmakers to decide on new measures to support the national economy. Today, US trading floors are closed for Labor Day, so the instrument is likely to attempt corrective gains.

Tools that I use in trading

The iPump indicator was used for this analysis

https://www.mql5.com/en/market/product/39895

Indicator defining the trend, levels, overbought / oversold

EA Pump and Dump Pro

https://www.mql5.com/en/market/product/51395

Multifunctional robot (averaging/piramiding/strategy for overclocking a deposit)

EA Long Term Strategy

https://www.mql5.com/en/market/product/35069

Trading strategy in the EA Long Term Strategy (fix stop loss, safe strategy)

#EURUSD #GBPUSD #NZDUSD #USDJPY #XAUUSD 07.09.2020analysis