Question - Answer ( FREQUENTLY ASKED QUESTIONS ):

-----

-----

A:

First, let's define the difference between Max-Mixed_Hedging and Multi-Currency_BRAIN:

. . .

. . .

Max-Mixed_Hedging (MMH) and Multi-Currency_BRAIN (M-C_BRAIN) these are completely different EAs, and they are different in everything:

- - Used different currency pairs in different ligaments.

- - Logic and trading algorithm are completely different. MMH immediately opens 2 hedging trades, M-C_BRAIN only one, and the second only opens if the first goes to minus. As well as the preservation of all logic throughout the trade inside the ligament.

- - Only direct correlated currency pairs are used in MMH, in M-C_BRAIN both direct correlated and inversely correlated ones are used.

- - Different strategies / trading systems for entering the market work. MMH uses only math calculations, M-C_BRAIN uses math calculations + MovingAverage indicator.

- - The development of a trading algorithm in M-C_BRAIN and its optimization takes into account the strength and direction of movement of each currency individually and for each type of opened position. In MMH, this process is collaborative.

- - With MMH, 6 different sets are provided for trading (these are 24 different Ligaments on 48 currency pairs), M-C_BRAIN has 3 sets (these are 12 different bundles on 24 currency pairs)

====================

So, now difference Multi-Currency_BRAIN between MC_Brain_SYNCHRO:

. . .

. . .

In MC_Brain_SYNCHRO uses a completely different concept for hedging, which is not applied now in any of my EA. For example, the first ligamentin MC_BRAIN-SYNCHRO:

(USDJPY + EURAUD)

Let's say EURAUD (BUY) is open, the next hedge will open on USDJPY (also BUY). And then the market entry will be for these pairs also in the BUY direction, but only if a certain signal is triggered by the movement of the currency (breakdown / rebound). That is, in this EA, all hedging (opening all trades in ligaments) is completely synchronous.

It's may write so:

- Symbol_1_BUY breakout + Symbol_2_SELL rebound

- Symbol_1_BUY rebound + Symbol_2_SELL breakout

- Symbol_1_SELL breakout + Symbol_2_BUY rebound

- Symbol_1_SELL rebound + Symbol_2_BUY breakout

(by different pairs from ligament)

MC_Brain_SYNCHRO is:

- Symbol_1_BUY breakout + Symbol_2_BUY rebound

- Symbol_1_BUY rebound + Symbol_2_BUY breakout

- Symbol_1_SELL breakout + Symbol_2_SELL rebound

- Symbol_1_SELL rebound + Symbol_2_SELL breakout

(by different pairs from ligament)

That is, the currency pairs in each of these EA's work differently and at different times and at different phases of the market. In simple words, if some pair in a bunch in one adviser is in the wait / open mode (that is, there is no signal to open a position), then in another adviser the same pair, but in interaction with another (a completely different ligament), will be in trading mode and vice versa. And most interestingly, the whole hedging algorithm used in these two expert advisors is completely different and even not at all similar!

In fact, it is really difficult to explain / understand - it must be seen in action.

But as I said before, I'm can not saying that the MC_Brain_SYNCHRO is better or worse than Multi-Currency_BRAIN or other of mine EA, it is just a completely different algorithm and approach to hedging using correlation pairs. I will be very interested to see the collaboration of Multi-Currency_BRAIN and MC_BRAIN_Synchro simultaneously on one account.

====================

Now Twin_HEDGE (TH) and Twin_Max-Mixed (TMM):

Both use 6 different sets are provided for trading (these are 24 different Ligaments on 48 currency pairs)

. . .

. . .

This is a completely different type of systems, in which deals, even in a bundle, are completely independent and market entry does not depend on the connecting correlation pair. But hedging is activated instantly when EA open an order for a connecting correlation pair.

Here are the main differences Twin_HEDGE compared to all EA's:

- independent trading of each currency pair

- RSI filter is implemented for more accurate inputs

- multidirectional strategies are used (breakdown - rebound) to enter the market, and if a currency pair is repeated in some set with another pair, then the opposite strategy is applied to it

- positions are not opened in pairs, but regardless of the currency pair in the ligament.

All 8 currency pairs in the set are still divided into 4 ligaments of two in each. But now, each currency pair opens deals regardless of the second one, and it is even possible at any time to close any position manually, if necessary, the logic will not be violated. That is, all market entry are regulated and depend only on the movement of a particular currency pair in which the transaction will be opened.

That is, for example, take the first ligament (EURUSD + GBPJPY), depending on the behavior of currencies, there may be a situation when 3 trades are open on EURUSD, 1 transaction on GBPJPY, and then each currency pair only tracks its movement, but the results are open positions are already combined into a ligament and the total result is summed up by this ligament (basket). And even if 3 EURUSD transactions are negative, and one GBPJPY will cover the entire minus and correspond to the established profit, then all transactions will be closed for profit fixing.

And now Twin_Max-Mixed (TMM) - after the last global modernization (it was in June 2020), this is a generally individual system using logic, trading principles and algorithms that are not used in any of my systems:

- All positions are opened independently, BUT for opening it is taken into account how the connecting correlation pair moves in this ligament. That is, the mathematical calculation of the movement of the currency pair, MovingAverage and RSI for this currency pair AND + the mathematical calculation of the movement of the connecting currency is applied. In addition, multidirectional strategies are used (breakout - rebound), and if a currency pair is repeated in any conjunction with another pair, then the opposite strategy is applied to it.

- Complete freedom and flexibility in trading, not used in any of the products I presented. Now there are no restrictions at all, manual intervention is possible (at the request of the trader), and the trading algorithm will not suffer. Moreover, it is possible to close any deals (both positive and drawdown). ---> Moreover, Twin_Max-Mixed, after any manual intervention, automatically analyzes the situation, monitors all changes and again continues to follow the specified algorithm and strategy, taking into account the changes.

- The uniqueness of TMM is that it uses all 6 sets (this is like Brain and Synchro together), but each set, each ligament uses multidirectional strategies that do not repeat twice for one currency, and this does not allow the system to go into a deep floating drawdown

So far, Twin_Max-Mixed is a favorite of all my systems. :)

-----

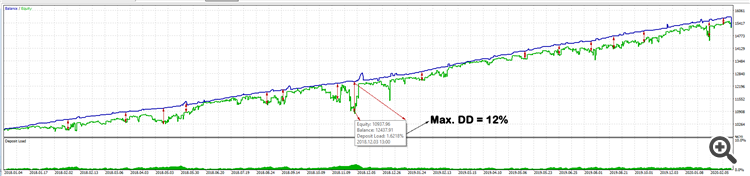

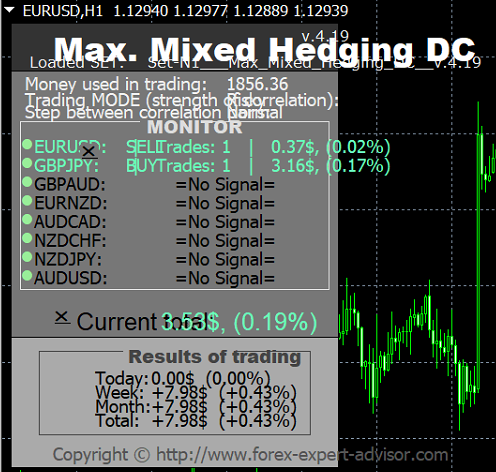

A: Yes, this is normal, because the adviser is almost constantly in the active phase (open trades) and this is very clearly visible from the results of real trading, as well as when testing the adviser in the strategy tester:

Floating drawdown is present almost constantly even when using one set in the trade. And if all 6 Sets (N1, N2, N3, N4, N5, N6) are involved in trading, the floating drawdown will be constant. That is, while some deals enter the hedging phase, others calmly fix profits and so on all the time: some deals are in drawdown, while others are making a profit. That is, at the time of the drawdown, the account is constantly growing. Some bundles can go into deep hedging, but up to a certain point, after which a dead end occurs, in which there is only one way - recovery.

There are trades on my real account that were opened several months ago, but they practically do not affect the result of the trade, because at the time of opening the balance was $ 2,000, now it is $ 4,000.

All indicators such as swap, broker's commission, spread, extensions and others are taken into account when calculating the advisor. These deals will be closed at the expense of their own profit due to the currency reversal, or due to additional orders for this ligament, but with an increased lot size due to an increase in the profitability of the account and, accordingly, an increase in the balance.

I can only say one thing: the longer you will be use any of the hedging EA's I have presented, the less you will worry about your trading and less often look at your account.

2. One more question, do you stop your EAs during the US elections?

3. Most analyst articles claim USD will rise, but EA sells USD against many currencies...

A: I will frankly tell you, I do not watch not what analysts any more long ago - as there is an opinion, if the trader is not able to trade, he becomes an analyst. Also I do not watch a news feed and I in any way react to important news at all and also to other situations in the world. I never turn off EA's, because I know that with any movement, any currency, with any strength and duration of these movements, ---> all trading on the account will be hedged as much as possible.

We just need understand, that it is impossible to foresee everything, to trace all events, news, rates, bonds, etc. The our task to have in an arsenal a system(s) that does not care where the one or other currency pair is moving, --- flat, or a trend now, --- will fall USD, --- or Britain will announce Brentry. It is necessary just to be able to diversify risks.

And I try to implement this concept in the systems and I will do everything possible that this concept works without failures.

A: You can not worry! The system uses professional trading methods and the principle of trading is not built on profit taking over short distances from opening a position. Therefore, such a value as the spread does not affect the trade at all, and when choosing a broker you can not even pay attention to it. The system will work equally well with any spread.

I will even tell you more - even if your broker expands the spread several times (and this happens often, especially before important news) - this also does not affect the trading system. As positions open, all values, such as

- ... spread,

- ... broker commission,

- ... swap

they are immediately recorded by the EA and taken into account when accompanying each trades and when calculating and taking profits.

A: As for the “heavy” - the EA in this regard is not picky, he does not require any specific conditions, works equally well on any type of account of any broker. Also does not need fast VPS and ultra-fast performance or any other specific conditions for trading. The EA also does not depend on the:

- spread,

- requotes (spread expansion)

- quick execution

- gaps

- slippages

- broker commissions

- swaps

A: The question of the cost of an EA is a philosophical question, but few people think about it, but in vain. Here, greater emphasis should be placed on security rather than cost. Everyone is trying to buy cheaper, they want to save, but on what? Want to save on product, that will manage your funds? But this is not the product that is appropriate to compare by cost.

You can buy an EA for $100 and use it in real trading on an account with a balance of $5000, and over time the EA kills the account balance ---> losses and, accordingly, the cost of the EA in this case was $5100.

And you can buy an EA for $2000 to use on the same account with a balance of $5000 and in quiet mode and safely earn 5% per month without the risk of loss of balance. There is no longer difficult to calculate and compare everything - simple mathematics.

When choosing a product to which you will entrust your funds, and which will earn to you without your participation, it is necessary to belong in a complexly and take into account many factors - from the results of the real trading history to support in difficult issues, and not just look at the price and the beautiful curve in strategy tester.

A: In trade, currency pairs with direct/invers correlation are used, and if there is any strong sharp unidirectional movement in one currency, correlated pairs also react to this and thus do not allow the account to go deep into a drawdown.

A: In fact, this is indeed a very complex mechanism, but I will try to explain: A regular grid simply adds orders if the price moves oppositely from open positions and depends only on the grid step. Our systems take into account many factors of interaction between two correlated pairs, and not just from one pair in a opened ligament.

- + That is, additional orders are opened not by one pair, but also in Ligament (two pairs), which interact in combination.

- + The plus takes into account not just the step from the last open position, but all the condition under which the correlation pairs must continue to diverge.

- + Plus the step is calculated taking into account the movement also from each pair in a ligament.

A: Yes EA will be works with US brokers. Any from my EA's will perfect works with FIFO and ESMA rules. Moreover, the settings allow you to use the EA even with a 1: 1 leverage

A: The EA does not open both <BUY> and <SELL> trades on the same symbol at once. Trade is carried out not on one pair, but on different. Therefore, you can not worry, I have a lot of clients who work with US brokers.

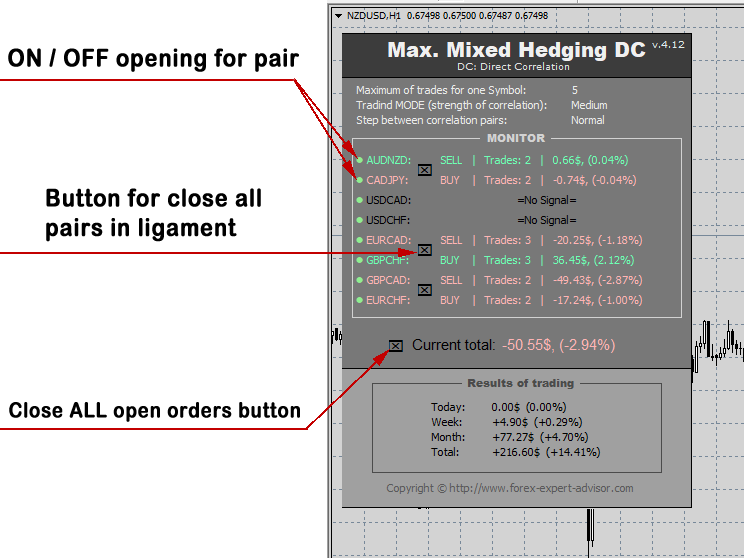

A: As you noticed I added in panel two types of manual closures:

- - closing only orders in a specific ligament (the button is located between pairs in a ligament).

- - close all orders of EA (the button in front of the phrase <Current total>).

But these buttons does not disable the work of the adviser, if a signal arrives, the adviser will entry the market with new orders. If you want the adviser not to open new orders after closing all positions (that is, to pause EA in trading), then before closing all orders, disable trade for each pair (click on the green circle in front of each pair, they will change color to red).

Q: I still have a small issue, the display is bottched for me, is there a way to make the font size smaller?

A: Yes of course, just change font size in setting, click F7 on chart with EA ---> Inputs

and scroll to the end of the settings and there you will find the parameters to changing.

A: At me on it only one answer - you will not receive money from a tester :)

You wondered why there are so many EA's that show millions of dollars when testing in the tester, and with low risk and without drawdowns, but can not do anything like this (repeat) in real trading? I am sure that almost everyone has come across such "grail's".

Therefore, the best tests are the results (history) of real trading! And it should be the results not from the demo account, not from the micro account, and similar types of accounts - these should be the results from a trusted broker, preferably from ECN accounts, which means that all client orders are displayed directly to the liquidity provider without interference from a broker.. Types of all my real accounts are ECN. Such confirmations of the system’s operation are much more convincing than any tests and they can already be trusted, since this means that the system has passed tests under real market conditions, with all broker conditions, including also spreads, requotes, delays, extensions, gaps, news items, force major situations and much, much more.

Here is the dynamics of real trading (not tests), and what you can expect from Multi-Currency_BRAIN + MC_Brain_SYNCHRO trading with the recommend settings:

Monitiring of this Account in real time here: https://www.mql5.com/en/signals/711583

____________________________

Any questions - just contact me.

Sincerely, Stanislau.

Contact me: https://www.mql5.com/en/users/setslav (Click: Send message)