Today, the euro is trading higher; receiving support after the President of Catalonia Carles Puicdemont said that he is postponing the declaration of independence. Yesterday in Barcelona, a declaration was adopted on the independence of Catalonia from Spain, however, the head of the Catalan government Carles Puicdemont said that "Catalonia should become independent, but it is impossible to hurry with this". The growth of the single European currency is limited, although the euro rose to 2-week highs against the US dollar and the Swiss franc, as investors await the reaction of Madrid.

The response statement of Spanish Prime Minister Mariano Rajoy may become a key factor determining the direction of the euro in the future until the October ECB meeting (October 26), when the question of the prospects for curtailing the QE program in the Eurozone will be again decided.

At the same time, today investors will study the text of the minutes from the September meeting of the Fed, which will be published at 18:00 (GMT).

As the president of the Federal Reserve Bank of Dallas and FOMC member Robert Kaplan stated yesterday, "if we wait too long for signs of accelerating inflation, then we will have to raise interest rates at a higher rate. In this case, the probability of a recession in the US economy will increase".

Earlier (last week) another Fed representative, FOMC member John Williams, said in the same vein that he "still considers it expedient to have another interest rate increase in 2017 and three rate hikes in 2018, which corresponds to a gradual rate of tightening policy".

Two representatives of the Federal Reserve Bank Charles Evans (11:15 GMT) and John Williams (18:40 GMT) are scheduled for today. It is likely that the dollar will receive support from their speeches, as they are likely to come forward in support of the Fed's plans for a phased tightening of monetary policy.

According to the CME Group, investors estimate the likelihood of an increase in interest rates in the US by the end of this year at 88% versus 31% a month ago after the publication of a report on the labor market in the US last Friday. Despite the fact that the number of jobs outside of US agriculture in September decreased for the first time in seven years (by 33,000), the unemployment rate in September fell by 0.2 percentage points, to 4.2%, which was the lowest since the beginning 2001.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

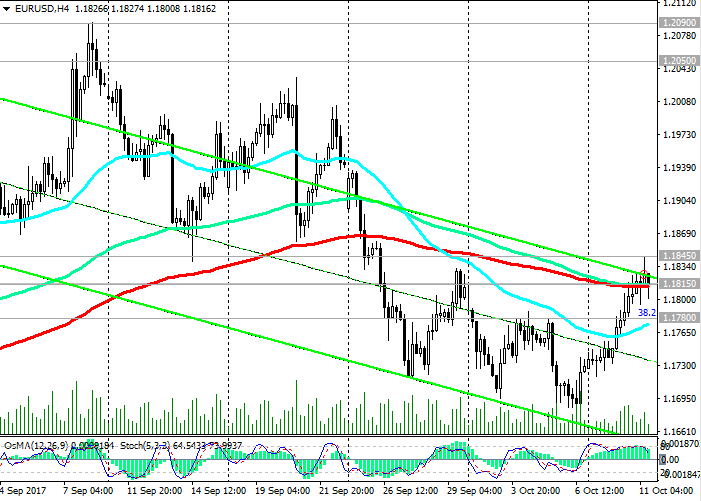

At the moment, the EUR/USD is trading at an important short-term resistance level 1.1815 (EMA200, EMA144 on the 4-hour chart), maintaining a positive momentum.

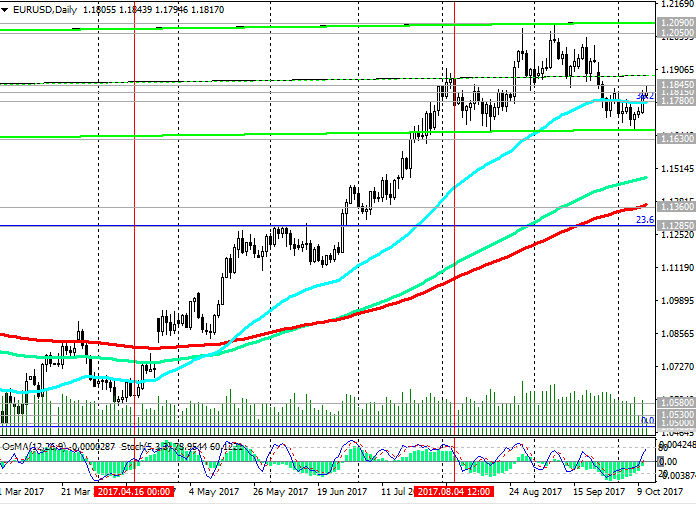

The signal for further growth will be a breakdown of the local resistance level at 1.1845 (today's highs). In this case, the EUR/USD growth will resume within the upward channel on the weekly chart. The target of the growth is the mark 1.2180 (the upper border of the channel and the Fibonacci level of 50% corrective growth from the lows reached in February 2015 in the last wave of global decline of the pair from the level of 1.3900).

An alternative scenario for the decline involves a breakdown of the support level 1.1780 (Fibonacci level of 38.2%) and a drop to support level 1.1630 (EMA200 on the weekly chart).

Medium-term reduction targets after the breakdown of the level of 1.1630 – are support levels 1.1360 (EMA200 on the daily chart), 1.1285 (Fibonacci level 23.6%).

Support levels: 1.1780, 1.1700, 1.1630, 1.1360, 1.1285

Resistance levels: 1.1815, 1.1900, 1.1925, 1.2000, 1.2050, 1.2090, 1.2100, 1.2180

Trading Scenarios

Sell Stop 1.1790. Stop-Loss 1.1850. Take-Profit 1.1700, 1.1670, 1.1630, 1.1600, 1.1400

Buy Stop 1.1850. Stop-Loss 1.1790. Take-Profit 1.1870, 1.1925, 1.2000, 1.2050, 1.2090, 1.2100, 1.2180

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com