North Korea once again threatened to test a nuclear bomb, and again quotations of gold prices crawled up. Foreign Minister Li Yong-ho said on Thursday that his country could conduct the most powerful test of a hydrogen bomb in the Pacific Ocean. This threat came in response to a speech by President Donald Trump at the UN, which said that if the US or its allies were threatened, the United States could completely destroy North Korea.

Geopolitical tensions are one of the main factors in the growth of gold prices. And today the threat of a new aggravation of the geopolitical situation on the Korean peninsula outweighs another important fundamental factor - expectations of a further increase in the interest rate in the United States.

As you know, the Fed signaled on Wednesday that it still expects another increase in interest rates before the end of this year, and plans to begin a gradual reduction in its assets portfolio in October.

According to the CME, investors are currently assessing the likelihood of an increase in interest rates by the end of the year at about 70%, while as recently as last week - less than 40%.

Assets deemed reliable, such as the yen, franc, gold, came under pressure following Fed statements. Gold fell in price yesterday to 1290.00 dollars per ounce, approaching the minimum since the end of August.

With an increase in interest rates, precious metals, including gold, usually become cheaper, if the geopolitical situation at this time remains stable. Gold, which does not bring investment income and can not compete with more profitable assets, becomes cheaper, as the cost of borrowing for its acquisition and storage grows with an increase in the interest rate.

From the news for today we are waiting for the data from the USA. At 13:45 (GMT) will be published indices (preliminary values) of business activity in the manufacturing and service sectors of the US (for September). It is expected that the indices will come out with slight deviations from the values for the previous month. Nevertheless, the values of the indicators are well above 50, which is a positive factor for the US dollar. If the data prove to be better than the forecast values, the dollar will get a good support, including in the pair XAU/USD.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

Since the opening of today and during the Asian session, the price of gold has resumed growth.

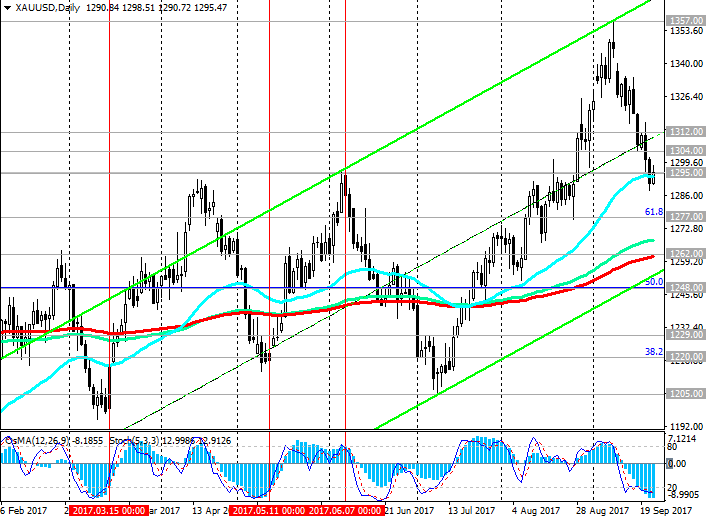

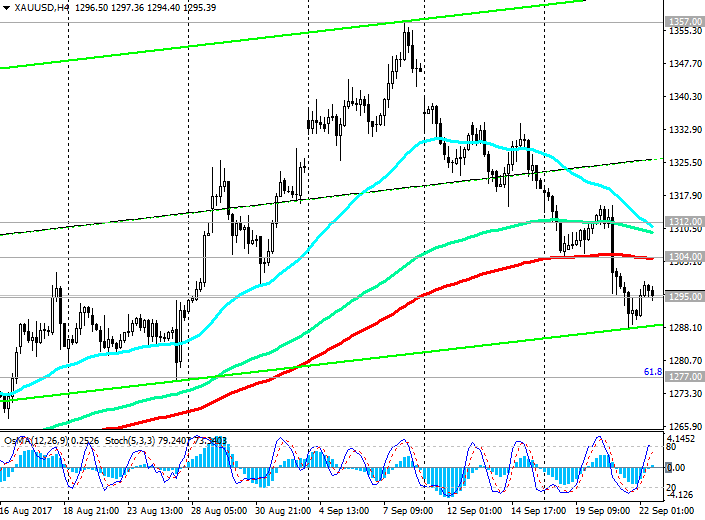

At the beginning of the European session, the pair XAU / USD is trading near the 1295.00 mark, through which the support level passes and the EMA50 line on the daily chart.

Indicators OsMA and Stochastics on different time frames show a multidirectional dynamics.

It is likely that in the short term, with a decrease in geopolitical tensions, the growth of the dollar will continue, and the price of gold will remain under pressure, again until the next aggravation of the geopolitical situation in the world and on the Korean Peninsula.

The fundamental background (tightening of monetary policy in the US) creates the prerequisites for further reduction of XAU / USD.

In the case of consolidation below the level of 1295.00, the target of the decline will be support levels 1277.00 (Fibonacci level 61.8% correction to the wave of decline since July 2016), 1262.00 (EMA200, the lower limit of the ascending channels on the daily and weekly charts).

The breakdown of the key support level of 1248.00 (the Fibonacci level of 50.0% of the correction to the fall wave from July 2016, EMA144 on the weekly chart) will provoke further decline in the pair XAU / USD and its return to the downtrend.

The alternative scenario is connected with the breakdown of the nearest resistance level of 1304.00 (EMA200 on the 4-hour chart). In case of fastening above the resistance level 1312.00 (EMA200 on the 1-hour chart), the growth of the pair XAU / USD will resume with the nearest target of 1357.00 (annual highs). The more distant goal is at the level of 1370.00 (the beginning of the wave of decline since July 2016 and the Fibonacci level of 100% and the upper limit of the rising channel on the weekly chart). In this case, the upward trend of XAU / USD, which began in January 2016, will resume.

Support levels: 1295.00, 1277.00, 1270.00, 1262.00, 1248.00

Resistance levels: 1304.00, 1312.00, 1340.00, 1350.00, 1357.00

Trading Scenarios

Sell Stop 1289.00. Stop-Loss 1302.00. Take-Profit 1277.00, 1270.00, 1262.00, 1260.00, 1248.00

Buy Stop 1302.00. Stop-Loss 1289.00. Take-Profit 1304.00, 1312.00, 1340.00, 1350.00, 1357.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com