US Dollar Selloff May Resume Following Payrolls Data

Welcome to my products:

https://www.mql5.com/en/users/soubra2003/seller

Talking Points:

- US Dollar gains, retracing after a second day of heavy selling

- Yen falls as Japanese shares fight back after down gap at open

- “Trump trade” unwind may resume after US jobs data passes

The US Dollar trader broadly higher overnight, retracing after a second day of heavy losses amid broad-based unwinding of exposure to the so-called “Trump trade” (as expected).

The bulk of yesterday’s down move came after a mixed bag of economic releases. The ADP measure of jobs growth fell short of forecasts but the ISM gauge of service-sector activity growth proved better than expected. This hints that markets were more concerned with getting past event risk than the data’s content. With the day’s releases out of the way, traders seemingly felt free to resume profit-taking.

The Yen underperformed as Japanese shares traded higher, undermining demand for the standby anti-risk currency. The benchmark Nikkei 225 index gapped down at today’s trading open and spent much of the day drifting upward to close this disparity (although it is still net down on the day compared with Thursday’s closing price).

Looking ahead, all eyes are unmistakably transfixed on December’s US employment data. The report is expected to show a 175k gain in nonfarm payrolls, a slight slowdown from the 178k increase recorded in the prior month, while the jobless rate is seen ticking a bit higher to 4.7 percent. Wage growth is seen accelerating to 2.8 percent, revisiting the seven-year high reached in October before a pullback in the subsequent month.

Absent a wild deviation from consensus forecasts, the release seems unlikely to mark a major shift in Fed policy speculation. Fiscal policy remains the critical unknown quantity on that front. With this in mind, the report may end up being another signpost to be passed rather than a catalyst in its own right, opening the door for corrective flows to deliver further US Dollar weakness.

See the schedule of upcoming webinars and join us LIVE to follow the financial markets!

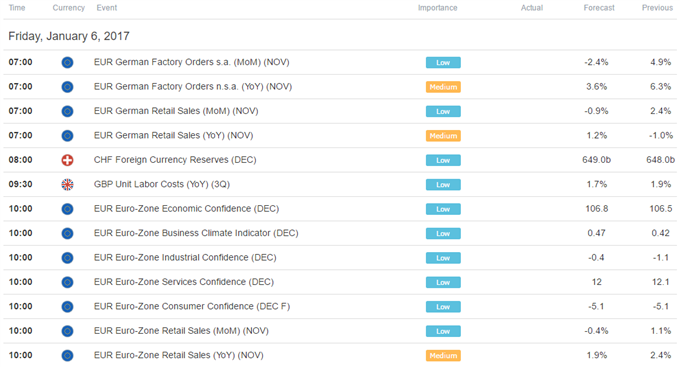

Asia Session

European Session