On Wednesday, the US dollar continued to decline. Concerns about US protectionist trade policies have come to the fore once after US President Trump threatened trade barriers to Chinese goods. After that, the media reported that China intends to start getting rid of US government bonds, which led to a sharp short-term drop in the dollar. So far, the US has not imposed additional duties on imports from China. Nevertheless, on Monday, the administration of the US president announced the introduction of duties on the import of cheap solar batteries and washing machines that are produced in other countries in Asia. And this, according to the American leadership, is only the first such step in the sphere of trade.

The yield of 10-year US Treasury bonds is growing, rising to a 3-year high of 2.63%. However, this does not support the dollar, which is actively falling against the basket of other major currencies. So, during today's European session, the dollar index DXY reached a new multi-month low near the 89.50 mark, falling below the key level of 90.00.

It is likely that in the next few months we should wait for the continuation in the US of the policy of trade restrictions on imported goods, including from China. This should lead, theoretically, to reciprocal measures on the part of the PRC. The escalation of tensions between the US and Asian countries, primarily with China, against the backdrop of the protectionist trade policy of the White House will lead to an even weaker dollar. Moreover, a cheaper dollar is beneficial to the US economy. A strong national currency has a negative impact on the US economy, making US exports less affordable for overseas buyers. Trump has repeatedly stated that the US foreign trade deficit has reached an impressive $ 500 billion precisely for this reason.

On Monday, economists at the Institute of International Finance (IIF) reported that, according to their calculations, the US dollar is still overvalued by about 10%, despite the fact that last year the dollar has already decreased by 7% against a basket of 16 currencies tracked by Wall Street Journal. Thus, we should expect further weakening of the dollar.

Of the news for today, it is worth paying attention to the publication at 14:45 (GMT) of business activity indexes (PMI) in the services sector and manufacturing sector in the US for January. The publication of indicators with strong values is expected. If they exceed their expectations, the dollar may strengthen for a moment.

From the fundamental point of view, we should expect further weakening of the dollar.

Meanwhile, at 09:30 (GMT), data from the British labor market was published, indicating that the unemployment rate in November was 4.3%, which is the minimum for the past 40 years. The number of new jobs also reached a record high, while the number of unemployed fell to a minimum in more than 15 years. Such data was cited by the National Statistics Office of Great Britain.

However, higher demand for labor did not lead to an acceleration in the growth of wages of the British. The worsening of the financial situation of consumers after the referendum on Brexit, apparently, continues.

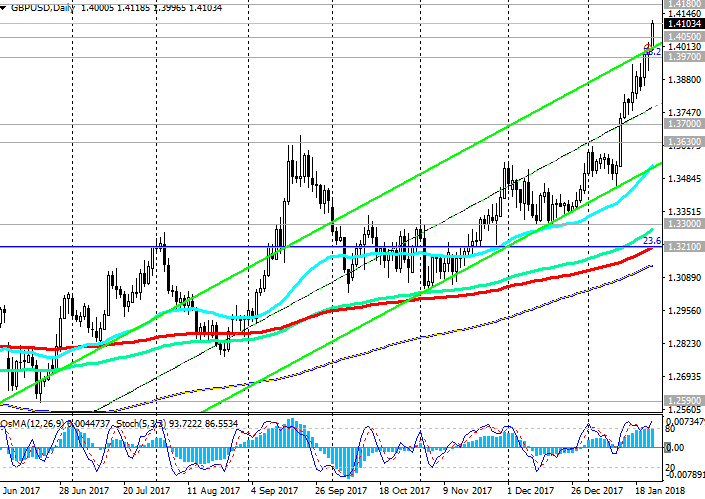

Nevertheless, the pound reacted with growth on the data presented. The GBP / USD pair updated the annual and multi-month high near the 1.4115 mark. For the last time at this point, the pair GBP / USD was at the end of June 2016, on the eve of the referendum on Brexit.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 1.4050,

1.4000, 1.3970, 1.3800, 1.3700, 1.3630, 1.3550, 1.3420, 1.3300, 1.3210

Levels of resistance: 1.4100, 1.4180, 1.4250

Trading Scenarios

Sell Stop 1.4070. Stop-Loss 1.4135. Take-Profit 1.4050, 1.4000, 1.3970, 1.3800, 1.3700, 1.3630, 1.3550, 1.3420, 1.3300, 1.3210

Buy Stop 1.4135. Stop-Loss 1.4070. Take-Profit 1.4180, 1.4250

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com