Gold, Crude Oil Prices May Fall More as US CPI Adds to Fed Impact

Gold, Crude Oil Prices May Fall More as US CPI Adds to Fed Impact

Talking Points:

- Gold prices sink as Fed upgrades 2017 rate hike projection

- Crude oil prices under fire as FOMC spurs US Dollar rally

- Commodities may face to deeper losses on US CPI report

Gold prices slumped as the Federal Reserve upgraded its outlook for the 2017 interest rate hike path. Policymakers now expect to raise the benchmark lending rate three times next year, up from a pair of increases projected in September.

Chair Yellen did her utmost to play down the change, saying only handful of FOMC officials taking into account the highly uncertain effects of future fiscal policy were responsible for the upward drift in central bank’s average view. The markets paid little heed however.

Yields soared alongside the US Dollar, undermining demand for non-interest-bearing and anti-fiat assets, sinking precious metals. Crude oil prices likewise declined as the greenback’s gains applied de-facto selling pressure to the USD-denominated WTI benchmark.

Looking ahead, November’s US CPI report headlines the data docket. Expectations call for the baseline inflation rate to rise to a 25-month high at 1.7 percent. An upbeat print in line with a recent string of upside surprises may fuel further steepening of the priced-in tightening path, punishing commodities.

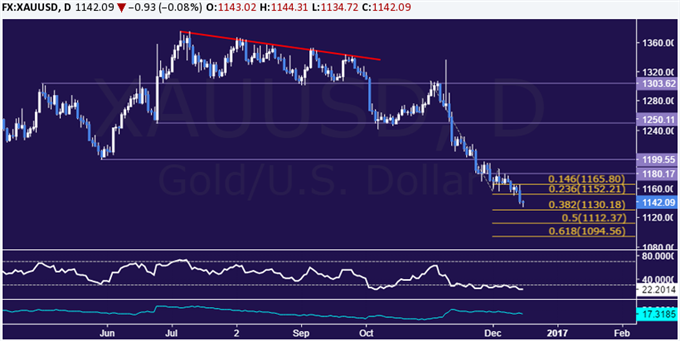

GOLD TECHNICAL ANALYSIS – Gold prices accelerated downward anew after a brief period of consolidation, sinking to the lowest level in ten months. Near-term support is now at 1130.18, the 38.2% Fibonacci expansion, with a break below that on a daily closing basis targeting the 50% level at 1112.37. Alternatively, a move back above the 23.6% Fib at 1152.21 opens the door for a retest of the 14.6% expansion at 1165.80.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices posted the largest decline in two weeks, retreating back below the $51/bbl figure. From here, a daily close below the 38.2% Fibonacci retracement at 49.78 exposes the 50% level at 48.33. Alternatively, a reversal back above the 23.6% Fib at 51.58 targets the 14.6% retracement at 52.58.