"Core inflation is still slow and has not yet shown convincing signs of acceleration. Price pressure and wage growth are still restrained, "European Central Bank board member Yves Mersch said today in Singapore.

The rate of price growth in the Eurozone last month slowed to 1.3% per annum, being significantly below the target level of the ECB, which is just under 2%. Because of low inflation, the Eurozone economy still needs "very significant" incentive measures, according to Yves Mersch.

Today, the pair EUR / USD resumed its growth after the release of positive macroeconomic indicators at the beginning of the European session. So, the PMI index in the manufacturing sector of the Eurozone in July was 56.8, the PMI index for the services sector - 55.4, the composite PMI - 55.8.

Nevertheless, the growth of the EUR / USD pair was insignificant, as the dollar today stabilized in the foreign exchange market on the eve of the publication of tomorrow results of the Fed meeting. The index of the dollar WSJ, which reflects the value of the US dollar against the basket of 16 other currencies, slightly increased and amounted to 86.58.

At 18:00 (GMT) on Wednesday will publish the decision of the Fed on the interest rate in the US. It is widely expected that the rate will remain at the same level of 1.25%.

According to the latest data of the CME Group, the probability of an increase in the rate at the December meeting of the Federal Reserve is 48%.

From the US, we continue to receive weak macro data, against which the Fed will be very carefully approaching the issue of further tightening of monetary policy. It is likely that the dollar will remain under pressure until the domestic political situation in the United States normalizes and macroeconomic indicators start to arrive with strong indicators.

We are waiting for data from the USA today. CB Consumer Confidence is published at 14:00 (GMT). This indicator reflects the confidence of American consumers in the economic development of the country. A high level indicates an increase in the economy, while a low indicates stagnation. The previous value of the indicator is 118.9. The growth of the indicator will strengthen USD, and a decrease in value will weaken the dollar. It is expected that this indicator will come out with a value of 116.5, which will negatively affect the dollar when the forecast is confirmed.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

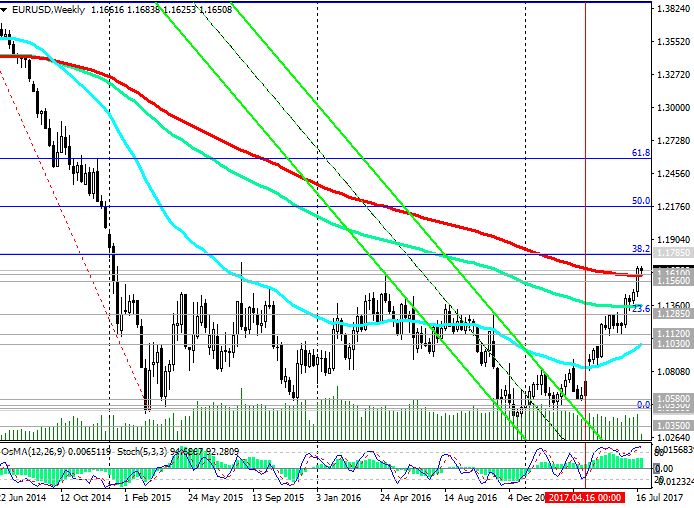

The pair EUR / USD continues to trade in the uplink on the daily chart, the upper limit of which runs near the level of 1.1720. The EUR / USD is trying to gain a foothold above the key support level 1.1610 (EMA200 on the weekly chart).

The positive dynamics of the EUR / USD pair remains. The growth of the EUR / USD pair may continue. In this case, the immediate target will be the resistance level 1.1785 (the Fibonacci retracement level of 38.2% of the corrective growth from the lows reached in February 2015 in the last wave of global decline from 1.3900).

An alternative scenario for the decline will be related to the breakdown of the support level 1.1610. In case of breakdown of the support level 1.1560 (EMA200 on the 1-hour chart), the pair EUR / USD may fall to support level 1.1285 (Fibonacci level of 23.6%), and in case of its breakdown, risks of return to the downtrend will grow.

However, in any case, while the EUR / USD pair is above the level of 1.1030 (EMA200 on the daily chart), a bullish trend remains.

Support levels: 1.1610, 1.1560, 1.1500, 1.1400, 1.1370, 1.1285, 1.1240, 1.1120, 1.1030

Levels of resistance: 1.1650, 1.1700, 1.1720, 1.1785

Trading scenarios

Sell Stop 1.1590. Stop-Loss 1.1685. Take-Profit 1.1560, 1.1500, 1.1400, 1.1370, 1.1285, 1.1240, 1.1120

Buy Stop 1.1685. Stop-Loss 1.1590. Take-Profit 1.1700, 1.1720, 1.1785, 1.1800*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com