Our Fed Preview and Dollar Outlook

.

The last time the Federal Reserve tightened monetary policy was in December 2015 but that will change in a few days with the U.S. central bank preparing to raise interest rates for the first time in a year. A lot has changed over the past year but the one thing that has not is that monetary policy announcements are big market movers for currencies especially when a central bank is expected to make a major policy change. This time last year, the Fed was preparing for its first rate hike in a decade and while this month’s move is less historically significant, it will still be the first round of tightening in 12 months.

Key Q – Everyone expects the Fed to raise rates, so when they do will the dollar rise or fall?

A rate hike is typically positive for a currency but in this case the U.S. dollar has hit multi-month highs ahead of the meeting with Fed fund futures showing the market pricing in a 100% chance of a hike. In other words, everyone expects the Fed to raise interest rates so the question now is when they do so, will the U.S. dollar rise or fall. The answer has grand sweeping ramifications for the forex market because all of the recent moves in the major currencies including the sharp drop in the euro, Japanese Yen and Australian dollar have been driven by the strength of the U.S. dollar.

When the Fed raised interest rates in December 2015, there was a brief continuation before a sharp reversal that took USD/JPY from a high of 123.57 to 116 in a matter of month and 111 in a matter of 2 months. At that time the market was pricing in 75% chance of a hike and not 100%

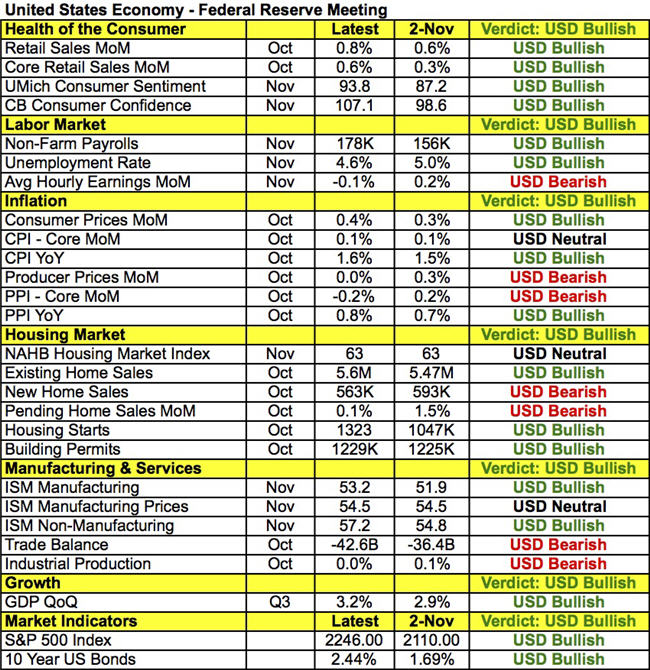

We see 3 possible outcomes for December’s FOMC meeting but before we explore these scenarios, it is important to understand why the Fed is ready to raise rates. The Fed has been talking about raising interest rates for months and 2 members of the policymaking committee (Mester and George) voted for an immediate rate hike in November. The following table shows widespread improvements in the U.S. economy since the November meeting. We can see that consumer spending is on the rise, job growth increased, the unemployment rate dropped, consumer prices rose and the housing market remains stable. GDP growth in the third quarter was very strong, helping to drive U.S. stocks to a record high. These improvements has made the Fed worried about inflation rising too quickly in the future and to avert that, they have been almost unanimously hinting that rates will rise before the end of the year.

When Donald Trump was elected U.S. President in a complete upset, it was

a major game changer for the financial markets. U.S. stocks, which had

been falling reversed course and hit a record high while U.S. 10 year

Treasury yields broke above 2% for the first time in 11 months. The

dollar soared 5% in response and these moves will impact the Fed’s

policy plans because the sharp rise in yields and the stronger dollar

tightens the economy by raising borrowing costs and making exports more

expensive. In other words, the recent changes in the financial markets

does part of the Fed’s work for them and reduces pressure to raise

interest rates again shortly thereafter. This explains why the chance

of another rate hike beyond December according to the Fed Fund futures

does not exceed 50% until June 2017. This is also the last chance for

Janet Yellen who Donald Trump has often criticized and said he would

replace to tighten before Trump becomes President and tries to exert

pressure on the central banker.

After the December hike, investors don’t expect another 25bp hike until June 2017 at the earliest

As for how the FOMC rate decision will impact the U.S. dollar, we don’t expect the dollar to have a significant reaction to the rate decision unless they surprise with a 50bp hike or forgoes raising interest rates at all, two scenarios that are extremely unlikely. Instead, the bigger movers will be the dot plot forecast and Janet Yellen’s forward guidance and the dot plot forecast. Back in September, Fed Presidents were looking for 50bp of tightening next year, so if the plot shows expectations for more than 2 rate hikes in 2017 the dollar will rise. If it holds steady at 2 rate hikes, the dollar could fall.

3 Scenarios for December FOMC and Its Impact on the U.S. Dollar

Scenario #1 – Fed Hikes, Yellen Provides Zero Forward Guidance

If the Fed raises interest rates and Yellen provides zero insight into

when rates will rise again, the U.S. dollar should fall. Given how

quickly and aggressively the U.S. dollar has appreciated over the past

month, profit taking is long overdue. While part of the move can be

attributed to Donald Trump’s spending plans, the man isn’t even

President yet and the markets are moving like he’s already rolled out a

major fiscal spending program. Structuring the program and getting it

past Congress could take much longer than the new President expects and

the eventual package may be far less impressive as members of Senate

worry about financing costs. So if Janet Yellen fails to convince the

market that rates will rise again in the first quarter, we foresee a 1-2

percent correction in the dollar in the days that follow.

Scenario #2 – Fed Hikes, Yellen Signals Long Pause

If the Fed raises interest rates and Yellen talks about the impact of

rising yields and/or confirms that future rate hikes will be data

dependent which means she’s not committing to any future moves the

dollar will also fall and more aggressively than in Scenario 1. Profit

taking into yearend is not unusual especially after the big moves that

we have seen over the past month but in this scenario, there will be

continuation and selling the dollar even as it is falling should be

fruitful trade. We expect the strongest move in USD/JPY and EUR/USD –

two of the currencies that have fluctuated the most on U.S. dollar

strength but with that in mind, all currencies will rise against the

dollar in this scenario.

Scenario #3 – Fed Hikes, Yellen Emphasizes Need for More Tightening

If the Fed raises interest rates and Yellen expresses her optimism about the economy, raises concerns about rising inflation and emphasizes the need for more tightening, the U.S. dollar will soar. We will see 115 in USD/JPY easily, 1.05 in EUR/USD will break and AUD/USD will make run for 73 cents. Fed fund futures tell us that unambiguous hawkishness and strong forward guidance is not expected so if have multi-day/week continuation.

But at the end of the day, the December FOMC meeting may prove to be a big disappointment in terms of market volatility. Everything has led up to this point and the investors have had plenty of opportunity to prepare for the move. Scenario 1 is the likeliest because yields have increased and the Fed needs to time to see exactly how much fiscal stimulus the Trump administration can or will provide. Yellen won’t commit to anything, dollar bulls will be disappointed giving investors a good reason to take profits on long dollar positions into year end. This does not mean that the dollar rally is over but we should see more two way demand.