GBP/USD: Trading scenarios. Brexit remains the main factor

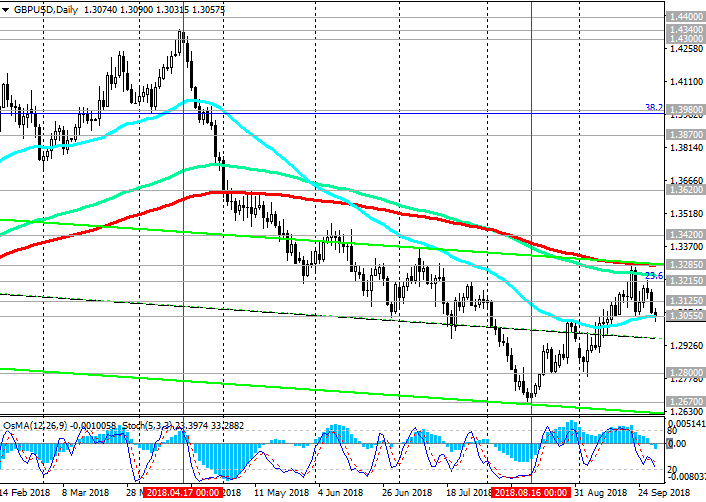

The GBP / USD was still unable to break through the key resistance level 1.3285 (EMA200, EMA144 on the daily chart) and again declining, returning to the global downtrend.

The Brexit theme remains central to determining the future dynamics of the pound. Depending on the future developments around Brexit, the pound may either grow significantly or fall strongly by the time the UK leaves the EU on March 29. The long-term outlook for the British pound remains uncertain. In the short term, further weakening of the pound and a decrease in GBP / USD are expected.

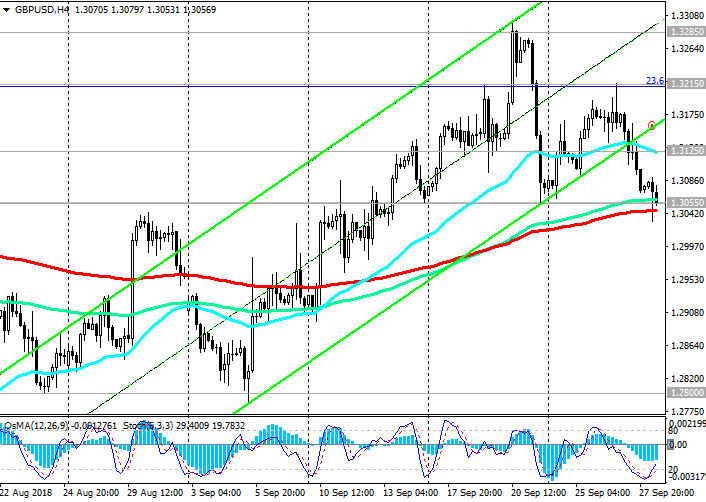

In case of breakdown of the support level 1.3055 (EMA50 on the daily chart, EMA200 on the 4-hour chart), the upward correction will finally be completed.

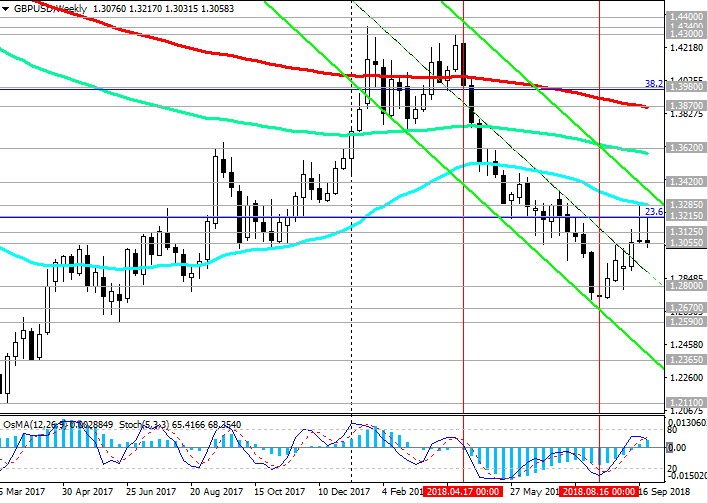

Short positions are again preferable. A long-term bearish trend persists, and the GBP / USD pair may decline towards the August and annual lows near support level 1.2670, and the lower border of the downward channel on the weekly chart passing through the 1.2365 mark.

The alternative scenario assumes the resumption of the upward correction and growth to the resistance levels 1.3215 (Fibonacci level of 23.6% of the correction to the GBP / USD decline in the wave, which began in July 2014 near the level of 1.7200), 1.3285.

The signal for the development of this scenario will be breakdown of the short-term resistance level 1.3125 (EMA200 on the 1-hour chart).

Long-term growth targets - resistance levels 1.3870 (EMA200 on the weekly chart), 1.3980 (Fibonacci level of 38.2%).

Support levels: 1.3055, 1.3025, 1.3000, 1.2900, 1.2800, 1.2670, 1.2590, 1.2365, 1.2110, 1.2000

Resistance levels: 1.3125, 1.3215, 1.3285, 1.3300, 1.3420, 1.3620

Trading recommendations

Sell Stop 1.3030. Stop-Loss 1.3110. Take-Profit 1.3000, 1.2900, 1.2800, 1.2670

Buy Stop 1.3110. Stop-Loss 1.3030. Take-Profit 1.3125, 1.3215, 1.3285, 1.3300, 1.3420, 1.3620

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.