(09 FEBRUARY 2019)WEEKLY MARKET OUTLOOK 1:BoE Joins Ranks Of Dovish Central Banks - Peter Rosenstreich

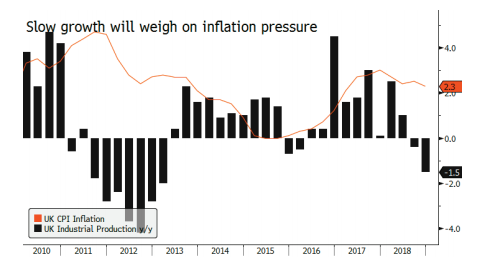

The Bank of England (BoE) joined a growing list of central banks shifting gears towards a dovish stance. Following high profile adjustments at the Fed and ECB, the BoE indicated that Britain is now confronted its weakest economic growth in 10 years. The slowdown, in the BoE view, was due to Brexit- related uncertainty and the global slowdown. The members stated “softer activity abroad and the greater effects from Brexit uncertainties”. In regards to inflation forecast “decline to slightly below” the 2% target in the near term, due to “the sharp fall in petrol prices”. A primary rationale sustaining the BoE’s inflation view has been the margin of spare capacity in the economy. The newest assessments indicated that output gap disputed near the end of 2018. This should trigger concerned over higher inflation, however, slowdown has postponed those conversation (potentially reopening output gap). The BoE meaningful downgraded its 2019 outlook lower growth projections at 1.2% against 1.7% in November. 10-year British sovereign bond yield fell to its lowest level so far this year at 1.158% reflecting the BoE’s weaker outlook. However, despite clear dovish data re-adjustments, the message from Carney & Co. was that should a hard Brexit be avoided interest rates would increase. Consequently, BoE stated “an ongoing tightening of monetary policy over the forecast period, at a gradual pace and to a limited extent, would be appropriate.” However, in our view this is an untenable position and an all-in-bet “soft” or no Brexit. By avoiding the Brexit question (generating current short-term volatility), and focusing on macro headwinds, weak domestic growth and slow inflation growth indicates the BoE will switch bias and leave rate unchanged for the remainder of the year.

Two key take-aways from the BoE. First is that we further downgrade our outlook for GBP against the Euro and USD. Of course, with the clear understanding we have zero, yes, zero visibility on the eventual outcome of EU-UK relations. Secondly, when global central banks loosen money, which is a growing trend it’s time to get bullish and fill your boots with shares. Loose money has been the primary inflator of asset prices in the last 10 years or longer. Should 2019 see slower economic growth – but easy money – equity prices will rise.

Peter Rosenstreich