The greenback, tracked by the US Dollar Index, keeps meandering around Friday’s close near 95.80, alternating gains with losses so far in the day.

US Dollar interim target at 96.25

The index is struggling for direction at the beginning of the wee,k while market participants continue to adjust to June’s non-farm payrolls released on Friday (222K act.). The results showed the US labour market stays strong although inflation wages still remain laggard.

USD appears within a sideline pattern in past sessions, where gains seem capped near 96.30 while the magnet on the downside stays around 95.20, multi-month lows (June 30).

Nothing worth mentioning data wise from the US docket today, although Yellen’s testimonies on Wednesday and Thursday plus June’s inflation figures tracked by the CPI along and retail sales to be published on Friday should put some colour to the buck’s price action in the second half of the week.

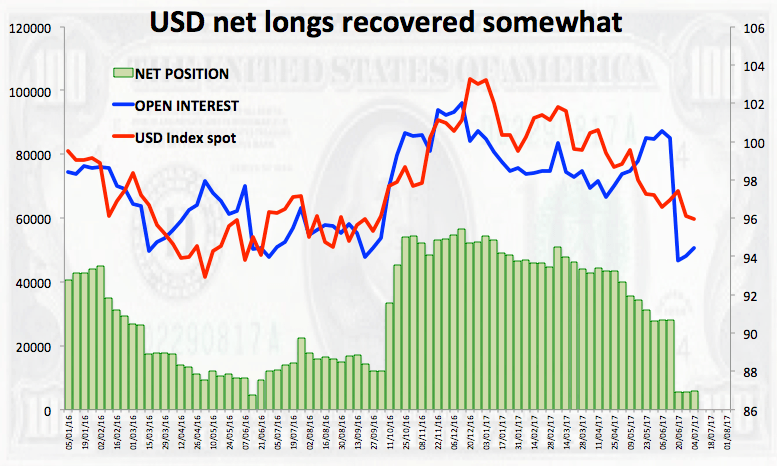

Some extra support for the buck comes from the speculative community, where longs have climbed to 3-week tops in the week to July 3, as shown by the latest CFTC report.

US Dollar relevant levels

The index is gaining 0.01% at 95.79 facing the next up barrier at 96.25 (high Jul.5) ahead of 96.32 (high Jun.28) and then 96.51 (20-day sma). On the other hand, a breach of 95.53 (low Jul.7) would open the door to 95.22 (2017 low Jun.30) and then 94.95 (low Sep.22 2016).