The dollar continues to decline. Concerns about geopolitical risks and natural disasters in the US, weak economic data and doubts about the prospects for raising the Federal Reserve's interest rates helped the dollar to fall to its lowest level for more than two and a half years.

The ICE dollar index today decreased by 0.5%, reaching a minimum of 33 months.

The fall in the USD / JPY began in July, as expectations for new stimulus measures in the US weakened, including lower taxes and increased spending on infrastructure. Recently, increased geopolitical concerns about the testing of weapons in North Korea, forced investors to buy more reliable currencies such as gold, franc, yen. This Saturday in North Korea will be the anniversary of the founding of the state. A year ago, on that day, the military tested nuclear weapons.

History can repeat itself. But this time it could be like the next launch of the missile towards Japan, as well as a test explosion of nuclear weapons in the DPRK.

Yesterday, US President Donald Trump again cautioned against North Korea, saying that "North Korea behaves badly and needs to be stopped". "The military actions against North Korea - this is one of the options for the development of events", according to Trump. Military confrontation "definitely can happen".

The dollar today fell by 0.7% against the yen and by 0.6% against the Swiss franc. Gold prices rose by 0.7% to 1,357.00 dollars per ounce.

Investors are also worried that the hurricanes "Harvey" and "Irma" may negatively affect the economic performance of the United States in the short term. This may also have a negative impact on expectations of an increase in FRS interest rates. The increase in interest rates, as a rule, provides support to the currency. However, a number of Fed officials have expressed doubts about the need for such a step on the part of the Fed on the background of low inflation in the US.

The decline in the dollar is also due to a decrease in the yield of US government bonds. Today, the yield of 10-year US government bonds continued to decline and, according to Tradeweb, fell to 2,027% from the level of 2,061%, recorded on Thursday.

Against the backdrop of a large-scale decline in the dollar and growth in demand for safe haven assets, the US dollar / Japanese yen has reached a new 10-month low, breaking through the 108.00 level.

It is likely that today, at the end of the trading week, many investors will want to fix profit in short positions on the dollar, which will cause its corrective growth. Nevertheless, the negative attitude to the dollar persists. Probably further decline in the dollar in the short term, including in the pair USD / JPY.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Technical analysis

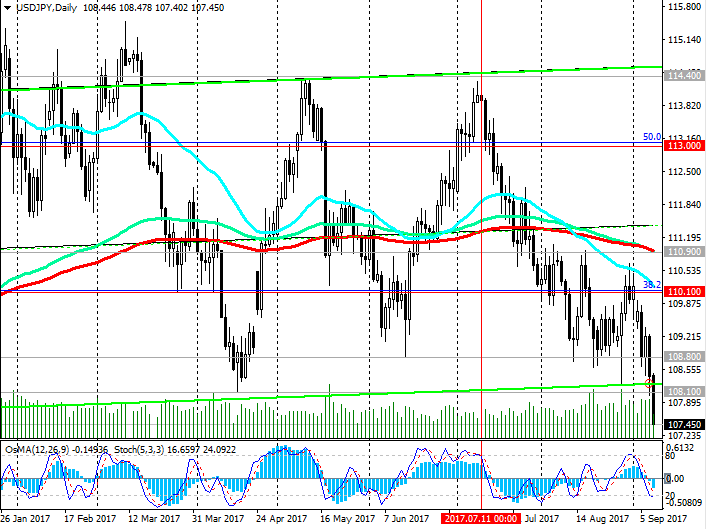

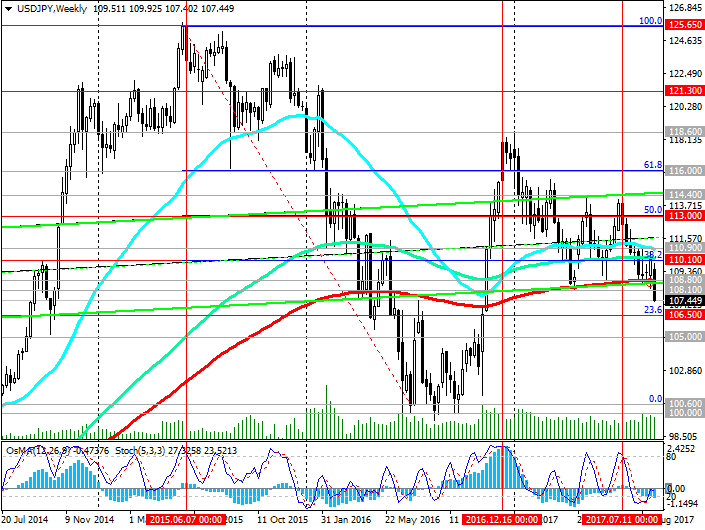

Since July, the active decline of the pair USD / JPY has started, which broke through the key support levels of 110.90 (EMA200, EMA144 on the daily chart), 110.10 (Fibonacci level 38.2% correction to the pair growth since August of last year and 99.90 level), 108.80 (EMA200, EMA144 on the weekly chart).

A powerful negative impulse, based on a large-scale weakening of the dollar, pushes the pair USD / JPY towards support levels of 106.50 (Fibonacci level of 23.6%), 105.00 (EMA200, EMA144 on the monthly chart).

Apparently, only near the level of 105.00 it is possible to stop the fall of the USD / JPY.

An alternative scenario involves the return of the USD / JPY in the zone above the level of 108.80 and the resumption of growth with targets at levels 110.10, 110.90.

Nevertheless, the fundamental factor speaks in favor of the further fall of the USD / JPY.

Technical indicators (OsMA and Stochastics) on 4-hour, daily, weekly, monthly charts also give signals for sales.

Support levels: 107.00, 106.50, 105.00

Resistance levels: 108.10, 108.80, 110.10, 110.90, 113.00, 114.40, 115.00, 116.00

Trading recommendations

Buy Stop. Stop Loss 107.40. Take-Profit 108.80, 110.10, 110.90

Sell in the market. Stop Loss. Take-Profit 107.00, 106.50, 105.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com