After the National Bureau of Statistics of Great Britain presented today very encouraging data from the UK labor market, the pound strengthened in the foreign exchange market. According to the data provided, for the period March-May unemployment fell to 4.5%, the lowest level since 1975, while the number of unemployed fell by 64,000, and the number of workers reached a record high. The average salary (excluding premiums) in March-May increased by 2% (with the forecast for growth of 1.8%). However, real wages in the UK remain, nevertheless, at a low level, as consumer prices grew faster than wages. In May, inflation was 2.9%, demonstrating the fastest growth rates in almost four years. The decline in the British pound on the outcome of the referendum on Brexit provoked an increase in import prices and spurred inflation.

At a meeting of the Bank of England in June, three of the eight members of the Bank of England's Monetary Policy Committee voted to tighten monetary policy. The Bank of England Governor Mark Carney also signaled the likelihood of policy tightening in the future. However, for this, according to Karni, requires a strong growth of companies' investments, which can neutralize the slowdown in the pace of consumer spending.

But there is another opinion on the tightening of monetary policy in the UK. So, today the Deputy Governor of the Bank of England Ben Broadbent said that, given the uncertainty of the economic outlook, "at the moment it is not worth making a decision (regarding raising rates)", and "there are many factors that can not be accurately assessed".

This week, market participants will closely follow the speech (Wednesday and Thursday 14:00 (GMT)) of the Fed Chairman Janet Yellen. It is likely that in her report before the US Congress she will confirm the Fed's intention to tighten monetary and credit policy. In this case, the strengthening of the US dollar will resume.

Also today, from 14:00 (GMT), volatility in the foreign exchange market could rise sharply due to the publication of the Bank of Canada's interest rate decision, which must be taken into account when making trading decisions.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

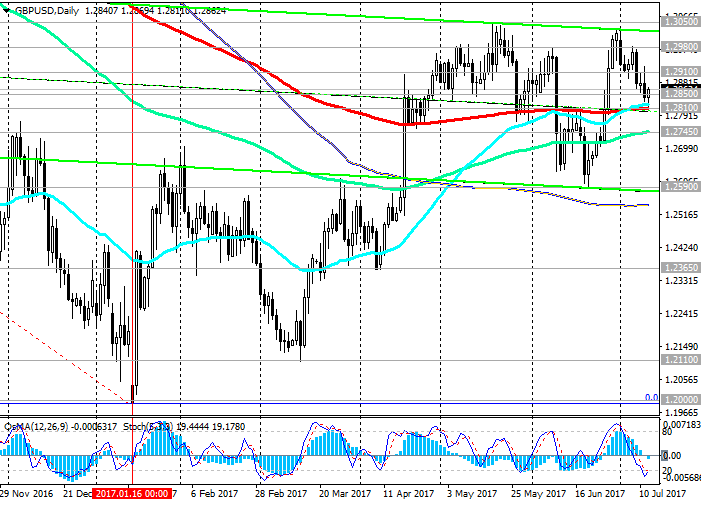

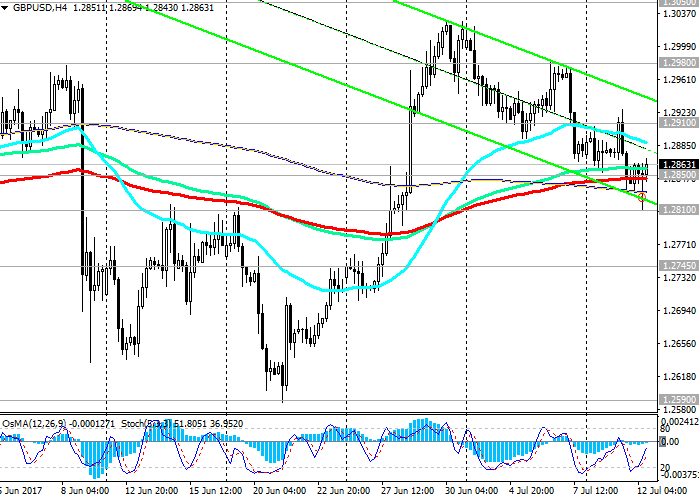

After the publication of data on the UK labor market, the pair GBP / USD rebounded from the key support level 1.2810 (EMA200 on the daily chart) and is currently trading above support level 1.2850 (EMA200 on the 4-hour chart). However, the positive momentum may not be enough to restore the positive dynamics of the pair GBP / USD.

Indicators OsMA and Stochastics on the daily chart turned to short positions, signaling the continuation of the downward dynamics.

The support levels of 1.2850, 1.2810 are good deterrent levels from the further decline of the GBP / USD pair. In case of breakdown of the support level 1.2745 (EMA144 on the daily chart), the GBP / USD decline will accelerate to targets near the levels of 1.2590 (June lows and the lower limit of the uplink on the weekly chart), 1.2365, 1.2110.

If the positive dynamics of the pound returns, then the GBP / USD pair will resume growth with targets of 1.2980, 1.3050 (May highs), 1.3100, 1.3210 (Fibonacci level 23.6% correction to the pair GBP / USD decline in the wave, which began in July 2014 Near the level of 1.7200 and the upper limit of the rising channel on the weekly chart).

Support levels: 1.2850, 1.2810, 1.2745, 1.2700, 1.2640, 1.2590, 1.2550, 1.2365, 1.2110

Resistance levels: 1.2910, 1.2980, 1.3050, 1.3100, 1.3210, 1.3300

Trading Scenarios

Sell Stop 1.2830. Stop-Loss 1.2870. Take-Profit 1.2810, 1.2745, 1.2700, 1.2640, 1.2590, 1.2485, 1.2365

Buy Stop 1.2870. Stop-Loss 1.2830. Take-Profit 1.2910, 1.2980, 1.3050, 1.3100, 1.3210, 1.3300

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com