USD/JPY: The Bank of Japan left monetary policy unchanged

As expected, the Bank of Japan left all three monetary policy goals unchanged during today's meeting. The report of the Bank of Japan said that expectations about the pace of economic growth and inflation remained the same, while in December the bank said that they are "in the phase of weakening". In the course of his speech, the Governor of the Bank of Japan Haruhiko Kuroda stated that "we have not yet reached the point at which we should discuss the exit from monetary stimulus". The Japanese stock index Nikkei added 1.3% and for the first time since November 1991 closed above 24000 points, even despite the strengthening of the yen.

During the European session, the pair USD / JPY continued to decline. The dollar has only briefly received a breather by resolving a potential crisis with funding from the US government. As it became known, yesterday the Senators approved the bill on provisional financing of the government until February 8. Nevertheless, the restrained-negative attitude to the dollar on the part of investors remains, which is facilitated both by the internal political tensions in the US and by the expectations of a faster growth of the economy outside the United States, especially in countries with the world's largest economies.

At the beginning of today's European session, the DXY dollar index is near the 90.25 mark, while last week DXY reached a multi-month low near the 90.15 mark.

For today, important news on the US is not planned for publication. At 23:50 (GMT), the Ministry of Finance of Japan will publish a report with data on imports and exports, as well as the overall trade balance for December. The trade balance surplus and exports (+ 10%) of Japan are expected to increase, which will positively affect both the yen and the Japanese stock market.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

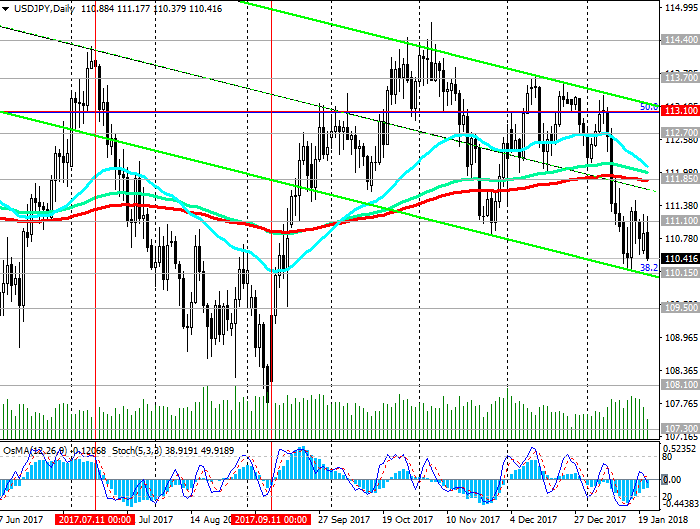

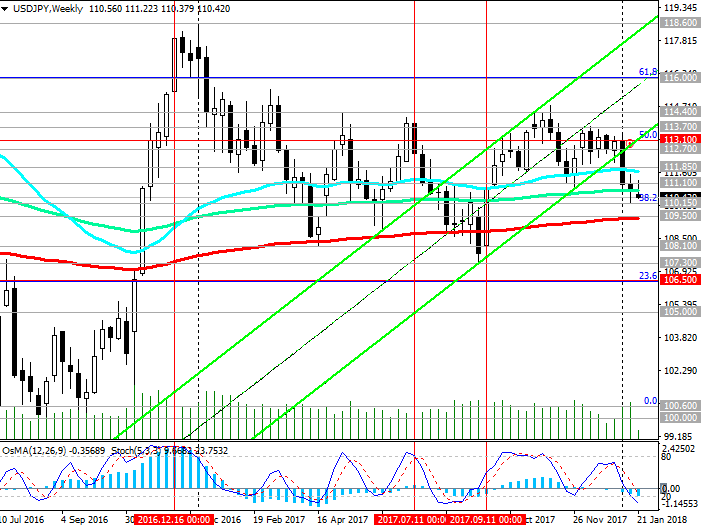

Support levels: 110.15, 109.50, 108.80,

108.10, 107.30, 107.00, 106.50, 105.00

Resistance levels: 111.10, 111.85, 112.70, 113.10, 113.70, 114.00, 114.40, 115.00, 116.00

Trading Scenarios

Buy Stop 111.30. Stop Loss 110.40. Take-Profit 111.85, 112.70, 113.10, 113.70, 114.00, 114.40

Sell Stop 110.40. Stop Loss 111.30. Take-Profit 110.15, 110.00, 109.20, 108.80, 108.10, 107.30, 107.00, 106.50, 105.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com