Brent: the price of oil is growing for the sixth day in a row

The report of the oil service company Baker Hughes, released on Friday, according to which the number of active drilling platforms in the US amounted to 766 units (against 764 last week), did not prevent the growth of oil prices. Brent oil was traded at the end of the trading day on Friday at a price of $ 52.21 per barrel, $ 0.7 higher than the opening price of Friday. In total, over the past week, the price for Brent crude rose $ 4 from $ 48.00 per barrel. A sharp decline in oil and oil products in the US last week (7.2 million barrels), as well as a large dollar weakening, contributes to the growth of oil prices.

The meeting of some OPEC members and countries outside the cartel last week in St. Petersburg also left an imprint on the dynamics of oil prices. Saudi Arabia's oil minister Khaled Al-Falih said at the meeting that Saudi Arabia, the world leader in oil exports, intends to reduce oil exports in August to 6.6 million barrels per day from 7.46 million barrels a day recorded in 2016. Nigeria, a member of the cartel, but exempt from participation in the deal, also expressed its intention to limit production at 1.8 million barrels per day.

If Saudi Arabia really further reduces oil exports, and other OPEC member countries follow its example, oil prices can restore the upward trend. This statement is also valid against the background of the weakness of the dollar. As long as the dollar stabilizes in the foreign exchange market, commodity prices, including oil, may again be under pressure.

Some skepticism about the effectiveness of OPEC's actions to reduce oil production is still valid, because within OPEC there may be a split among the countries participating in the agreement.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

With the opening of today's trading day and at the beginning of today's European session, the price for Brent crude is close to $ 52.30 per barrel, trading in a narrow range.

In the foreign exchange market there is a correction of the dollar after its strong decline last week. There is no important news on the oil market today, and an upward correction in the dollar may affect oil prices.

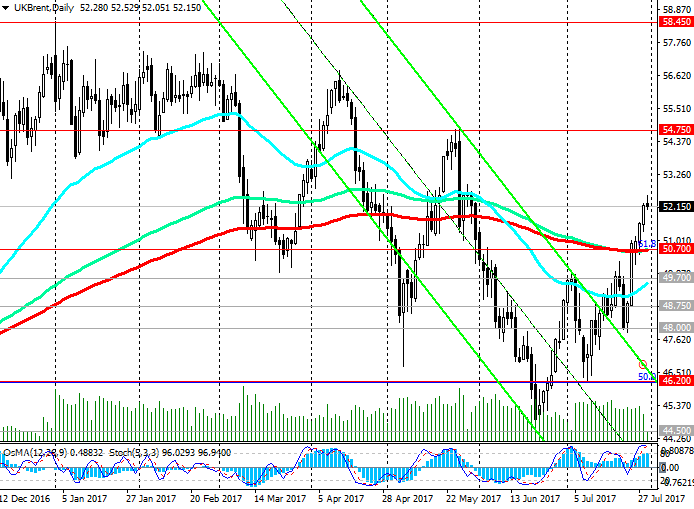

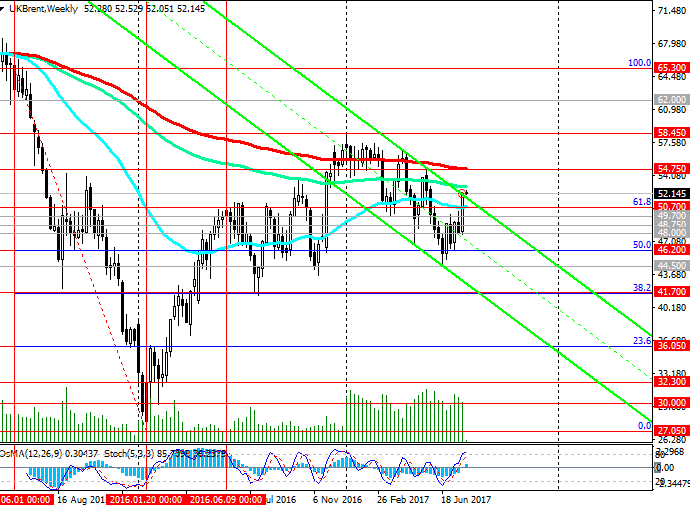

Indicators OsMA and Stochastics on the daily and weekly charts recommend long positions. However, on the 4-hour and 1-hour charts, the indicators turned to short positions, signaling an overdue downward correction after a strong six-day price increase.

The price broke through an important level of 50.70 (EMA200, EMA144 on the daily chart, EMA50 on the weekly chart, and the Fibonacci level of 61.8% correction to the decline from the level of 65.30 from June 2015 to the absolute lows of 2016 near the 27.00 mark), above which a positive dynamics. Preferred long positions with a target at 54.75 (EMA200 on the weekly chart and May highs).

In the case of the breakdown of the support level of 50.70 and the resumption of the decline, the targets will be support levels of 49.70, 48.75, 48.00, 46.20 (Fibonacci 50%), 44.50 (lows of the year). The more distant goal is the level 41.70 (the Fibonacci level of 38.2% and the lower boundary of the descending channel on the weekly chart).

Support levels: 52.00, 51.00, 50.70, 50.00, 49.70, 48.75, 48.00, 47.70, 46.20, 45.50, 44.50, 41.70

Levels of resistance: 53.00, 54.75

Trading Scenarios

Sell Stop 51.90. Stop-Loss 52.60. Take-Profit 51.00, 50.70, 50.00, 49.70, 48.75, 48.00

Buy Stop 52.60. Stop-Loss 51.90. Take-Profit 53.00, 54.00, 54.75

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com