Overview

Further you may find information about Pattern Explorer © built-in patterns. The above information has a brief and formal description about patterns and its interpretation in a classical literature according to our topic. Do not take the information as a recommendation for trading with this patterns. Alternatively, according to our work with patterns experience shows that frequently a known pattern on some instrument alarms an opposite to information described in an open source. Often turns out that it is unworkable on the trading instrument/time frame. Thus, though the Pattern Explorer © adviser is not a constructor, which allows to implement every idea of trading system in life, anyway the usage list of built-in patterns is wide and we recommend you to use the adviser in aid of searching your own working algorithms. Do not pay extreme attention to a well known information about patterns, which usually on practice shows a meaning less thesis, copied from one source to another. Prove a usage of this or that pattern may only statistical information, which you may get from the Pattern Explorer © adviser, it is accessible for everybody and primarily for those traders who has no programming skills.

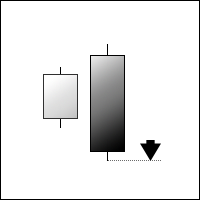

A list of accessible patterns

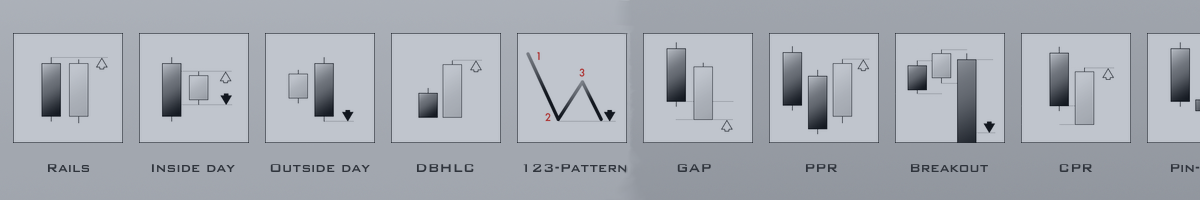

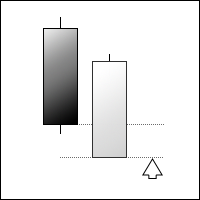

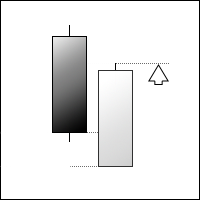

1) Rails – pattern, which consists of two candles, at that, the last one moves in an opposite direction to the first one, it alarms that previously started moving is “run out”, starts quick pullback. The entrance is usually on an opposite extremum of the first candle in the side of moving of the last one.

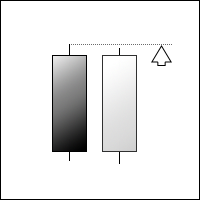

2) Inside Bar consists of two candles, at that, the last candle can not step out from a range of the previous one. Alarms about a moment of market “uncertainty” with possibility of further quick moving in a chosen direction. Allows to trade as a burst of a range of inside bar in both sides. Thus, try to catch, trend/ contr-trend only.

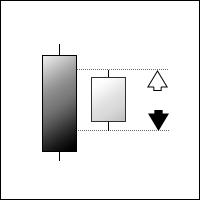

3) Outside Bar consists of two candles, at that, the last candle “engross” the previous one's range. Ususally consider two separated variants: bull's and bear's signal, depends on the direction of the last candle.

4) DBHLC - pattern consists of two candles with identical minimum/maximum. The reason of this kind of visual formation is that the price pushes away from valid level and confidently goes in an opposite direction. Usually it is advisable to use co-directional entrance for breaking maximum of the last candle.

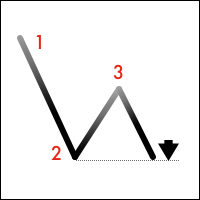

5) 123-Pattern - pattern presents a repeated trying of breaking the level with price. Previously jump-off and correction were accomplished from the level. It is impossible to define unmistakable pattern with computer approach. A criteria set is using in the adviser, Accuracy setting gives an opportunity to chose the most appropriate variant for stated instrument/time frame.

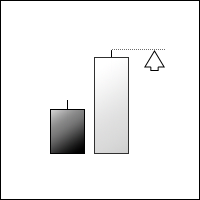

6) Opps! (Gap) - pattern presents a new bar opening with gap relative to the previous closing. Speak that often the price try for leveling this gap before moving somewhere.

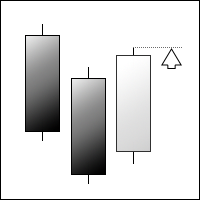

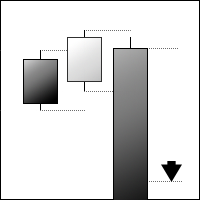

7) PPR -pattern consists of three candles, the second candle renew the minimum of the first, but the third can not renew the minimum of the second, alternatively it closes higher of the maximum of the second. Thus, in this case we buy.

8) Volatility Breakout - the pattern core is breaking out with a candle of stated percentage from average daily volatility, it probably means that the price has a strong wish to move in a chosen direction. We try to jump over a leaving train. Selecting different levels for “catching” break out, we should try to find some stated regularity of movements inertance of different instruments in different situations.

9) CPR (Closing price reversal) - similar to Oops! (Gap) pattern. Only after opening with a gap, we wait for chosen direction confirmation, we enter after candle closing.

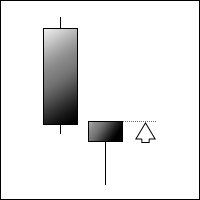

10) Pin-Bar - pattern with a long shadow and quiet short candle body. Offers to take as reversal, because this kind of form says about that the inside bar price is trying to move in a chosen direction, but market has no strength, so returns happens.

Download Pattern Explorer EA

Example of making strategy with Pattern Explorer EA.